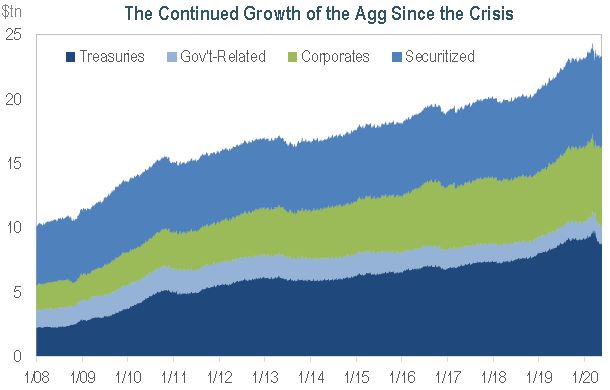

Managers’ performance is often measured against benchmarks, which are ever-changing. Since the financial crisis, the Bloomberg Barclays US Aggregate Index (the Agg) has changed markedly, becoming riskier (6.5% more BBB-rated bonds) and longer (1.5 years in additional duration). Its composition has shifted away from mortgage-backed securities (MBS), and more towards Treasuries and corporate bonds. As the market evolves, we believe that investors in both active and passive strategies should understand index mechanics.

CORE CURRICULUM

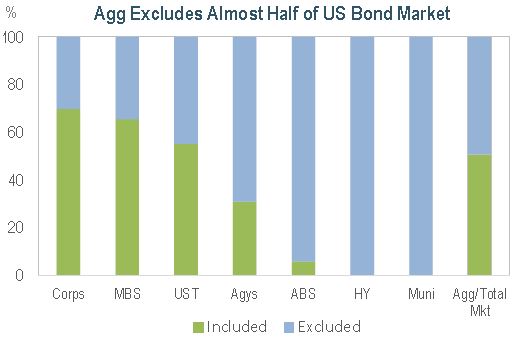

- Since inception, the Agg has endeavored to be an accurate proxy for the investment grade, US dollar-denominated, fixed-income taxable bond market. However, the Agg’s inclusion rules have not changed one-for-one with market innovation, leaving many sectors excluded.

- The $23.3 trillion Agg represents only approximately half of the total US fixed-income universe. It excludes certain asset-backed security sectors, non-Agency residential mortgage-backed securities, and 144a securities, among others.

- The index provider has ultimate discretion over the Agg’s parameters, and may take unprecedented action in extraordinary circumstances. For example, in March, it temporarily suspended the rule that excludes index bonds with less than one year to maturity.

- The decision was intended to mitigate index turnover during extreme market volatility. Eighty bonds with a market value of $220 billion stayed in the index until the end of April. The market value of the Agg’s corporate bond holdings rose 2%.

- Index inclusion and exclusion rules can result in increased trading and transaction costs, especially for passive investors that need to mirror indices. In 2020, we expect that trading costs could be elevated for these managers, in particular.

Required Reading

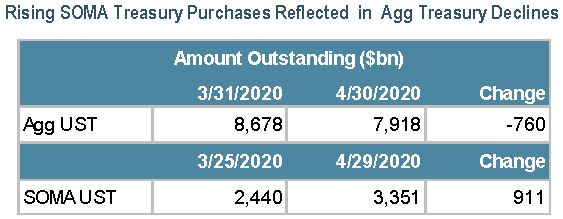

- The composition of the Agg, like all Bloomberg Barclays indices, is adjusted in response to the Fed’s System Open Market Account (SOMA*) holdings. SOMA holdings are deducted from the total float outstanding. The Fed’s new issue purchases cannot enter the Agg, and its net secondary market purchases or sales are adjusted with a one-month lag. It is worth noting that the Fed’s MBS purchases are not adjusted and remain in the index.

- From March to April, the Fed ramped up its Treasury purchases, which peaked at $75 billion per day. The SOMA purchases increased from $358 billion to $727 billion, which effectively made these securities index ineligible. As a result, the Agg’s permissible Treasury holdings experienced the largest monthly decline since the index’s inception, with the market value falling approximately 2.5%.

- With new issue Treasury supply expected to surge, and the pace of Fed SOMA purchases unknown, Treasuries could become a more variable portion of the index.

New Kids

- The composition and size of the index may be impacted by the Treasury’s auction plans. Historically, the Treasury has used shorter-dated maturities – “T-bills” – to close budget deficits. To manage its maturity profile, the Treasury decided to relaunch its 20-year bond, which has not been issued regularly since 1986. Also, it will ramp up auction sizes of other longer-dated securities.

- Increased Treasury supply across longer-dated maturities could trigger higher yields.

- The inaugural auction featured a higher-than-expected $20 billion in 20-year bonds. Demand for this maturity was robust, as evidenced by the $50 billion in orders.

- The new 20-year Treasury could be constructive for corporate bond holders, since it will help frame out the 20-year key rate. Until now, we did not have a defined reference for seasoned 30-year corporates or 20-year new issues.

- In 2020, the Agg’s corporate exposure could rise an estimated 8%, given potentially record-setting issuance of $1.6 trillion, and an offsetting $250 billion in fallen angels and $860 billion rolling out of the index.

Last Class

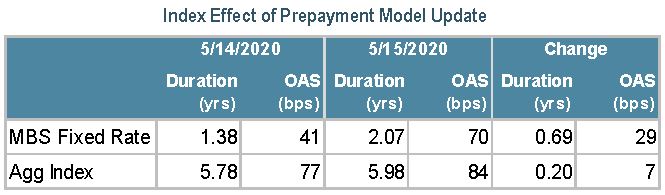

- Bloomberg Barclays’ US MBS Indices have not been immune to COVID-19-inspired changes. Weaker economic outlooks have caused a surge in delinquencies and a decline in voluntary prepayments. Social distancing has disrupted the purchase and refinancing process. Primary-secondary spreads have widened from historical levels.

- On May 15th, Bloomberg Barclays updated its fixed-rate MBS prepayment model to better reflect the ongoing pandemic and Fed stimulus programs, which have affected the housing market, mortgage rates, and borrower behavior.

- These prepayment model modifications caused the US MBS Fixed-Rate Index’s duration to increase by 0.69 years, and OAS to increase by 29bps. For the Agg, the overall duration and OAS rose by 0.20 years and 7bps, respectively. The duration change will not impact neutrally-positioned managers. Active managers that are longer or shorter than the index may have to alter model percentages to better match cash flows and reduce tracking error.

At IR+M, we are benchmark aware, but not beholden. Still, we believe that bond indices play a central role in portfolio construction, and understanding their intricacies can lead to differentiated performance. As active investors, we closely track the ever-changing bond indices, and use rule alterations on composition and characteristics to inform our investment decisions.