The NCAA March Madness tournament has begun. Sixty-eight colleges are playing for the national title over the next month in a single-elimination basketball tournament. College basketball fanatics and non-sports fans alike have finalized their brackets with hard copies printed on their desks and refrigerators to keep track of how well they predicted the outcome (or maybe it is in the trash already…).

Everyone has their own unique methodology for choosing winners and losers: seed, conference, mascot, colors, home state, alma mater, an ex’s alma mater losing…or any combination of these can create the “winning” formula. Although there might be some spurious correlation to any of these, there is one statistic that has been quite consistent in picking teams that make it to the later rounds: defense.

Historically, the teams that most often make long runs in the tournament have well-ranked defenses – of the last 40 final four contestants, 35 have been in the top 25 in defensive efficiency. Defensive efficiency is a statistic used to measure how well a team’s defense performs based on how many points the opponent scores per possession. If you’ve ever heard the motto, “offense sells tickets and defense wins championships,” this statistic is a real-life example of this coming to fruition.

As with college basketball, we think having an efficient defense resonates with our clients and how we strive to manage bond portfolios. An efficient defense allows us to transition quickly and efficiently to offense when the market environment shifts.

Evaluating the players

Every player has a role in the team – some players are solid in the paint, others readily drain three-pointers, and there are those born to be a sixth man. There are also players who can block, but can barely shoot from the line. A team probably doesn’t want five centers on the court at the same time, but likely doesn’t want five point guards either.

Similarly, there are many ways to construct a fixed income portfolio. The Bloomberg Aggregate Index (the Agg), which could be used as a very rough approximation of the investable universe, is roughly $25 trillion in market value across over 12,000 unique issues (although only a fraction of the roughly 35,000 dots on a basketball). Layer in that many investment managers can invest in bonds that don’t make it into the Agg – 144a’s, below investment-grade, bonds with a small amount outstanding, TIPS, non-USD, EMD, bank loans, etc. – and this creates an almost infinite number of possibilities to package together in a portfolio.

bonds that don’t make it into the Agg – 144a’s, below investment-grade, bonds with a small amount outstanding, TIPS, non-USD, EMD, bank loans, etc. – and this creates an almost infinite number of possibilities to package together in a portfolio.

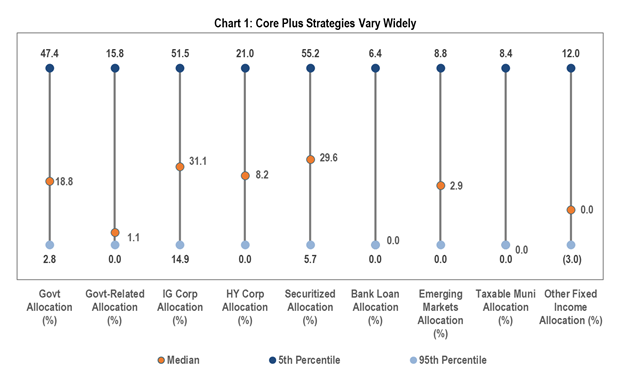

This is clear when examining core plus strategies, which have seen increased interest as a way for investors to earn additional yield and for defined contribution plans to offer a single and more diversified fixed income option to participants. Many core plus mandates are benchmarked against the Agg, but give fixed income managers the flexibility to invest in many of the previously mentioned sectors that are not in the index.

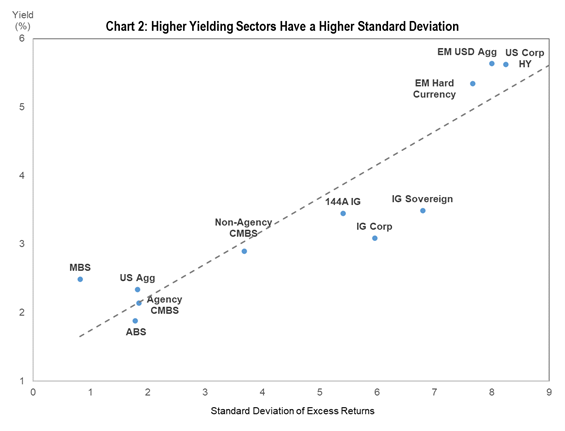

There is a wide dispersion across these mandates as managers attempt to take advantage of, in their view, a dislocation in interest rates, liquidity, market-perceived risk, or any other factor, not only in the index-eligible sectors, but across the universe. This can result in a higher yield and increased portfolio diversification by investing outside the Agg. For example, investors can pick up roughly 215bps and 250bps of additional yield compared to investment-grade corporates by investing in high-yield corporates or emerging market debt.

So why aren’t all managers investing more in these sectors? The prospect of higher yields and potentially greater diversification sounds compelling at face value. However, there are more factors to consider.

Team chemistry

Syracuse University is famous for playing with a “2-3 zone defense” where each player is responsible for defending an assigned area on the court. This type of defense is structured with two players at the top, which allows them to be in an excellent position for a fast break to the opponent’s basket. However, this type of defense is heavily reliant on working together. If one player “falls asleep,” others will need to compensate, creating gaps.

A core fixed-income portfolio is typically the foundation of an investor’s broader asset allocation and is commonly touted for diversification, income, and stability. The three characteristics should be balanced in a fixed income portfolio, working together like five players on the court do:

A core fixed-income portfolio is typically the foundation of an investor’s broader asset allocation and is commonly touted for diversification, income, and stability. The three characteristics should be balanced in a fixed income portfolio, working together like five players on the court do:

- Holding too many securities and sectors can reduce the ability to express conviction in an idea, reducing the benefits of active management and alpha-generating opportunities.

- Focusing too much on maximizing income can degrade the portfolio’s credit quality or make the portfolio increasingly sensitive to changes in interest rates or currency moves.

- Increasing risk and volatility potential should be done when appropriately compensated.

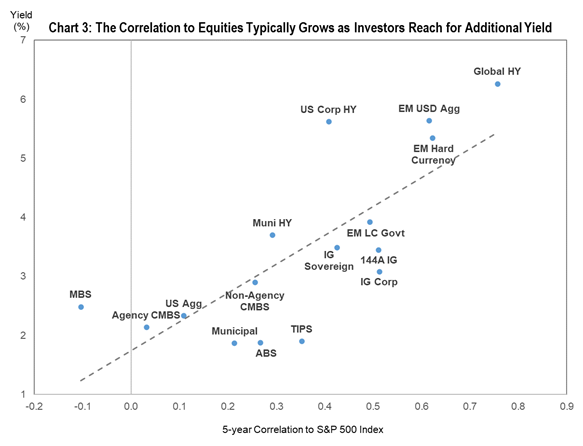

Focusing on one of the characteristics more can also negatively impact others, evident in the chart to the right. As investors introduce higher-yielding bonds into a fixed income portfolio, they become more correlated to equities and potentially increase the risk of not just the fixed income portfolio, but across the broader asset allocation.

The one characteristic that is often overlooked is stability. Diversification and income can be easily expressed by looking at the overall characteristics of a portfolio – yield, number of line items, ticker concentration, sector weights, etc. On the other hand, stability is not truly tested until market volatility picks up or a previously unforeseen event happens, such as the recent war in Russia/Ukraine. Managers with outsized exposures to Russia heading into the invasion feel its impacts, and the news is full of headlines about whether Russia is able and willing to make its upcoming debt payments. During times like these, investors typically expect less market value swings from their fixed income portfolios and prefer to be spending time on other asset classes. Not to mention that investors typically use their fixed income portfolios to fund risk asset purchases when markets sell-off – it’s important to preserve that purchasing power through a stable and consistent fixed income allocation, even while looking for a little extra yield through Core Plus.

Sometimes the best offense is a good defense

At IR+M, we incorporate risk management and “defense” throughout the entire investment process. Not only do we stress individual bond holdings to assess worst case scenarios during our bottom-up credit research process, we also evaluate risk holistically across sectors during portfolio construction. We believe this helps our fixed income portfolios act as our clients intended and limits downside risks, especially when other asset classes are underperforming. We want our clients to avoid surprises, particularly in volatile markets.

But to get back to basketball, have teams won the national championship without an efficient defense? Of course. And there will likely be tons more that win with a poor one. However, it is nice knowing your team won’t risk getting blown out by the other team…but what do I know? My bracket has been busted since last week, which is how I found enough time to write this blog.