- The market tone turned cautious as investors prepared for artificial intelligence-related earnings reports and the return of economic data releases, following the longest government shutdown in US history

- October FOMC meeting minutes revealed members continued to disagree on whether inflation or the labor market poses the bigger risk to the economy

- Many members prefer to hold rates steady until 2026, while some believe another rate cut is warranted

- The market-implied probability of a December rate cut has fallen from nearly 100% in October to just 29% as of last night’s close

- The September jobs report was released and likely did little to sway the Federal Reserve one way or the other; nonfarm payrolls rose 119k while the unemployment rate increased to 4.4%

- Treasury yields were slightly higher week-over-week as investors lowered expectations of another rate cut in 2026, with the 2-year rate 2bps higher to 3.59%

- Investment-grade (IG) companies issued over $47 billion this week, more than double estimates of $20 billion; supply typically decelerates from Thanksgiving through the rest of the year

- There were small signs of supply indigestion as one deal was pulled – a rarity in the IG market – while some others experienced elevated attrition rates

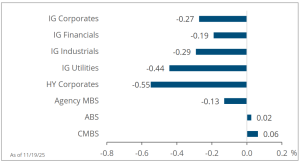

- Investment-grade corporate spreads widened 1bp to 83bps

- Rising credit concerns and the potential for a higher-for-longer rate environment pushed high-yield spreads 17bps wider to 300bps; CCC rated spreads surpassed 660bps for the first time since June

- Four issuers priced new debt despite the softer tone, totaling roughly $5 billion

- Agency mortgage-backed securities (MBS) underperformed Treasuries and securitized sectors amid an increase in rate volatility

- Municipal supply totaled over $10 billion this week, bringing the year-to-date total to $516 billion, almost 15% ahead of last year’s pace

Treasury Yield Curve

Month-to-Date Excess Returns