3Q25 Market Themes + Outlook

- Consumer resilience appears to be softening as the tariff pause ends, inflation persists, and uncertainty remains elevated.

- Fundamentals are solid but could weaken if economic pressures intensify.

- The Federal Reserve (Fed) now projects higher unemployment and inflation than previously expected.

- Yields remain supportive, though markets are sensitive to fiscal surprises and geopolitical shifts.

Taxable Sectors – Corporates

- Corporate fundamentals remain solid, though debt levels – now about double those seen before the GFC – reflect years of borrowing amid low interest rates.

- Tight spreads, easier financial conditions, and a likely accommodative Fed may increase the potential for renewed “animal spirits.”

- Consumer balance sheets remain healthy, supported by wealth gains and continued strong demand, particularly among higher earners.

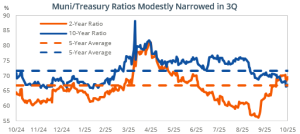

Tax-Exempt – Municipals

- Municipal bonds had their strongest October in 30 years, returning 1.24% and outperforming the broader US taxable bond market’s 0.62% gain.

- Primary market activity remains robust, with nearly $460 billion in year-to-date issuance. Issuance is on pace to set a new record in 2025, and supply could approach $600 billion in 2026 amid sustained confidence and financing demand.

Sources: Bloomberg as of 10/31/25, unless otherwise noted. Top left chart/table: Returns, yields, and spreads are from the respective Bloomberg indices as of 10/31/25. After-tax yields assume the highest federal marginal tax rate of 40.8%. Bottom left chart: Percentile calculated using monthly spread going back 20 years. Top right chart: Source: BofA Global Research. IG = investment grade corporates and HY = high yield corporates based on the average rating across Moody’s, S&P, and Fitch. Bottom right bullet: Returns quoted are from the Bloomberg Municipal Bond Index and Bloomberg US Aggregate Bond Index, respectively . The views contained in this report are those of IR+M and are based on information obtained by IR+M from sources that are believed to be reliable but IR+M makes no guarantee as to the accuracy or completeness of the underlying third-party data used to form IR+M’s views and opinions. This report is for informational purposes only and is not intended to provide specific advice, recommendations, or projected returns for any particular IR+M product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from IR+M. “Bloomberg®” and Bloomberg Indices are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by IR+M. Bloomberg is not affiliated with IR+M, and Bloomberg does not approve, endorse, review, or recommend the products described herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to any IR+M product.