A familiar Oz tale has returned to the silver screen, transporting moviegoers as the Wicked Witch soars into an uncertain future. In this account, the narrative shifts depending on the storyteller. Wicked and good are just about perspective. For 2026, the US fixed income market embodies a similarly complicated tale. Inflation continues to defy gravity, and calls for AI-driven, record-setting issuance are taking center stage. Behind the curtain, the K-shaped economy, blurred lines between public and private markets, and a lame-duck Fed chair add to the layers of ambiguity. In this environment, the challenge is not to simply avoid sectors that may appear wicked, but to uncover bonds that may be harnessed for good – using bottom-up security selection and a cross-sector lens to transform an AI-obsessed world into one defined by risk-aware opportunity.

Belief takes many forms. And history often reflects who is telling the story.

In 2025, the market has been characterized by a series of – at times – disruptive and conflicting forces. Tariffs resulted in supply chain volatility and renewed inflation pressures as the Fed found its rate-cutting groove. Political gridlock culminated in a 43-day long government shutdown – the longest in history. Through it all, fixed income held in remarkably well, even in the face of stubbornly tight spreads.

-

- Where we see opportunity. Given our more cautious risk posture, we continue to emphasize short- and intermediate-term spread product, which we believe offer the best return potential. We remain overweight high quality, non-agency securitized bonds, and maintain robust liquidity, particularly in the long end. When and if market volatility occurs, we can activate numerous levers to take advantage of dislocations.

-

- The word on the IR+M desk. “In 2025, the market demonstrated remarkable resilience despite numerous headwinds, with spreads hovering near all-time tights. At IR+M, we invest in the process – not just the portfolio. We challenge ourselves to look under every rock while adhering to our time-tested approach of bottom-up security selection and active risk management. We stay disciplined, resisting the temptation to chase returns, spreads, or valuations.” – Jim Gubitosi, CFA, Co-Chief Investment Officer

Chart Source: Bloomberg as of 11/30/25. Each category based on Bloomberg Indices (Short = Bloomberg 1-3yr Corporate Index, Intermediate = Bloomberg 3-10yr Corporate Index, Long = Bloomberg Long Corporate Index, Bloomberg US High Yield Index, Bloomberg US MBS Index, Bloomberg ABS Index, and Bloomberg CMBS Index, respectively). Percentiles calculated using monthly spread and yields going back 20 years.

A broader horizon lays ahead.

As we wondered what the markets would do for an encore in 2026, in September 2025, we had the beginnings of an answer – an answer that could reverberate throughout fixed income in 2026 and beyond. Major hyperscalers awoke from their years-long slumber and, in just a few months, issued nearly $100 billion in investment-grade, AI-focused supply – and that may be just the beginning. While the Big Five have captured the market’s attention, they should not completely command it. We anticipate that 2026 will be a variation on the 2025 theme, with robust issuance, solid fundamentals, and slightly wider credit spreads. Plus, we expect some Fed leadership turbulence and private credit chatter.

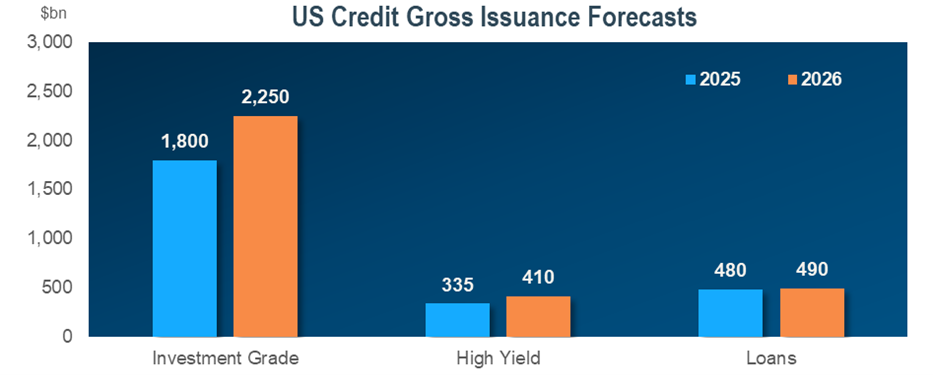

- Investment-grade corporates: The Yellow Brick Road ahead. After hanging tough in 2025, we believe that investment-grade fundamentals will enter 2026 buoyed by still-strong prospects for earnings growth and investor demand. With spreads hovering around 79bps1 in December, questions linger about the potential for further spread compression. With spreads this tight, most dealer forecasts call for modest widening in 2026. Yet we believe the real bend in the road is supply. After years of balance sheet discipline, corporate issuance is poised to rise, fueled in part by AI-related capex needs and an intensifying M&A cycle. While estimates vary, investment-grade issuance could reach a record-setting $2+ trillion, eclipsing 2020’s low-rate-inspired $1.9 trillion.

-

- Where we see opportunity. We believe opportunity lies in companies that are less likely to face binary outcomes – either surviving or defaulting. Building materials companies – those that supply cement and infrastructure for ongoing capex projects – may fit this profile, with their straightforward business models and limited leverage. We are also closely watching highly regulated utilities, which are spending capital to build grid connections for data centers. These issuers benefit from long-term leases with operators and the ability to pass through rate increases to their customers, which is a more stable way for us to participate in the AI growth era.

-

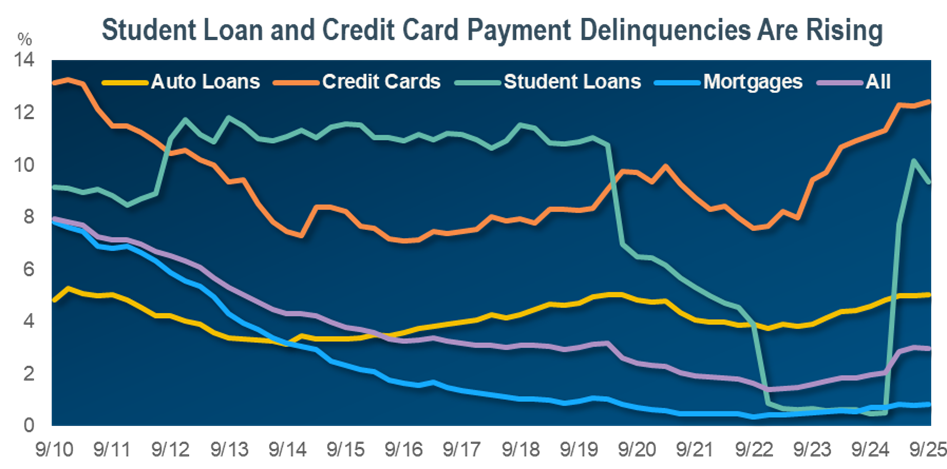

- The word on the IR+M desk. “Looking to 2026, we’re extremely concerned about the path of the consumer and are closely monitoring the direction of consumer fundamentals. Spending can’t remain this strong indefinitely, and the eventual pullback could have meaningful implications for the broader economy. Inflation is elevated, costs are rising, and labor market cracks are emerging. Even high-quality borrowers are feeling the strain of renewed student loan payments. If those 720-FICO consumers begin slipping into the 600s, it could signal a shift toward a more polarized, K-shaped economy – one we’re watching closely." – IR+M Senior Portfolio Manager

Chart Source: US credit gross issuance forecasts sourced from Morgan Stanley Research as of 11/21/25.

- High yield: Opportunity with altitude. The high-yield market – which is typically more sensitive to the economy and consumer – continues to echo shades of investment grade, with solid fundamentals and historically tight credit spreads. With expectations of modest spread widening and increased M&A, we are focused on identifying – and avoiding – potential pitfalls. We are also monitoring recent AI issuer trends, particularly those tied to data centers, which introduce construction risk – a relatively new risk in the high yield market. We believe that prudent security selection is key to navigating this flight path. Still, we believe that elevated yields, solid corporate balance sheets, and low default rates should offset any weakness due to higher net issuance or shifts in broader market sentiment.

-

- A word on loans. Like high yield, loans are expected to see slightly wider spreads in 2026. Yet the real headline to watch is the downstream impact of AI, given that the technology and software sectors are significant players in the loan market. While loan default rates will likely decline in 2026, the discrepancy between loan and high yield default rates should endure due to loan issuers’ typically weaker credit fundamentals.

-

- The word on the IR+M desk. “We’re entering a world of blurred lines, where issuers will gravitate to the market that offers them the best execution, whether that’s high yield, loans, or securitized. The high yield market, specifically, is very reactive; issuers need a strong, supportive backdrop for them to come to market. If the outlook is cloudy – if conditions feel shaky – issuers will step back, potentially for months.” – IR+M Senior Portfolio Manager

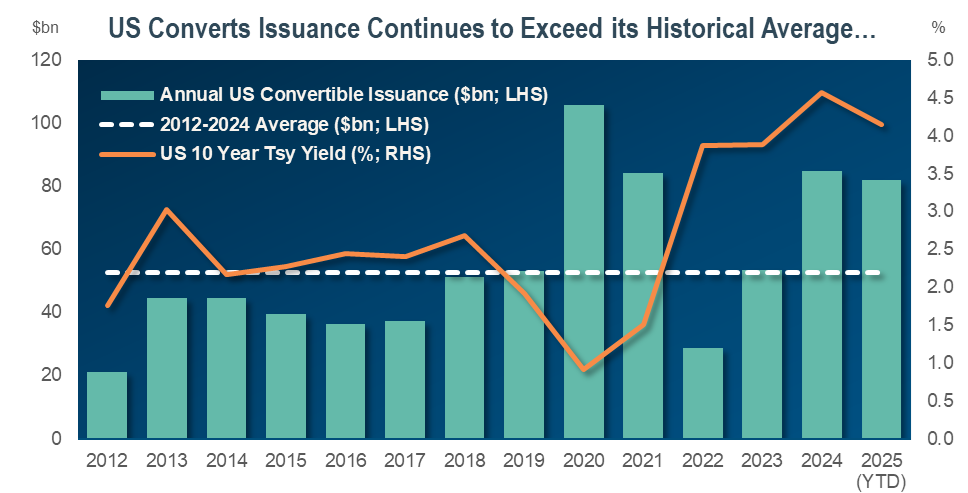

- Convertibles: Something has shifted. A market transformed. After an impressive 2025, the convertibles renaissance is fully underway. The market continues to deliver competitive relative performance, strong liquidity, and record-setting issuance. Its broader investor base – hedge funds – has returned, helping restore market depth. We expect this momentum to persist in 2026, due in part to cost advantages for issuers over traditional debt in this non-zero rate environment. AI is also a factor in this market, bringing opportunity and volatility as high-growth issuers increasingly use converts to fund their capital needs. We believe that converts have real staying power – a power they have not had for years.

Chart Source: BofA Global Research as of 9/30/25. Reprinted by permission. Copyright © 2025 Bank of America Corporation (“BAC”). The use of the above in no way implies that BAC or any of its affiliates endorses the views or interpretation or the use of such information or acts as any endorsement of the use of such information. The information is provided "as is" and none of BAC or any of its affiliates warrants the accuracy or completeness of the information.

-

- How we are positioned. At IR+M, our approach to convertibles is highly differentiated, with an emphasis on the investment-grade-rated cohort of the market. Given that traditional benchmarks are not great reflections of this investable universe, we take a more selective, deliberate approach to building high-grade convertible strategies. We avoid the diversification bias embedded in broad indices and focus on issuers that meet our quality and risk standards.

- Securitized and artificial intelligence: The coming wave. The securitized market sits at the intersection of massive, AI-driven capex needs and persistent consumer affordability concerns. Data center financing will likely remain a dominant theme, with a single transaction potentially doubling annual issuance and testing market capacity. The consumer outlook is becoming increasingly bifurcated, with higher income households profiting from equity market gains, and lower income households struggling to pay auto and student loans – although elevated 2025 tax-year refunds could provide some relief. Some consumer cohorts will be forced to prioritize certain payments over others; we prefer to stick to those assets that consumers value most. In 2026, we believe the securitized market will confront heavy supply, navigate an uneven consumer, and underwrite AI-fueled transactions, leaving the market challenged and central to the broader fixed-income landscape.

-

- Where we see opportunity. We believe that AI is not a tech theme, but the next credit cycle, defining how companies operate, borrow, invest, and grow. With issuers bringing AI-related transactions to whatever market will accommodate them, we think an overarching, risk-based language is vital for consistency. To that end, we are developing a proprietary, sector-agnostic evaluation framework that will help us map each issuer’s idiosyncrasies, irrespective of its market of origin. We will assign each factor a value, which will then roll up into a risk/reward assessment score and facilitate cross-sector and cross-market comparison.

-

- The word on the IR+M desk. “Our approach to AI mirrors our approach to every sector – it’s deeply collaborative. By sitting together and bringing all our teams into the conversation, we’re able to evaluate opportunities side by side and apply a shared, consistent view of risk. That collaboration helps us uncover relative value across markets and asset classes, wherever AI-related financing shows up.” – IR+M Senior Research Analyst

Chart Source: All payment delinquencies sourced from Bloomberg as of 9/30/25.

- Municipals: Few places feel more like home. The municipal market’s defining theme remains its record-setting supply, which could surpass $550 billion2 in 2025 – and maybe even more in 2026. This steady expansion could ultimately push the size of the municipal market, which has long been anchored to $4 trillion, to the once-unthinkable $5 trillion mark. Municipal performance continues to be shaped by the long-end’s solid relative value versus corporates, elevated muni/Treasury ratios, and – given its significant retail-buyer base – an emphasis on interest rates and equities. And even the muni market is not immune to AI’s reach. If the so-called AI bubble bursts, equities could decline sharply, causing investors to opportunistically reallocate capital away from munis and into stocks.

- Private credit: Keeping an open mind. While private credit may not necessarily be reason for concern, we think it is a reason to at least pay close attention. Private credit has emerged as a market force that is simply too big to ignore. Fueled by strong investor demand, the market offers compelling yields relative to those of comparable public market debt. Yet that premium is compensation for the market’s illiquidity, opacity, and complexity – and may be concealing cracks in its foundation. As the lines between public and private credit blur, we leverage our expertise in all things bonds to evaluate how private credit is reshaping today’s investment landscape.

- The Federal Reserve. A moment years in the making. With three interest rate cuts in 2025, and rhetoric surrounding Fed Chair Powell’s departure in May 2026, the Fed is not exiting stage left any time soon. With three dissenters on record in December – the most since September 2019 – the Fed’s outlook may be uncharacteristically scattered. While the median projection calls for one quarter-point rate cut in 2026, three officials signaled a rate increase next year, and two others anticipate aggregate cuts of at least one percentage point. This uncertainty, coupled with an unknown Fed Chair heir, could result in a more turbulent turn for the Fed in 2026.

It’s time to follow our instincts, take a breath, and step into the unknown.

As the childhood fairytale about Oz reminds us, every story depends on the viewpoint of who is telling it – both in a mythical world and the fixed income market. In 2026, investors will likely navigate a landscape where, with AI-driven issuance, shifting consumer dynamics, and a Fed in a state of flux, the plot is still unfolding. Yet with our prudent security selection and cross-sector perspective, we believe that bonds can be harnessed for good, providing clarity amid the uncertainty. The real magic lies in recognizing that perspective – and vigilant preparation – can help determine the outcome.