- President Trump signed legislation Wednesday ending the longest US government shutdown and restoring normal operations; the economic impact remains unclear

- The Congressional Budget Office (CBO) projected a six-week closure would reduce current-quarter real GDP growth by 1.5%

- White House officials said the October jobs and CPI reports are unlikely to be released, limiting the amount of official data the Federal Reserve (Fed) can use to validate a rate cut at the December FOMC meeting

- Consumer sentiment fell to the lowest level since June 2022, driven by concerns over consumer’s personal finances and expectations of further labor market deterioration

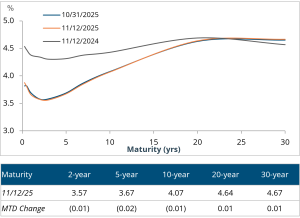

- Treasury yields fell across the curve after the shutdown ended, as investors saw room for another Fed rate cut to support the labor market, despite limited economic data for October

- The 2-year and 10-year Treasury rates fell by 6bps and 9bps to 3.57% and 4.07%, respectively

- Borrowers took advantage of attractive funding levels as investment-grade supply totaled $28 billion for the week – pushing this year’s volume over $1.5 trillion and above 2024’s total; high-yield issuance was similarly active, with issuance totaling $5 billion

- Investment-grade spreads widened by 2bps to 82bps, while yields decreased by 7bps to 4.82%

- High-yield corporate spreads tightened by 4bps to 283bps driven by the shutdown ending; yields fell by 11bps to 6.77%

- Commercial mortgage-backed securities (CMBS) outperformed other securitized sectors as spreads tightened 1bp to 76bps; year-to-date issuance of $132 billion is 30% ahead of last year’s pace

- Municipals underperformed Treasuries as muni/Treasury ratios rose across the curve; municipal bond funds reported $650 million of net inflows last week

Treasury Yield Curve

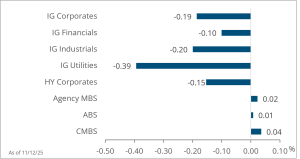

Month-to-Date Excess Returns