- Economic data continued to suggest a slowdown in the labor market, cementing expectations that the Federal Reserve (Fed) delivers another rate cut in December

- ADP private employment declined by 32k jobs in November versus expectations of a 10k increase; small business employment notably fell by 120k jobs – the largest one-month decline since May 2020

- Continuing jobless claims remained elevated at 1.94 million, as workers are having a harder time finding new employment; Initial jobless claims declined to 191k, below expectations of 220k

- The ISM Services Index improved to 52.6 last month, as projects restarted after the government reopened; business activity improved from October, despite a slowdown in new orders

- Treasury yields were higher, led by the long-end, as investors looked ahead to 2026 and reassessed the speed and depth of the current easing cycle

- Investment-grade (IG) supply totaled over $26 billion this week – above forecasts of $20 billion; deals were met with strong demand, with the average order just over 5x oversubscribed

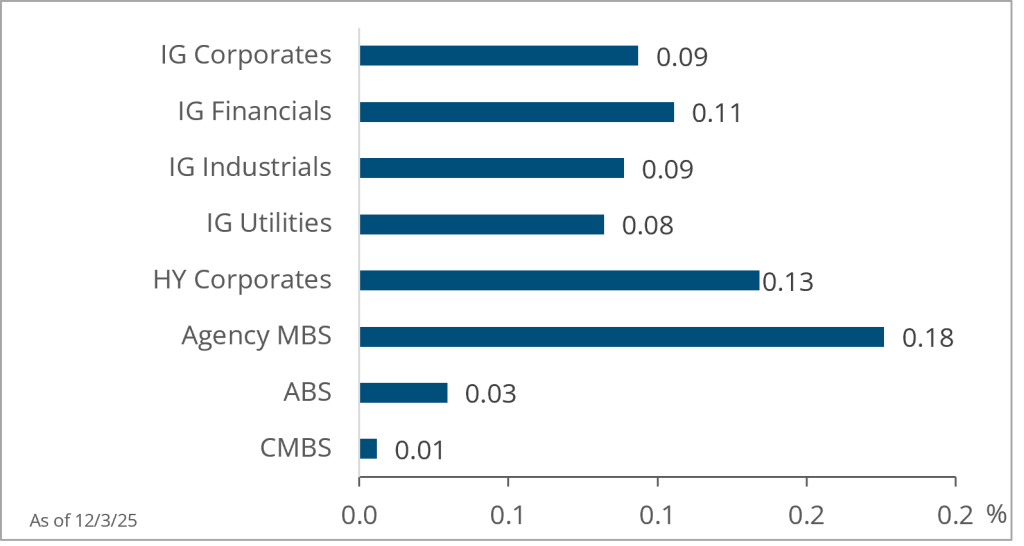

- Investment-grade corporate spreads tightened 1bp to 79bps, while yields increased 2bps to 4.78%

- High-yield (HY) issuers were similarly active and capitalized on attractive funding levels, pricing over $8 billion of new debt

- High-yield corporate spreads remained unchanged at 269bps, while yields rose 2bps to 6.59%

- Agency mortgage-backed securities (MBS) outperformed other securitized sectors as strong bank demand helped drive spreads tighter by 3bps to 26bps

- Intermediate- and long-duration municipals outperformed Treasuries, with the 10-year muni/Treasury ratio falling from 68.2% to 67.8%; municipal bond funds reported $217 million of net inflows

Treasury Yield Curve

Month-to-Date Excess Returns