“What is history, but a fable agreed upon?” – Napoleon Bonaparte

It feels like one of those years – it’s only April, and we’ve already been through a full cycle of volatility. And the outlook doesn’t get better. It’s hard to say where markets may be in a month, never mind six months. This type of environment can fuel hearsay, innuendos, and old myths in fixed income. But myths are filled with embellishments and separating fact from fiction is critical in fast-moving markets.

Myth #1: Investors Should Avoid Bonds When the Federal Reserve (Fed) Aggressively Hikes

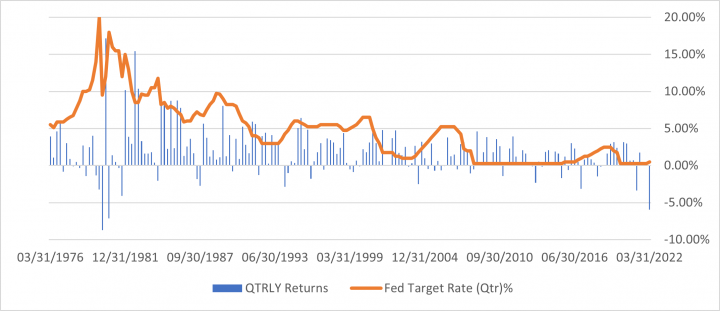

The Bloomberg Aggregate Index (Agg) just printed its worst quarterly return since the bond market hit rock bottom in 1980. Yes, 1980 – 42 years ago – the same year that the Agg ended with a yield-to-maturity over 13% (Chart 1). That brings us to 2022. Six months ago, Fed fund futures had one 25bp hike priced for 2022, and the Agg’s yield held steady at 1.18%. Now Fed funds have 8-9 hikes priced through December, and the Agg’s yield has risen to 2.92%. Are bond investors catching a falling knife?

Buying a 2-year high-quality corporate bond with a spread of 60bps yields approximately 3.00%, but comes with duration risk amidst a time of tremendous rate volatility. Alternatively, an investor can hold cash and avoid the Fed hiking period altogether. But a quick calculation shows that the hurdle for Fed hikes implied by the corporate bond’s yield has risen tremendously over the past six months. The Fed now needs to hike roughly 12 times per year (across eight meetings) for the income earned on the cash to match that of a 2-year high-quality corporate bond to maturity. This hurdle is the strike investors should heed in a time of rising rates, and not simply the direction of rates or even the Fed’s advertised plans over the next couple of months.

Chart #1: Bloomberg Aggregate Index Quarterly Returns vs. Fed Funds Target Rate

Myth #2: A Yield Curve Inversion Means Investors Should Brace for Recession

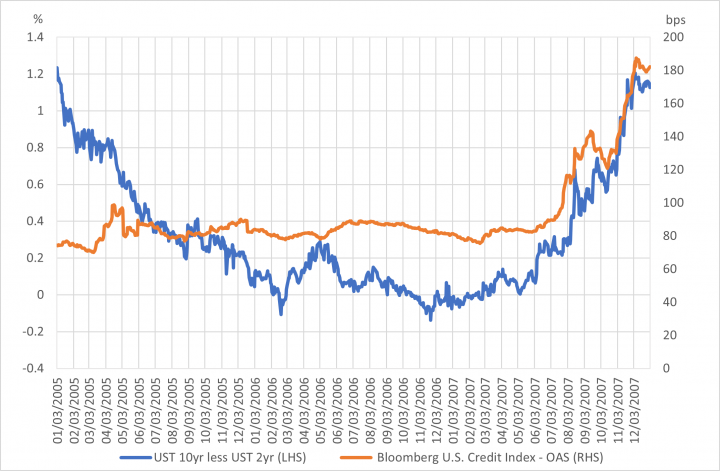

An inverted curve screams something is amiss. It could be from a commodity squeeze, a Fed that hiked a tad too far, or (gulp), a budding economic slowdown. We know only that the short-end and long-end are at odds about the future. But that doesn’t necessarily mean it’s time for investors to panic about recession. Interest rates are continuously attempting to handicap future states of the world, and it appears they are now telegraphing to the Fed that they need to be mindful of pushing too fast. The economy is still recovering from the worst pandemic in 100 years, so forcing consumers and businesses to pay meaningfully more to finance homes, autos, and durables while they also face higher prices from suppliers, grocery stores, and gas stations is fraught with uncertainty. When this short-end barometer is coupled with long-end technical factors, such as the steady growth of hedged pensions, central banks, and foreign insurance buyers, modest curve inversions are not surprising. One such inversion, in early 2006, serves as a prime example (Chart 2). It tells the cautionary tale that rushing for exits upon sight of an inversion can be costly if the real downturn is still 1-2 years away. But more significant curve inversions are a different story. These are rare and typically come with an extremely aggressive Fed — one that has donned inflation blinders at the expense of economic stability. Volker wore those blinders in the late 1970s, and the short-end of the curve inverted by hundreds of basis points before the 1980 recession. That experience still reverberates across bond markets today.

Chart 2: Bloomberg U.S. Credit Index OAS Volatility Remained Tame Long After the First 2yr/10yr Inversion in 2006

Myth #3: Inflation is Toxic to All Forms of Fixed Income

We often hear that bonds and inflation don’t mix. It makes sense. Fixed bond cashflows don’t adjust for variable inflation rates. But we also hear that Treasury Inflation-Protected Securities (TIPS) returns don’t correlate well with inflation. This also makes sense. TIPS returns from the duration component may more than offset the earned inflation float (for more on TIPS, see: Tips on TIPS – Income Research + Management). But this is unfair to TIPS, which haven’t been around that long. The first TIPS issue was a ten-year issue auctioned in Feb 1997, and, while the Treasury soon followed with a five-year, it remained the only short-maturity TIPS for several years thereafter. Meanwhile, inflation remained muted…until now.

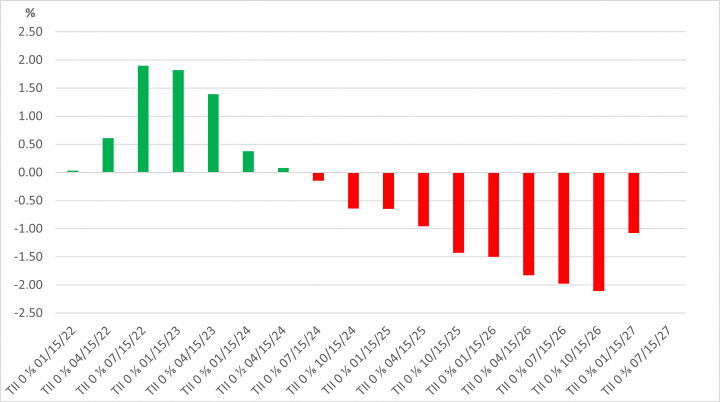

In this highly charged macro-economic environment, TIPS offer dual benefits. They serve as liquid fixed income exposure, while accruing inflation float to their principal balance. TIPS investors can manage their duration to either accentuate the bond-like attributes (longer-duration TIPS) or their inflation-linked attributes (shorter-duration TIPS). Chart 3 below shows the year-to-date return differences in 0-5yr TIPS maturities in 1Q22. Even amidst a terrible quarter for bond returns, TIPS shorter than 2 years to maturity still managed to produce positive returns. This demonstrates both the benefits of this $1+ trillion fixed income sector when inflation really does spike.

Chart 3: U.S. TIPS YTD Returns with Maturities From 0 to 5 Years

Conclusion

In 1994, Greenspan’s Fed surprised bond markets with two 25bp hikes followed by two 50bp and one 75bp hike. But that Fed didn’t provide forward guidance, and they rarely spoke to the press. Today the Fed has a communication toolkit to establish immediate yield curve pricing relative to expected hikes in the foreseeable future. 2022, however, brings a special flavor of uncertainty. The pandemic, European conflict, and midterm elections cloud even the Fed’s best estimates. Fortunately, high-quality yield can offer a margin of safety — the Fed can hike aggressively, and bond investors can still win. And if the investor is especially worried about runaway inflation, short TIPS can offer diversification and return upside. Of course, if we do slide towards recession, the asset allocation playbook does say you’ll want to own high-quality, liquid bonds.