Simple was good.

Years ago, when I was a new analyst taking on corporate credit, it was explained that corporate bond spreads could be broken apart into three simple components. Although there are many different ways to cut it, I took a liking to think about risk compensation in three buckets: idiosyncratic risk (issuer default risk and cusip specific deal structure risk), liquidity risk, and systemic risk. While drivers and effects of these risks often overlap (i.e., higher-quality credits are often more liquid), these partitions gave us a good way to think about how and why we are being compensated as bondholders.

Prior to 2008, we used to measure idiosyncratic risk compensation via credit default swap spreads as they were a low capital, liquid way to bet on an issuer. Systemic risk compensation was measured by the spread between maturity matched LIBOR swap rates and US Treasuries. Liquidity compensation was the remainder. It was easy; it was logical and helped one make sense of changes in spread. When trading, we knew specifically which component or components appeared mispriced and would shape our action accordingly. For instance, if a bond offered excess compensation for liquidity, we would buy it. If a bond offered too little compensation for credit, we would sell. In essence, grinding out fairly knowable excess return.

Over the past ten years, this model was slowly dismantled bit by bit.

First to go was single name CDS as an observation of “pure” spread risk. The CDS volume and the depth of issuers covered by the market dropped materially after the Volker rule and capital standards regulation. While one can still look to the CDS market for default risk clues, it is not nearly as clear as it once was.

As of this writing, and the past few years, we are losing LIBOR, and its associated swap spreads. At its inception, LIBOR measured the interest rate of an unsecured short term loan (typically three months) from one bank to another. As you would imagine, the rate was standardized, and it was quickly bootstrapped out to a whole curve via interest rate swaps. One party would exchange the payment of a stream of cash flows that reset quarterly at LIBOR for a fixed rate for a set period. Swap rates and swap spreads were the result, and it was clear to see that they had a credit component to them as LIBOR would rise and fall relative to other short rates based on perceived systemic/global money market and banking risks.

A couple of factors undid LIBOR and the swap curve as signals of risk. The human element played a big part as some traders couldn’t help themselves and engaged in the gaming and the fixing of the rates. Regulators don’t like that and hence pushed to shut LIBOR down. Also pressing on the utility of LIBOR as a signal of risk was quantitative easing. With central banks around the world removing government bonds from the float, the interest rate swap market became the place to go for liquid duration. This demand pushed swap spreads in long maturities negative and turned the idea of swap spreads as a proxy for systemic risk compensation on its head.

What should I charge as my base level of risk? What’s the base cost of a spot in the market’s portfolio? This is now much less clear.

And then came the pandemic.

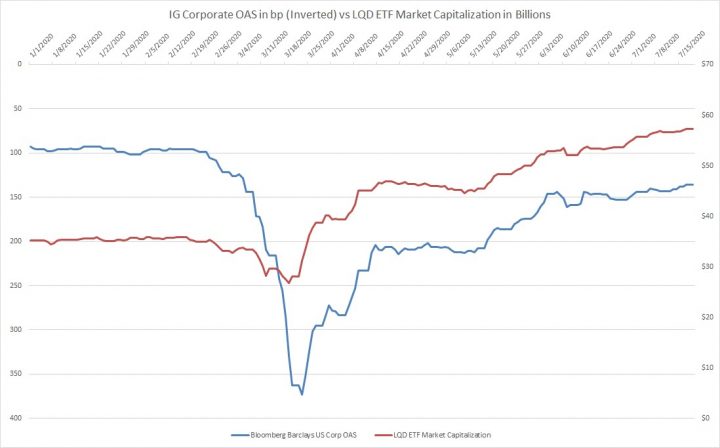

The new elephant in the room distorting the picture now, and perhaps forever, is the massive action and ongoing “threat” of action taken by the US Treasury and the Federal Reserve in the form of the SMCCF and PMCCF buying facilities. A few paragraphs in the CARES act may change how we will all think about the price of corporate credit risk for a long time. We’ve seen the money come in from all corners of the world and aggregate into passive ETFs, which, in conjunction with SMCCF buying, has served to totally reprice the market.

It’s obvious now that we have a new fourth element that will massively impact all other elements of risk and spread. The backdrop of fresh capital from PMCCF, if needed, reduces single credit risk to a degree (RISK NOT ELIMINATED!) while systemic risk and liquidity risk (perhaps merging into one) get massively repriced lower in spread.

Old and new risks interplay and defy traditional definition.

What is the right price (spread)? For the index, it is tough to say. Credit fundamentals are worse than average at the issuer level, but investor demand and the perception of a Treasury/Fed put has the market back close to “normal” spreads. The interplay of risks make a beta/spread directional bet much less obvious at this point. For patient holders of good securities selected from the bottom up, the correct price is easier to pinpoint. While pockets of the market are still very attractive, we would warn against getting too comfortable in embracing government policy. Grinding out excess return is still very possible but now far less obvious.