Recently, the FOMC has shifted its focus from closing the employment gap to mitigating inflation trends. They’ve announced their conventional tightening toolkit and ramped up hawkish rhetoric. Yet waning fiscal spending, rising tax revenues, and shortening auctioned Treasury maturities has countered their efforts to tighten financial conditions back to “normal”.

“When you find yourself on thin ice, skate fast” – Ralph Waldo Emerson (paraphrased)

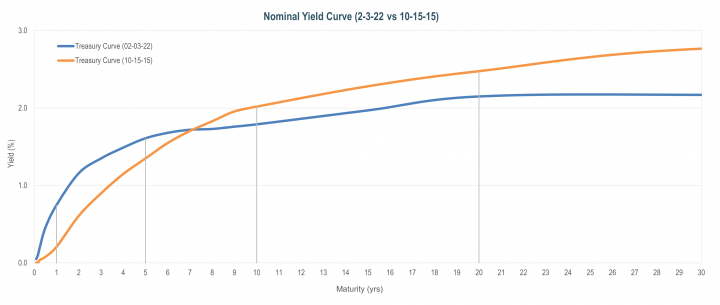

Fed jitters have blanketed the bond market in 2022. Powell’s perceived turncoat from dove to hawk has prompted the Treasury curve to now assume six hikes for the balance of 2022 and a potential 50bp hike in March. Today’s CPI print underlies the market’s quick reaction. Figure 1 shows how steep the short end has become – steeper than the previous hiking cycle from 2015-2018. Yet the long end seems “stuck-in-the-mud”. It’s also suggesting something’s not quite the same as the last cycle.

Figure 1: The front end of the yield curve has responded to the FOMC’s hawkish turn more than the long-end to-date. (Source: Bloomberg)

Powell’s Hairpin Turn

Taken at face value, Powell’s comments have not been especially alarming. So far, he’s raised his long-term inflation forecast “a few tenths of a percentage point”. However, in a few short months, he’s dramatically pivoted from a dovish to hawkish tone. This has been, at least in part, the reason for the rise in volatility across interest rate, credit, and equity markets in 2022. But bond investors have been prepared for this pivot better than they were in 2013 – even with the assumption that this tightening will happen far faster than the last one. Furthermore, the Fed’s recently republished Principles for Reducing the Size of the Federal Reserve’s Balance Sheet reads very similar to the principles they followed last time (albeit with a caveat that they may adjust their principles at any time):

- Conduct a taper of MBS and Treasury purchases (expected to finish by early March).

- Initiate Fed Funds Target Rate hikes (expected to begin on March 16th).

- Announce Quantitative Tightening along and schedule of reinvestment tapering of Treasury and Agency MBS (expected this summer).

- Allow their bond portfolio to passively shrink over the long run (expected 2H-2022).

- Forgo the option to actively sell bond holdings for now.

Normalizing Treasury Supply

Treasury issuance is expected to decline in 2022. While the Federal budget for FY2022 remains in flux, the deficit is expected to decline as much as 50% from that in FY2021. The end of fiscal stimulus, the dramatic rise in tax revenue, and Congressional gridlock over spending are the main culprits. Furthermore, inflation acts as a tailwind – growing nominal tax receipts and pushing many taxpayers into higher income tax brackets. The result is a deficit projected to be roughly $1.4trn – almost back to pre-pandemic levels. However, the Fed’s Quantitative Tightening may counteract some or even all this shrinkage. While the Fed does not directly buy bonds from the U.S. Treasury, it presently does absorb a significant amount of Treasury float by pairing-off maturities with new purchases. So, if/when Quantitative Tightening is kicked-off, it’ll mark the sunset of a roughly $500bn/year line-of-credit from the Fed. In turn, that will have to be replaced by public absorption of additional duration risk at some market determined yield level.

How To Train Your Financial Conditions

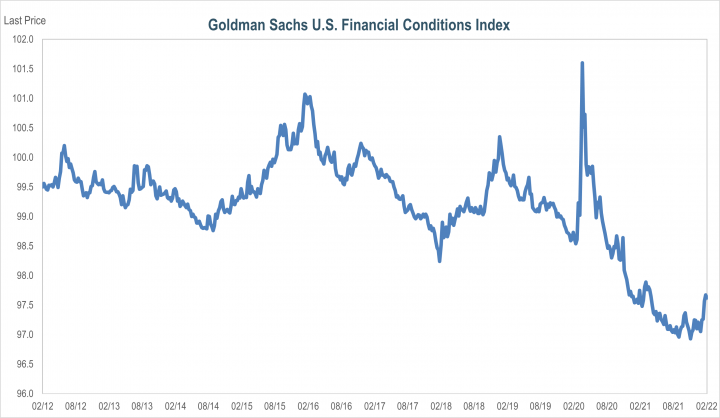

Powell’s real goal is to tighten financial conditions. These conditions are dictated by capital markets and serve as the gas to fuel economic growth (and inflation). The trick is to tighten that gas valve just enough to keep the economy cooking, but not overheating. Based on The Goldman Sachs Financial Conditions Index (GSFCI; Figure 2), he still has quite a few tightening turns to go for conditions to return to long-term averages. Yet Powell has already laid out the tightening plans, leaving the FOMC with limited additional conventional tools to counteract the possibility that inflation continues to spiral higher. In that case, his best bet may be to further amplify his hawkish rhetoric by suggesting that unconventional tools, such as active bond sales, are being considered. This threat – an immediate “duration” supply shock – would likely shift both short and long-term interest rates, along with broad financial conditions, meaningfully higher.

Figure 2: Goldman Sachs Financial Conditions Index (GSFCI). Higher is tighter. (Source: Bloomberg)

The “Other” Committee Behind Long-Term Treasury Yields

Ostensibly, Quantitative Tightening (QT) reverses the impact of Quantitative Easing (QE). However, if QT is conducted passively (i.e., without actual asset sales), then it’ll take years, if not decades, for maturities to counteract the FOMC’s pandemic-era bond purchases. Furthermore, for the same amount of duration to be added back to the market, the Treasury must commit to issuing similar maturity Treasuries. This decision is made on a quarterly basis by the Treasury Borrowing Advisory Committee (TBAC). Membership on this committee is comprised of sell-side and buy-side participants, including asset managers, hedge funds, insurance companies, and broker-dealers. They recommend, to the Treasury Secretary, the distribution of long-bonds, notes, and T-Bills to be auctioned each quarter. So, TBAC’s decisions are a less known, but critical, ingredient to the yield spread pricing between short and long bonds. Recently, TBAC recommendation shortened the maturity profile for the coming quarter by approximately a quarter year. So, the Treasury is not only shrinking auction sizes, but favoring shorter issues. These technical details help to explain the shape of the Treasury curve today.

Conclusion

The Fed seeks to orchestrate tightening with the tools and transparency afforded to the market in the last tightening cycle. However, if inflation trends do not soon abate, then they may have to cook up other methods to lift yields and tighten financial conditions. This may include verbal hints that they’re considering alternatives to their conventional “tightening gameplan”, such as 50bp hikes and/or active bond sales. The thought of these “shock and awe” tools are scary for bond investors, but, if successful in curtailing inflation, may be beneficial to the long-term stability of the entire yield curve.