- Markets absorbed mixed economic data following the November jobs report and CPI release, with investors looking to the return of official economic data for insight into the Federal Reserve’s decision-making process in 2026

- Non-farm payrolls increased by 64,000 in November after declining 105,000 in October, as the 162,000 government employees who participated in the Trump administration’s deferred resignation program officially dropped off payrolls

- The unemployment rate rose to 4.6%, exceeding consensus estimates and driven by increased layoff announcements and workers’ struggles to find employment

- Core CPI rose at the slowest annual pace since March 2021, growing 2.6% versus expectations of 3.0%; the report points to some easing in inflationary pressures, although data collection issues related to the government shutdown may have affected the November figures

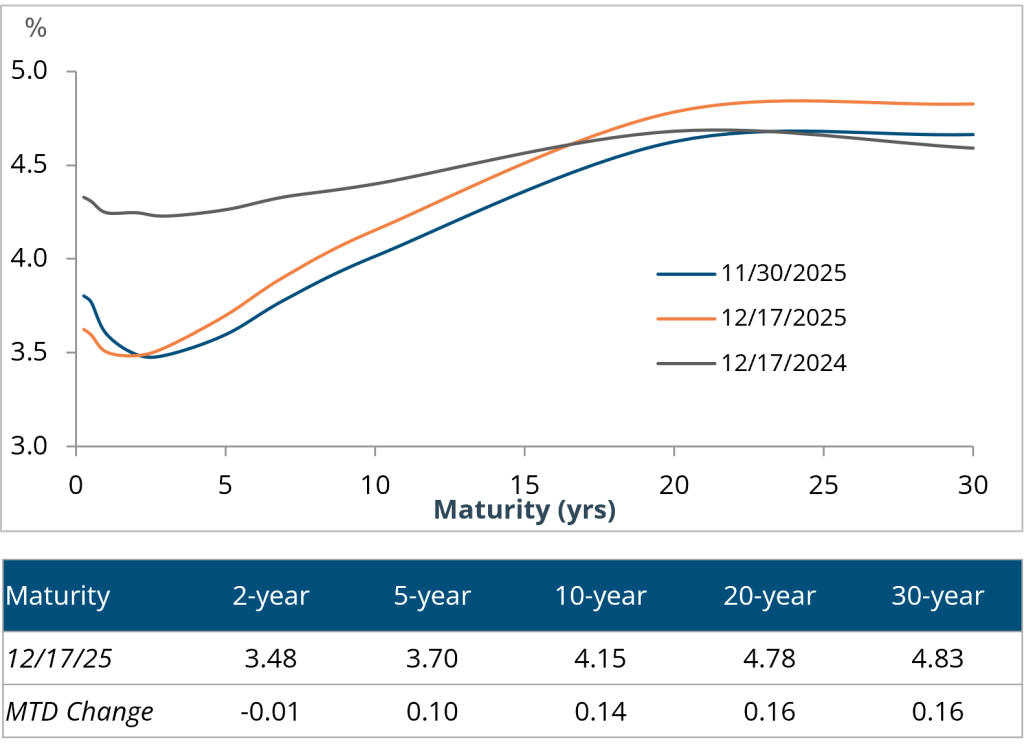

- The Treasury curve steepened week-over-week, supported by the December FOMC outcome; the spread between the 2- and 10-year Treasury rates widened 6bps to 67bps

- Investment-grade and high-yield issuers wrapped up the week with supply in each market totaling $1 billion, likely concluding new debt issuance until 2026

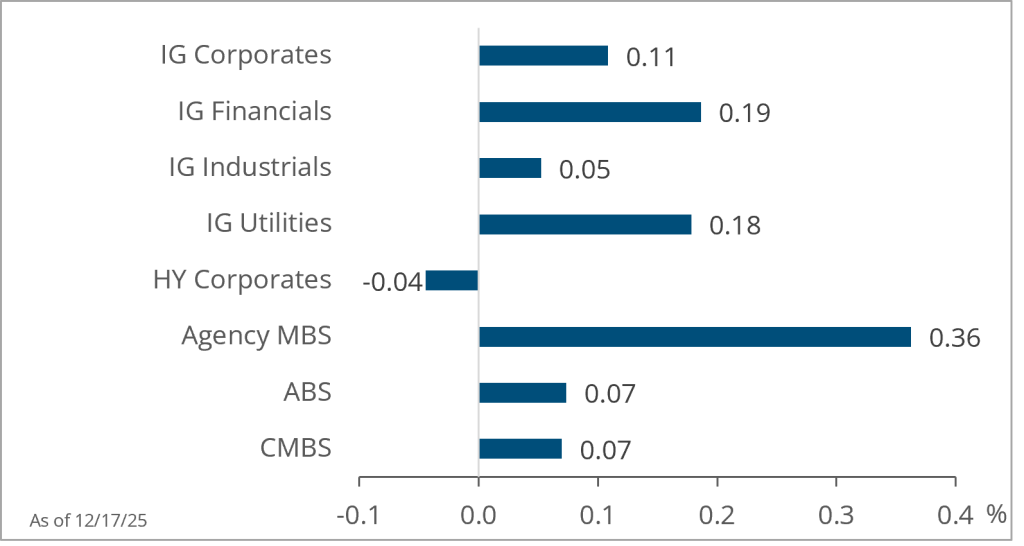

- Investment-grade corporate spreads widened by 3bps to 79bps, while yields increased 2bps to 4.85%

- High-yield corporate spreads widened by 8bps to 283bps as mixed economic data and an uncertain rate path weighed on sentiment; yields rose by 4bps to 6.73%

- Asset-backed securities underperformed other securitized sectors despite ABS spreads remaining unchanged at 53bps for the week

- Short-maturity municipals underperformed Treasuries as the 2- and 5-year muni/Treasury ratios rose; the 2-year muni/Treasury rose from 69.8% to 70.7%

- Demand was relatively strong as municipal bond funds reported $260 million of net inflows last week

Treasury Yield Curve

Month-to-Date Excess Returns