The Island of Yap is famous in economic circles for its doughnut-shaped stone currency. Islanders quarried these giant limestones on another island almost 500km away. Once, legend has it, a massive Rai Stone was en-route to Yap by raft when it sank to ocean depths in a violent storm. Several seamen attested to its general whereabouts, and island leaders decided to count it as if it were just another land-bound Stone. This phantom stone could be lent, spent, and used as collateral in the same manner as the tangible ones. But this also changed the paradigm of Yapese money from rigid to flexible.

by raft when it sank to ocean depths in a violent storm. Several seamen attested to its general whereabouts, and island leaders decided to count it as if it were just another land-bound Stone. This phantom stone could be lent, spent, and used as collateral in the same manner as the tangible ones. But this also changed the paradigm of Yapese money from rigid to flexible.

The U.S. Federal Open Market Committee manages a flexible fiat currency to facilitate optimal economic growth. It has a variety of tools to adjust the money supply (M) in the banking system – a target lending rate, an interest rate on nightly excess reserves, and long-term bond trading operations, to name a few. Cash then moves into the broader economy via commercial loans, mortgages, credit cards, etc. The speed at which those funds circulate outside the banking system is called the Velocity of Money (V). M times V equals nominal GDP or the quantity of real economic activity (Q) times the price level (P). Irving Fisher asserted this in his Equation of Equivalence:

Money Supply (M) x Velocity of Money (V) = Aggregate Price Level (P) x Real Output (Q)

This is the framework for the economy’s transmission mechanism, from the printing press to real economic growth. It demonstrates how newly minted dollars, such as those from previous rounds of Quantitative Easing, may end up in banks’ “vault cash” and recirculated back into the bond market. But the Fed has increased the money supply by a whopping 27% over the past 14 months. So, when does our currency become too flexible?

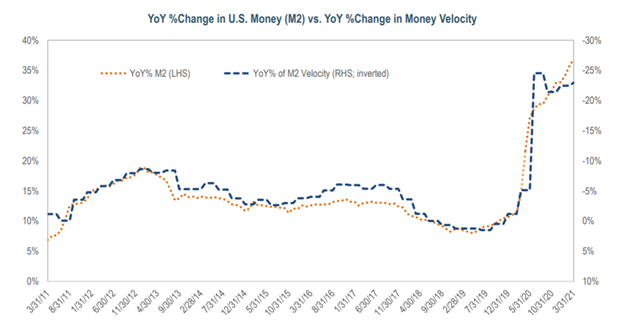

The Velocity of Money slowed sharply in 2020 in response to the Fed’s massive liquidity injections, but it’s now showing signs of stability (see Figure 1) as the economy gets back on its feet. While supply chain disruptions, pent-up demand, and volatile commodities markets are stoking inflation concerns, these types of price pressures point to transient “demand-pull” inflation, which can be easily overcome in a dynamic economy such as ours.

Figure 1

Thus far, the missing piece in the inflation puzzle has been broad-based wage pressures. Not only do higher aggregate wages increase disposable income, but they also pressure profit margins. This may germinate “cost-push” inflation, which is more challenging to eradicate over the long run. It is also a key ingredient in stagflation, which is when P has more momentum than Q in Fisher’s Equation of Equivalence. But with the unemployment rate at close to 6%, the Fed’s models still show more than 2% slack, indicating that wage pressures are not imminent. After all, that metric ended 2019 at 3.6%, while Core CPI remained steady at 2.25%.

Since the Great Financial Crisis, the Fed has been using a “QE toolkit” focused on fighting the lingering effects of a deflationary shock. This has included the purchase of over $7 trillion in long-term fixed-income securities. But aging demographics, disruptive technologies, and high debt levels have kept a lid on any threat of broad-based economic overheating. But in a post-pandemic world, businesses must re-assess PPE, work-leave benefits, and insurance coverages along with cash compensation that lures workers off the sidelines. Collectively, this incremental burden on businesses may stoke “cost-push” inflation enough that the Fed will have to re-assess their extraordinary monetary accommodations. If that proves to be the case, then volatility could return to markets in a sudden fashion.

The Fed’s phantom Rai Stones continue to grow. As service sectors fully re-open this summer, some of these stones will roll up onto our beach as real economic growth. Others will be recirculated back into the bond market. And others will stoke scarcity, potentially with long-term consequences in the labor markets. But nothing is for sure at this point. The data is choppy, evolving, and, at times, misleading. Nevertheless, the Fed is likely planning to be nimble, and so should bond investors.