We bond folks use duration as a measure of price volatility that is easy to absorb and apply. If someone on the team spots a “cheap” 10-year corporate bond trading at +200 basis points (bp, 2% in yield) spread to the 10-year that they think should trade at +160bp spread, my mind immediately captures the 40bp. I take that spread and multiply it by eight. Eight is my mental shortcut for the duration of a 10-year bond. 40bp x 8.0 = $3.20. The bond is over three points cheap. BUY!

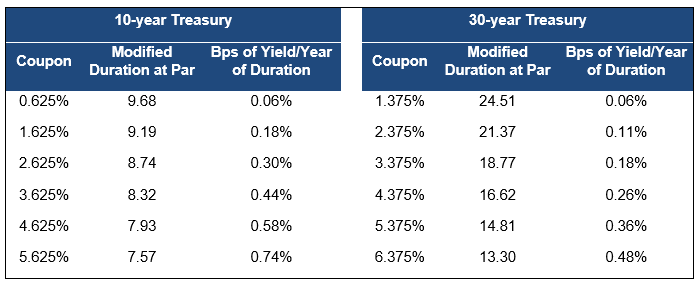

In my 42-year-old brain, the duration of a 10-year bond is eight years. A 5-year bond is 4.5 years. A 30-year bond is 15 years. Given these duration estimates, my colleagues and I are never far from feeling/sensing/intuiting price volatility and opportunity.

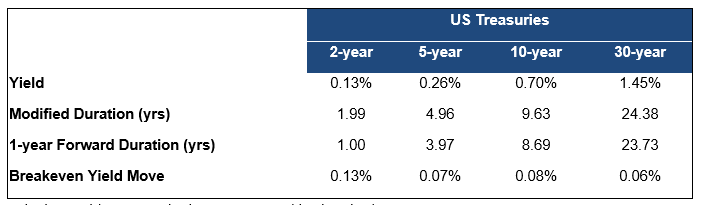

However, the current “QE Forever” environment necessitates that we update our mental model of duration. The latest burst of lower rates and low coupons has pushed bond durations to levels unseen in the US. An egregious example is the on-the-run 30-year Treasury (T 1.375 8/15/50), which weighs in with a duration of 24.38 years. We used to have to buy 25-year Treasury STRIPS to get that type of duration. One could argue, with its 1.375% coupon, the current 30-year is practically a STRIP anyway.

As seen below, current yields do not do a great job at absorbing risk. The price impact of a modest 0.06% rise in long-end rates could wipe out an entire year’s worth of coupon income.

At higher yields, price volatility is more readily absorbed.

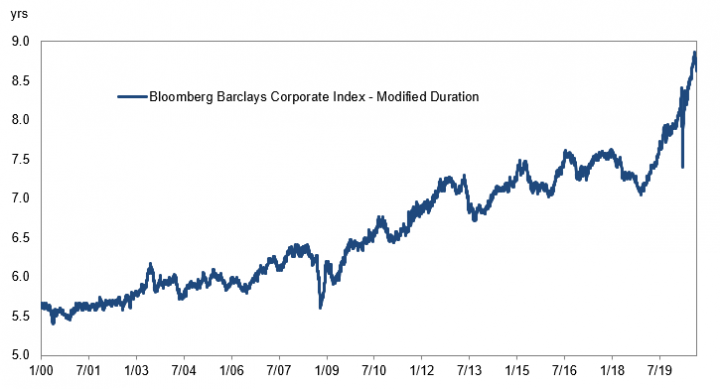

Corporate bonds are not immune to this extension phenomenon. Low rates have extended durations and prompted longer-dated issuance. A double whammy! Most people tend to think of a US Corporate Bond mandate as having five to six years of duration. The current figure is 8.63 years.

The extension of durations and the resultant expansion of volatility can be managed via close attention to safe income generation, portfolio convexity, active relative value trading, and, most importantly, principal protection. That is what we aim to do every day.

We’ve seen many mental models and commonly held standards fall as of late: “the Fed can’t buy corporate bonds,” “a balanced budget is important,” and “the Fed values price stability,” to name a few. The only constant is change.