Some of the most iconic science fiction was written amidst periods of great social and economic upheaval. Aldous Huxley’s Brave New World (1932) was published at the depths of the Great Depression, George Orwell’s 1984 (1948) during the global expansion of Communism, and Phillip K. Dick’s Do Androids Dream of Electric Sheep (1968 – and the inspiration for the sci-fi film Blade Runner) as inflation and government spending were spiraling higher.

Yet this is the 2020s, and although we’re living through a period of extensive change, much of the decade has yet to unfold. For now, a strong economic rebound is forecasted for later this year. But is it sustainable? And what about rising inflation? After all, the Federal Reserve (Fed) has expanded its balance sheet beyond $7 trillion, and Congress has pushed the deficit in excess of $2.5 trillion.

In theory, the stimulus and bond-buying have been priced into today’s interest rates. The 10-year Treasury yield has risen over 70bps year-to-date. Short-maturity Treasuries now suggest that the first Fed hike could come as soon as 2022, despite the Fed’s guidance of 2023 or beyond. Year-over-year headline CPI is forecasted to crest over 3% in 2Q, but this is primarily due to the base effect of last spring’s deflationary lock-downs. Inflation remains subdued in Europe and Japan. Over $10 trillion in global bonds still trade at negative yields, and US Treasuries remain an attractive alternative to foreign investors.

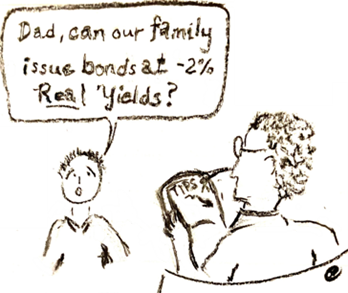

Getting Real About Yields

The TIPS market provides valuable market pricing in the modern bond market (for more, see Tips on TIPS). Interestingly, short-maturity breakevens are trading higher than longer ones, suggesting that investors believe rising price pressures will be more temporal than permanent. This is a view shared by the Fed. Their preferred breakeven metric, the 5-year, 5-years forward, is trading only slightly above 2% now.

Bond investors remember the 2013 Taper Tantrum too well – and it had little to do with changing inflation expectations. In the second quarter of 2013, the 5-year real yield spiked 125bps on Bernanke’s hint that Fed bond purchases would be slowed later that year. Interestingly, today’s CPI (1.7%) and 5-year real yield (-1.7%) are virtually the same as they were eight years ago. The Fed learns from its mistakes, and in January, Powell remarked, “We need to be very careful in communicating about asset purchases.” We also have reason to believe Powell may view real yields as too high. The Fed’s new FAIT (Flexible Average Inflation Targeting) implies that a taper won’t be announced until Core PCE is sustainably above 2% (it is currently 1.5%). The Fed may allow inflation to rise but offset it with additional tools to push real yields down if they remain unhappy with the pace of economic recovery.

Check the Term Premia

Another tool available to today’s bond investors is the New York Fed’s Term Premia Model.[1] While models have limitations, this one serves as a bellwether for investor sentiment. It tracks the yield difference between the 10-year Note and the expected path of T-Bills over 10 years. The differential is the market’s price for taking fixed duration risk over that span. Recently, the 10-year Treasury term premium has risen sharply – over 100bps since last October. This coincides with anecdotal accounts of a popular trade by Hedge Funds to short Treasuries. Borrowing, and then selling, long-term UST’s in the repo market provides a means to profit from rising yields. However, the trade has become crowded and 10-year Notes so scarce that the cost to lend cash against 10-year Note collateral has reached 4%. If yields do not continue to rise, this expensive trade could unwind quickly.

Lastly, there’s an implicit cost to avoiding interest rate risk. The Treasury curve is positively sloped, which provides a degree of cushion against rising yields. For example, the 2-year is currently trading at 14bps, while the 5-year is at 84bps. If an investor is concerned about rising rates, s/he may choose to buy a 2-year today and then roll the proceeds into a 3-year in two years. However, forgoing the additional yield of the 5-year today means that, in two years, the 3-year note must offer at least 1.31% in yield for the investor to match or exceed the income of today’s 5-year over the next five years. Currently, the 3-year is trading at 34bps. A rise of 97bps over the next two years implies a bet that the Fed will be actively hiking by then. It took seven years for the Fed to make its first hike after the Great Financial Crisis.

Conclusion

Peter Theil famously remarked, “We wanted flying cars, and instead we got 140 characters.” Over the long run, interest rates rarely follow the path of our greatest hopes or fears. Runaway inflation, debilitating deficits, and collapsing currencies make for captivating thought exercises, but they’re best left to science fiction writers. While yields may continue to trend higher in the coming months, the timing and magnitude matter greatly for a bond investor. We believe good fixed income managers understand this and position portfolios in a dispassionate manner. History will unfold, but not often as we dream up.