Time of Possession

Last week, Preston Raymond, a long-time member of our trading team, located and purchased a block of a 2 ½- year bond issued by a high BBB-rated mid-size REIT (real estate investment trust). We added the bonds to our client portfolios at an attractive spread relative to the comparable Treasury.

Like most REIT paper, this bond trades at a slight discount to similarly-rated corporate bonds due to COVID-related uncertainty around the future of commercial real estate rents and property valuations. Our REIT analyst Rob Nuccio wrote this about the specific credit: “Their portfolio, under the new management team, has been materially repositioned the past four years with close to half its assets divested. These actions have resulted in the most balanced portfolio and the best fundamentals going forward among their big competitors. The recent large asset divestiture and repositioning simplifies the credit story and sets them up for more favorable long-term fundamentals.”

Given Rob’s optimism on the credit and the attractive front-end yield, the team liked the purchase because we viewed the issue as possessing two critical properties: 1) the ability to protect principal (REIT bonds have attractive protective covenants), and 2) a material risk-adjusted yield above an extremely low comparable maturity Treasury rate.

We made the purchase on Wednesday, January 20th. Though we didn’t plan on it, the very next day, we learned that the company was tendering for the issue at an appealing yield and price. It was a quick turn for that holding, but a nice ½ point price pop.

Up Front Pressure

This tender is one in a long line of many, and represents the carryover of a theme that developed late in the first quarter of 2020. We have been fortunate to have had multiple tenders provide a bump to performance across our strategies, especially for shorter maturities.

In March of last year, many pockets of the fixed income market were suffering mightily due to the panic surrounding COVID- induced shutdowns and their potential impacts on the economy and business results. Corporate bond spreads widened to levels not seen since the Great Financial Crisis, and bond issuers wondered about downgrades and access to capital. In a stroke of good fortune for corporate issuers (and investors), the US Treasury and the Federal Reserve, empowered by the CARES Act, established two corporate credit facilities (SMCCF and PMCCF) that essentially backstopped the market.

At this time, corporate issuers took a hard look in the mirror and determined that it was prudent to bring forward planned future issuance in case volatility returned. 2020 saw record corporate issuance with about double the normal proportion of long duration issuance. Two common uses of proceeds from these sales were to: 1) put cash on the balance sheet, and 2) clear out front-end maturities. Both served to make issuers less market dependent in the coming years should volatility persist.

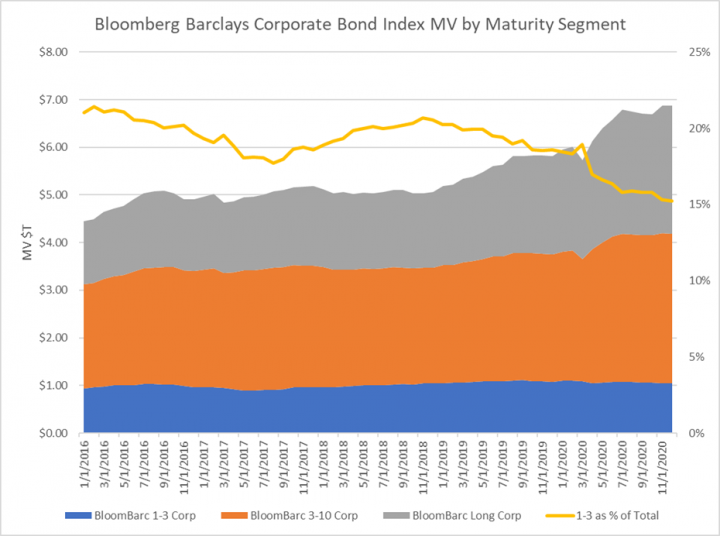

The impact to investors is that the front end has been “hollowed-out”. As seen below, the market value of the Bloomberg Barclays US Corporate 1-3 Index was lower year-over-year in a period of otherwise outsized corporate bond universe growth. To further illustrate the point, consider this statistic: As of 12/31/19, there was $405 billion in index-eligible par with maturities between 2.25 and 3.0 years. The par outstanding of that same list of bonds as of 12/31/20 was $329 billion, a nearly 20% reduction in the amount outstanding due to tenders, calls, and exchanges. This universe’s cusip count went from 465 to 383, with many of the remaining issues having been partially retired.

In Between the Posts

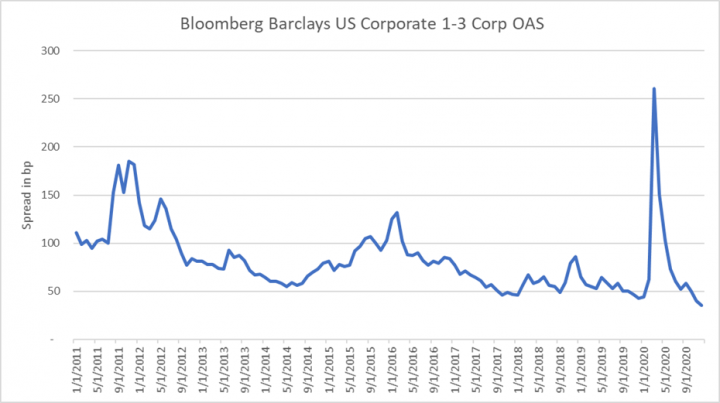

Continued expansionary fiscal and monetary policy has contributed to a robust bid for almost all financial assets. This bid, combined with a shrinking market, has stretched valuations on the front end of the corporate curve. As seen below, spreads are currently at multi-year lows despite the remaining economic unknowns.

As you can imagine, low spreads and a shrinking market have pushed investors out the maturity curve and into other asset classes. As such, we’ve seen increased demand in many other asset classes, such as longer-duration investment-grade bonds, short high yield, ABS, CMBS, RMBS, and the like. A look at these asset classes indicates that there are no free lunches to be had (though that is another blog post).

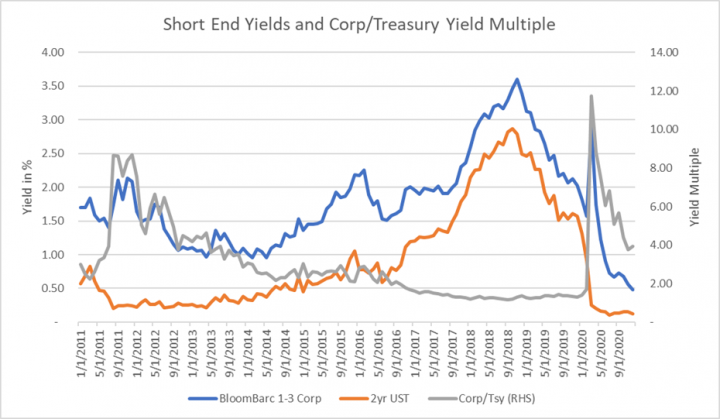

One comparative asset that makes front-end corporate valuations shine is US Treasuries. Recent single-digit short-maturity yields (let’s not even talk about overseas yields, which are predominantly negative) highlight that corporate bonds remain an excellent substitute for investors with low duration/cash alternative needs. Unlike spreads, corporate bond yields as a multiple of Treasury yields are at a record high. The magnitude of the yield difference between these two asset classes speaks to the importance of collecting something other than the US Treasury base rate.

For our short duration client portfolios, we plan to kick the ball between the left goal post of ugly Treasury yields, and the right goal post of taking too much credit risk in the investment-grade spread markets. We endeavor to provide a return well in excess of the base rate, while maintaining: 1) principal protection, 2) liquidity, and 3) flexibility. As seen above, the market appears to go into crisis every five or so years, so we’ll be prudently (but not excessively) collecting some yield in anticipation of taking advantage of the next opportunity.