With the pandemic safely behind us, inflation is finally turning a corner. Supply bottlenecks are easing, consumer demand is reverting to services over goods, and all is well with the world….at least that’s what was supposed to happen. Instead, inflation continues to accelerate, driven by the flood of monetary and fiscal stimulus, snarled supply chains, lingering COVID concerns, and a recent surge in commodity prices. The Federal Reserve (Fed) has been forced to take a more aggressive stance on the growing threat of inflation and interest rates have soared as a result. In this piece, we explore how we got here, the Fed’s and the market’s reactions, how fixed income investors can position themselves in these uncertain times, and what may happen next.

Before Transitory Was A Four-Letter Word

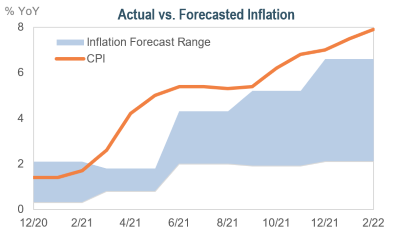

- Inflation was expected to normalize. From the onset of the pandemic until late last year, the Fed characterized inflation as transitory. Rising prices were attributed to several unusual circumstances that were expected to resolve as COVID receded.

- Base effects. Inflation was abnormally low at the start of pandemic. As inflation returned, elevated year-over-year readings were expected given the low comparison point.

- Shift in spending. The shutdown led to a massive increase in consumer spending on goods over services. Goods, which have averaged about ~32% of consumer expenditures over the last decade, jumped to ~35%, a shift of over $1 trillion.

- “Reopening” categories. As the economy started to reopen last summer, pent-up demand for travel caused a surge in airfares, hotels, and rental cars.

- So what happened? While much can ultimately be linked to the COVID shutdown, inflation has broadened and proved to have more staying power than originally anticipated. Several factors have contributed.

- Labor. There are still 1.7 jobs available for every unemployed person, and the labor force is roughly a million workers shy from pre-pandemic levels. This dynamic has led to the fastest wage growth on record.

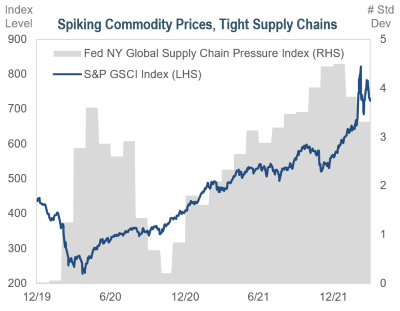

- Supply chains. The pandemic snarled global supply chains for a variety of reasons. While some pressures have begun to ease, the flow of goods remains restricted, and by some measures remain several standard deviations away from normal.

- Commodities. The Russian invasion of Ukraine and the implementation of sanctions has had a ripple effect across commodity prices. Russia is the largest exporter of oil to global markets, and prices shot up 30% in less than two weeks on fears of supply shortages. While other countries are ramping up production and releasing reserves, it may not fill the gap.

What’s A Central Bank To Do?

- While the Fed still believes this bout of inflation will not be permanent, it has acknowledged inflation has remained elevated far longer than originally anticipated and downside risks to the economy are growing. Given the strength of the US economy, they think it is appropriate to begin removing monetary support.

- The Fed kicked-off a rate hiking cycle, with several additional rate hikes projected this year. Markets are currently pricing in another eight to nine hikes by the end of the year, including multiple 50bp hikes. While details have yet to be released, it is anticipated the Fed will also begin reducing its balance sheet at the May meeting.

- Flying is easy, landing is hard. The Fed hopes to pull off a “soft landing”, where it can raise rates enough to control inflation but not damage the economy. While the Fed has had past successes, its track record is mixed.

And The Survey Says?

- Consumers are worried. Consumer surveys thus far suggest concern about the level of inflation. Consumer sentiment is at its lowest level in over a decade, and median expected inflation over the next year has risen to 5.4%, the highest level in over three decades.

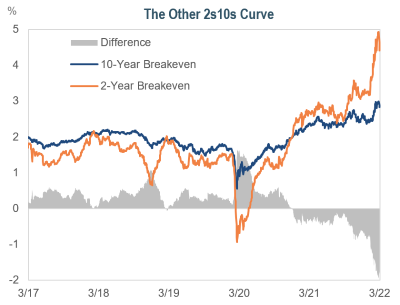

- Markets anticipate inflation will eventually fall. Breakevens (BE) are the difference between the yield on a Treasury Inflation-Protected Security (TIPS) and a nominal Treasury and are a measure of market inflation expectations. Short-term BEs are at the highest level ever. Longer-term BEs are also up, but they remain significantly lower than their shorter counterparts, suggesting this bout of inflation will be relatively temporary. Other metrics, such as the 5-year forward breakeven rate, which measures 5-year inflation expectations in 5-years, point to a similar conclusion.

- Inflation and the yield curve. 2-year Treasury yields are influenced by rate hike expectations and have risen 178bps year-to-date as the Fed confronts inflation. The 10-year yield, however, is only up 119bps, and reflects the market’s belief that the Fed will ultimately get inflation back to more normal levels.

What’s A Bond Investor To Do?

- Where are we now? Since our last inflation update, trend inflation, defined as the 5-year rolling average of CPI, has moved meaningfully above its 20-year average, and actual CPI has remained sharply above trend.

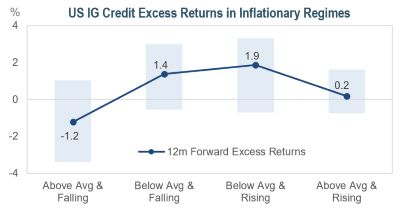

- Investment grade (IG) credit typically offers positive forward excess returns even when inflation is above average and rising. Spreads usually tighten at the start of rate-hiking episodes as the economy is still doing well. This cycle may behave differently as the Fed is reacting to already high inflation instead of proactively trying to control it. While economic data indicates areas of continued strength, an over-aggressive Fed could hurt fundamentals and weaken returns.

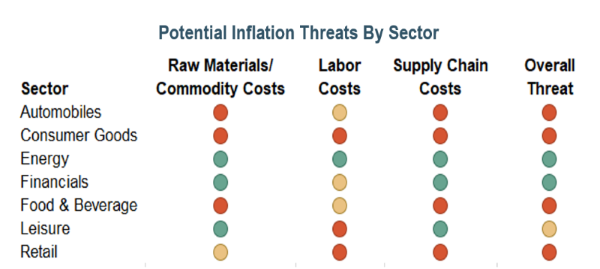

- Be mindful of inflation exposure. While corporate fundamentals remain broadly healthy, we believe it is critical to analyze portfolios on a sector-by-sector and bond-by-bond basis. Certain sectors and issuers are better positioned to cope with higher inflation costs. For example, energy companies directly benefit from rising commodity prices, and financials can offset higher costs through higher interest rates. On the other hand, sectors like consumer goods and automobiles are exposed to multiple inflationary headwinds, such as commodity, labor, and supply chain costs.

A Word on TIPS

US Treasury Inflation-Protected Securities (TIPS) can provide protection against inflation as the principal adjusts with an inflation accrual. TIPS normally perform well when higher inflation is anticipated or when the economy is in a stable-rate stagflationary environment. However, they are sensitive to higher real interest rates, which can hurt returns. With the Fed telegraphing their intent to be somewhat aggressive, the negative effect of rising real rates may offset the benefit of the accrual.

When Will Then Be Now?

- Several unusual factors have contributed to the run-up in inflation, and the Fed projects inflation will settle at its 2% target in the longer run. How long it takes to get there, and how well the economy handles the higher inflation in the meantime, depends on several factors.

Sooner, Less Painful

- Outsized contributors. Many of the outsized contributors to inflation, such as autos and reopening categories, can be reasonably expected to subside as COVID continues to recede and supply chains eventually normalize.

- Increased household wealth. While inflation has certainly caused discomfort, consumers are well-poised to absorb rising costs as household wealth is up over $30 trillion since the start of the pandemic.

- US economic strength. The Fed believes the US economy no longer needs the support provided during the pandemic. Many economic indicators such as PMIs, retail sales, and Leading Economic Indicators (LEI) all point to a growing economy, albeit at a slower pace.

Later, More Painful

- Supply chains. The recent geopolitical crisis has put supply chains, still recovering from COVID, under further stress. An increased focus on supply chain resiliency could add further costs if production is onshored and suppliers diversified.

- Shelter. CPI measures of shelter are a lagging indicator as they capture average rents vs. new rents. Rents within CPI increased at a pace of over 4% recently, while other metrics registered more than 15%. Shelter will likely remain a strong contributor to inflation in the near term.

- Commodities. The surge in prices may not have fully played out, and it is unclear if/when sanctions on Russia will be reversed. The longer the conflict lasts, the more likely these impacts will be magnified.

While IR+M does not attempt to forecast inflation or interest rates, we are acutely aware of their impacts on fixed income investors and the upside and downside risks. We believe it is important for investors to understand their exposures to inflation. As part of our bottom-up security selection process, we thoroughly evaluate bonds to determine the potential impacts of inflationary pressures and ensure we are well-compensated for the level of risk. Given the uncertainties around the future direction and timing of inflation, we have increased the quality and liquidity of our portfolios so that we are ready to “take what the market gives us”.