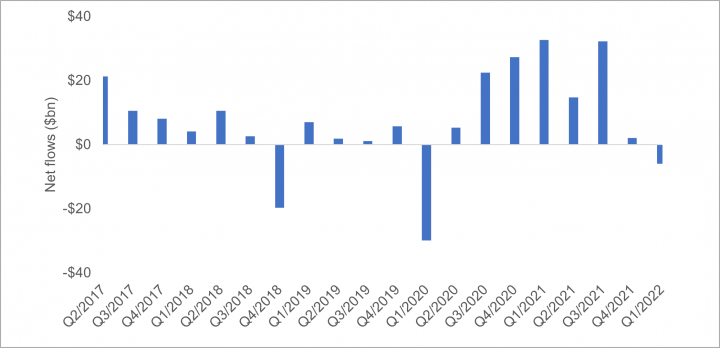

In the normal course of business, there are multiple reasons for client cash flows, both in and out – asset allocation, cash needs, additional funding, funds movement among asset managers to name a few. While the timing of incoming cashflows is very important, many clients pay even more attention when they are taking money out, focusing on liquidity and how quickly and easily they can get their money back. We often get RFP questions such as “how many days would it take to liquidate the portfolio?”. Of course, the answer depends on the type of instrument being sold, the size and timing of the flow, best method of execution, and how you define liquidity, among other factors. As a fixed income-only manager, we naturally traffic in markets that maintain better liquidity in times of overall global market stress, especially relative to private markets. That said, the over-the-counter function of the bond market comes with its own nuances. Within the investment grade space, liquidity is relatively high on the overall spectrum. And fortunately, liquidity in the bond market flows more than it ebbs. For illustrative purposes, the following chart shows the quarterly net flows of eVestment’s US Core Fixed Income Universe.

Chart 1: Managers need to accommodate numerous cashflows

When a client needs to raise cash, of course, Treasuries have the deepest liquidity. Smaller flows are typically easy to accommodate, and it is easier to trade when the markets are free flowing (though not too busy). Spread product (corporates and securitized issues) is inherently less liquid, but there is a wide variation in the ease of trading and the potential cost. A modest proportion of a portfolio should be relatively easy to provide, in fact, small cashflows can often be done only with Treasuries. As the percentage of the portfolio gets larger, most managers wouldn’t want to give up all their Treasury liquidity, nor have the remaining portfolio over-concentrated in less liquid issues. As such, for a decent size withdrawal, a slice of spread product is typically sold, as well, so the end portfolio looks much like it did prior in regard to its duration, key rate, and sector and issue exposures.

The larger the flow, the more notice and time to execute is encouraged. Normally, a few days to a week is sufficient for a typical Core Bond portfolio. We can usually accommodate next day settlement, or even same day, if necessary, as long as the flow is relatively small. If the entire portfolio is being liquidated, there may be a few issues that we’d suggest working on for several days to get good execution. Again, it comes down to the definition of liquidity. Generally, liquidity refers to the ease with which an asset can be converted to cash without affecting its price, although some think liquidity means getting cash quickly, even if there is some cost to it.

In the bond market, pricing can be opaque, as well as ephemeral. This reminds me of an old adage I learned in my early days in the bond market, which is that “there’s no such thing as a bad bond, just a bad price”. Our traders know a good price when they see it, as they are continually watching the market, doing comparative analysis, and have a good sense of market flows. In a “risk-on” market, you can more or less sell a reasonable size of most investment grade bonds easily. Conversely, in a market like March of 2020 in the midst of the pandemic, it was costly, as even Treasury bid/offer spreads widened out quite a bit.

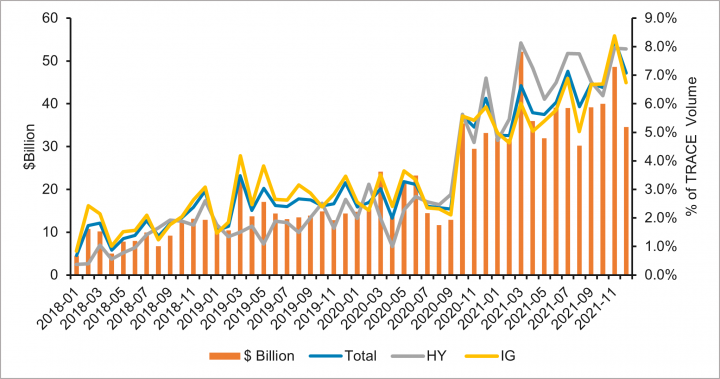

What tools do we use to get best execution? Traders will often use “Bid Wanted In Competition” (BWICs) when trying to sell a sociable list of issues (when buying, this is called an OWIC – Offer Wanted In Competition). This type of list would typically be sent to a handful of dealers with a stipulated time to respond, and the trader would pick the best prices. We can also send out BWICs/OWICs electronically on Market Axess, TradeWeb, or a similar system, in which case the list would go to numerous dealers to reach a broader audience of potential buyers/sellers. However, with larger lists or somewhat less liquid issues, we generally don’t want to broadcast that we have bonds to sell/buy. If we know that a particular dealer has a specific “axe” on a specific bond, or for larger sizes, we would likely go directly via phone or instant message and negotiate directly. Finally, with the emergence of the ETF ecosystem, portfolio trading is often an excellent alternative to the above. With portfolio trading, several dealers will bid (offer) a portfolio in its entirety, in competition. The connection with ETFs is that they provide a natural outlet for hedging, risk control, and arbitrage that dealers can use. The following chart shows the growth of portfolio trading over the years.

Chart 2: Portfolio Trading has more than doubled over the past 18 months and continues to grow

Often, clients want to contribute assets in kind. We are happy to work closely with them to analyze the portfolio and determine the most cost-efficient way to transition it to IR+M’s strategy. In the case of what we define as a large cash flow into or out of a private fund, our Fund Governance Committee, in consultation with other parties, consider a variety of options to seek to avoid material impact the flow may have on the fund and its members.

As far as best practices, we encourage clients to avoid cash outflows during popular vacation and holiday periods, when there is often an early close and/or light staffing on the Wall Street desks, and during market dislocations. These are often good times to be a buyer, as providing liquidity in a weak market or less liquid environment can be on our terms at a better price. Advance notice is always good, and our client team is always open to discussing the plan with the client and/or consultant. Duration management, estimated cost, and impact on the remaining portfolio are potential areas of discussion. Cash flows are part of the business of portfolio management, and good client service, and we strive to deliver on both.