For executive chefs, food innovation involves skillfully pairing flavors, textures, and techniques to create a harmonious dish and bespoke dining experience. The motivation is similar for fixed income portfolio managers, some of whom have historically used US government securities as their primary ingredients and broad indices as their foundational recipes. As bond chefs, if you will, we at IR+M tailor portfolios to accommodate investors’ discerning and ever-evolving palates, balancing sweetness and acidity – or in this case – safety and risk. As US government securities become a larger and atypically risky segment of the market, we look for ways to incorporate other elements into our portfolio recipe.

Over 70% of a Single Ingredient…

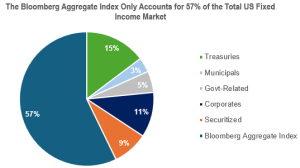

Within the US bond market, the growth of government-backed sectors has been driven in large part by the increase in outstanding Treasury debt. Perpetual fiscal deficits are financed through additional Treasury borrowing, which results in mounting US debt.

- Currently, over $13 trillion of Treasury debt meets the Bloomberg Aggregate Index’s inclusion criteria. When coupled with agency-backed debt (ie. agency debentures, mortgage-backed securities and agency commercial mortgage-backed securities), there has not been a larger percentage weighting in the last 10 years.

- As deficits persist, the Treasury sector is expected to continue growing relative to the broader fixed income universe. This trend leads investors to question whether this historically safe haven is becoming riskier.

… At Least it’s Safe, Right?

Like shifting sentiments regarding what constitutes nutritious foods (some readers may fondly recall sugary, fruit-flavored treats), securities backed by the US Government must now be evaluated with a much higher degree of scrutiny.

- Gone are the days of the US’ AAA credit rating, which when paired with an unparalleled degree of liquidity, created the ultimate safe-haven assets. In May, Moody’s downgraded the US’ credit rating from Aaa to Aa1, following moves by S&P (2011) and Fitch (2023). Although the decision was largely a non-event, it highlighted the increased focus on the US fiscal outlook.

- With Treasuries, today’s reality includes debt-ceiling default concerns, episodes of illiquidity not generally associated with the asset class and rumors of foreign selling as protection against some of the current administration’s stated trade objectives.

- Bonds backed by Freddie Mac (FHLMC) and Fannie Mae (FNMA) now have their own added degree of risk. Government-Sponsored Entities (GSE) reform has been revived – most recently with President Trump calling for FNMA and FHLMC to go public – amplifying uncertainty to the Bloomberg Aggregate Index’s second largest cohort. Increased allocations to these now riskier sectors of the market, without appropriate compensation, could leave some investors with indigestion. Fortunately, investors have options, depending on whether they believe these are perceived risks or actual risks.

I’ll Take a Serving of the Aggregate Index… As Is, Please

Like that meal you have eaten innumerable times at your favorite restaurant, a passive investment strategy is designed to deliver no surprises. A portfolio positioned almost identically to the benchmark, in terms of the sector and issuer weights, will likely deliver index-like returns.

- A passive approach can lead to outsized allocations in the largest issuers—some of which may present less attractive valuations or heightened credit risks. Without active management, investors risk being disproportionately exposed to these issuers, potentially sacrificing return potential.

- Fixed income investors relying on passive strategies may confront the reality that their government-backed bond allocations may not behave – or taste – as expected. Traditional safe-haven assets have exhibited atypically strong correlations with risk assets, complicating portfolio diversification.

- This quarter highlighted this phenomenon as risk assets and long-duration Treasuries alike sold off following tariff announcements. The traditional flight to quality failed to materialize, underscoring the need for a more proactive approach to your fixed income allocation.

Are Substitutions Allowed?

Waitstaff are often asked if menu items contain potential allergens or if the chef allows substitutions (“Can I have a salad instead of fries, please?”). With dining, the end goal is to create a more pleasurable and tailored experience for the customer. Similarly, as active managers, we devote considerable time to thinking what bond or sector substitution would address a client’s objectives and potentially enhance performance.

- While a Core/Core Plus strategy benchmarked to the Bloomberg Aggregate Index includes government-backed sectors, we believe in the power of deliberate asset allocation. Rather than completely avoiding Treasuries and agency securities, investors can benefit from strategic diversification that incorporates high-quality alternatives with prudent risk profiles.

- These securities may offer the potential for enhanced yield, improved credit quality, and better risk-adjusted returns, making them compelling additions to a well-constructed portfolio. Often, these securities are either not included, or underrepresented, within traditional indices.

I’m Allergic, Can You Make the Dish Without That Ingredient?

Absolute-ly! In the world of fixed income, active managers can remove certain ingredients – such as securities, sectors, or benchmarks – from portfolios; at IR+M, we call that our Absolute Return Strategy. Absolute Return is largely benchmark-agnostic, as opposed to those strategies that use a government-heavy index as a guidepost.

- With Absolute Return, a manager has the broad flexibility to rotate between sectors and ratings (both investment grade and high yield), with a controlled duration that is not explicitly tied to a benchmark. For bottom-up bond selectors like IR+M, it is a sweet spot. We focus on the higher probability, more easily repeatable generators of alpha (credit, structure) and eschew the considerably more difficult (duration).

- Absolute Return is not necessarily a replacement for investors’ Core/Core Plus Aggregate-benchmarked allocation. However, it can be an alternative for those looking to reduce their government exposure, dynamically oscillate across sectors, and continue to emphasize preservation of capital.

Just as a chef skillfully uses flavors, textures, and techniques to create an inspired dish, active fixed income managers search for the precise ingredients for their portfolio recipe. With government-backed bonds becoming a larger and potentially riskier part of the market, investors may want to rethink their portfolio construction. At IR+M, we build portfolios bond by bond, balancing safety and return with investors’ ever-evolving needs. Like a memorable entrée, we believe every ingredient – or security – in a portfolio should have a well-defined purpose.