We recently sat down with Portfolio Managers Lyniese Patterson and Ginny Schiappa to discuss the high-yield corporate bond market. Amid record low yields, this asset class has received more attention due to its potential to increase the yield of fixed income allocations. At IR+M, we believe there are attractive opportunities for a bottom-up security selector, while respecting the differences between investment grade (IG) and high yield (HY) debt. In this Q+A, we touch on some of these distinctions, how the HY market has changed, and where we currently see value.

What makes the high-yield market different than the investment-grade corporate market?

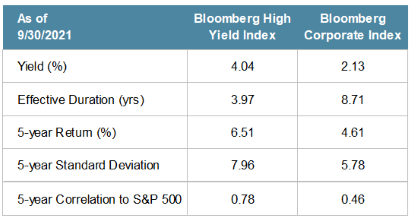

High-yield corporates are riskier than investment-grade corporates. When compared to IG, HY companies often have smaller scale, operate in more niche sectors, or have relatively weaker balance sheets. This requires more in-depth, equity-like credit analysis. We also must consider things like structural subordination, bond indentures, leveraged buyouts, and payment-in-kinds (PIKs). As a bondholder, you should get paid for those additional risks and considerations. Historically, HY investors have been compensated with 200-300bps more spread than IG investors.

High-yield corporates are riskier than investment-grade corporates. When compared to IG, HY companies often have smaller scale, operate in more niche sectors, or have relatively weaker balance sheets. This requires more in-depth, equity-like credit analysis. We also must consider things like structural subordination, bond indentures, leveraged buyouts, and payment-in-kinds (PIKs). As a bondholder, you should get paid for those additional risks and considerations. Historically, HY investors have been compensated with 200-300bps more spread than IG investors.

The majority of HY bonds are callable prior to their maturity date. We think this optionality is an important feature of HY market because it allows an issuer to redeem and refinance outstanding debt at potentially lower interest rates if its credit profile improves or interest rates are lower in the future. Call options shorten duration but also increase reinvestment risk as most HY bonds are called before their final maturity.

Given the higher risks and complexities, HY returns are typically higher than IG over a market cycle, but not quite as high as equities. HY typically has a lower correlation to IG corporates, and a low or even negative correlation to US Treasuries, which means that including a HY allocation in a broad fixed income portfolio may enhance portfolio diversification.

How has the HY market changed over time?

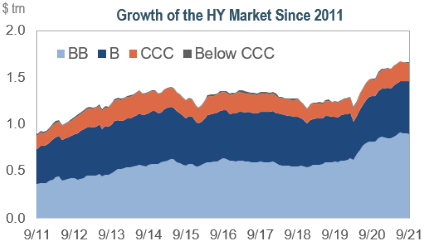

We’ve seen the HY market rapidly grow over the last decade, nearly doubling in size since 2011. Once a smaller asset class, the HY market now finances many large household names such as T-Mobile, Ford Motor, and Kraft Heinz Foods. Credit cycles, together with waves of fallen angels and rising stars, constantly change the composition of the market. We saw a record amount of fallen angels last year which grew the BB-rated segment of the market by nearly 40%. The HY index is now the highest quality it has ever been.

We’ve seen the HY market rapidly grow over the last decade, nearly doubling in size since 2011. Once a smaller asset class, the HY market now finances many large household names such as T-Mobile, Ford Motor, and Kraft Heinz Foods. Credit cycles, together with waves of fallen angels and rising stars, constantly change the composition of the market. We saw a record amount of fallen angels last year which grew the BB-rated segment of the market by nearly 40%. The HY index is now the highest quality it has ever been.

The primary market has been wide-open and contributed to the growing market, as well. Gross new issue volume of $407 billion in 2021 is on track to be the highest on record, surpassing last year’s record of $430 billion. HY bonds are often issued under Rule 144a, which has grown to roughly two-thirds of the overall market. Rule 144a allows issuers to access the capital markets much faster than non-144a bonds, and at a lower cost, due to less reporting requirements.

We’ve seen two notable trends in 2021: there have been more debut-issuers, with almost 80 year-to-date, and a rise in longer-duration issuance – 10 years or longer versus what was traditionally eight years and shorter. Even with record issuance this year, refinancing debt and/or loans remains the primary use of proceeds, which is generally healthy for companies as it reduces issuer interest costs while terming-out debt maturities.

What are some major sector differences between HY and IG?

The Energy sector comprises a larger percentage of the HY Index than in IG (13% vs. 8%, respectively). Much of the HY Energy exposure today is former investment-grade bonds from the Midstream and Independent sub-sectors. Prior to COVID, free cash flows were often negative as issuers focused on growth over free cash flow. The energy crisis showed the importance of solid balance sheets, low leverage and cost structures, positive free cash flow generation, and the ability to return discretionary cash to shareholders. Many companies without these characteristics were pushed by the ratings agencies to HY.

Similarly, the Consumer sector is much larger in the HY index (35% vs. 22%) and much more diverse. Retail is a good example of this; department stores that traditionally rely on foot traffic are experiencing distinct secular changes. There are also niche retailers within this same sector that have multiple sales channels across brick-and-mortar, online, and/or wholesale. This makes it more difficult to generalize broad-based themes across the sector.

On the other hand, Banking is a much smaller sector. Within IG, we are positive on money center banks, which account for over 21% of the IG index. Banks rated high yield are only 1% of the HY index and are primarily smaller Yankee banks.

Where is IR+M currently finding value in HY?

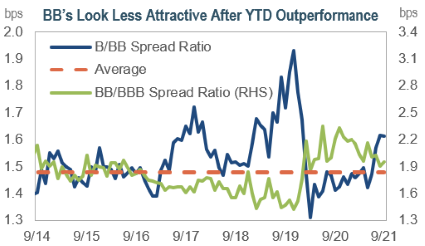

Fundamentals have dramatically improved, and spreads are trading near post-crisis tights. To start 2021, we favored an up-in-quality bias within HY, toward BBs, fallen angels, and secured debt. We viewed these segments of the market as attractive given their less callable exposure, relatively flat credit curves, and an outlook for elevated upgrades. The yield differential between secured and unsecured debt was minimal, while secured bonds offered added protection via asset coverage.

Fundamentals have dramatically improved, and spreads are trading near post-crisis tights. To start 2021, we favored an up-in-quality bias within HY, toward BBs, fallen angels, and secured debt. We viewed these segments of the market as attractive given their less callable exposure, relatively flat credit curves, and an outlook for elevated upgrades. The yield differential between secured and unsecured debt was minimal, while secured bonds offered added protection via asset coverage.

Spreads continued tightening in 2021, given the improvement in credit fundamentals, accommodative Federal Reserve, and global reach for yield. Our favored segments at the onset of the year outperformed, and we are now opportunistically monetizing outperformers. At current valuations, we are comfortable moving portfolios slightly down in credit to single-B’s where we continue to find solid companies trading at attractive valuations. The primary market also allows us to selectively source new ideas, as newly-issued bonds priced at par have a higher convexity and any potential price appreciation is not as limited by call prices.

How does IR+M think about high yield differently than other firms?

We are looking for durable, sustainable businesses. We believe it is easier for a good company, with a solid business model, to support a bad balance sheet, than it is for a bad company with weak fundamentals to persist with a good balance sheet. This philosophy motivates us to seek opportunities across and within sectors and credit ratings and “take what the market gives us”. Just like with our IG strategies, our HY and Opportunistic strategies are managed across sector teams, including securitized, municipal, and in HY, especially credit. Our team approach allows us to evaluate relative value across sectors and capital structures and buy our best ideas for all strategies in which they belong. One of our favorite examples of our cross-sector relative-value approach is within the restaurant sector; we look at corporates across HY issuers but currently favor their BBB-rated asset-backed security (ABS) counterparts, whole business securitizations, which are issued by well-known names like Domino’s Pizza and Dunkin’. Our collaboration across sector teams allows us to find securities with preferable risk profiles and better yields.

As rates hover near record lows, yield-hungry investors are increasingly focused on the high yield corporate bond market. This market has grown over the years due to a variety of factors, accommodating its wider investor base. Investors should remain cognizant of its unique risks, especially relative to investing in investment grade bonds. At IR+M, we lean on our experienced Investment Team to navigate the nuances of the asset class. We use our 30+ year process of bottom-up security selection, emphasizing credit, structure, and price, to find bonds that we believe will withstand a variety of market environments.