On March 11th, the American Rescue Plan Act of 2021 (ARPA) was signed into law, providing additional economic stimulus in response to the pandemic. Pension relief for both multiemployer and single-employer pension plans was included. ARPA contains an $86 billion financial assistance package for certain distressed multiemployer plans. The Act also extends contribution deferral policies for single-employer plans. While the effects of the relief are temporary, ARPA is expected to deliver much needed near-term financial support for troubled sponsors.

MULTIEMPLOYER PLANS

Special Financial Assistance

- The $86 billion allocation within ARPA provides pension benefit payments for 30 years to chosen plans. The arrangement for distribution of funds is unique; the Pension Benefit Guaranty Corporation (PBGC) will receive the entire amount from the Treasury, and then the PBGC is responsible for administering the program. The PBGC will vet requests from plan sponsors and pay out a single lump sum to sponsors for the approved amount.

- These distributions must be invested in investment-grade bonds and other PBGC-approved investments. They must also be segregated from other plan assets. Given the amount must cover payments for 30 years, we believe that actively managed long corporate bonds may offer the most attractive risk-adjusted returns while providing downside protection.

- Critics have called this relief a “bailout” because it lacks any systematic reform to multiemployer funding requirements. The concern is that it will only result in a stopgap for 30 years, and plans may be in a worse position when funds are depleted.

The Technical Details:

- Our understanding is that not all eligible plans will be approved, and the PBGC will prioritize applicants by needs. Eligible multiemployer plans must meet one of the four qualifying requirements:

- The plan is in critical and declining status for plan years 2020 through 2022;

- A suspension of benefits has been approved;

- The plan is in critical status with a modified funding percentage less than 40% and a ratio of active to inactive participants less than 2/3; or

- The plan became insolvent after December 16, 2014, has remained insolvent since, and has not been terminated.

- Applications must be received by December 31, 2025, and payments must be made prior to September 30, 2030. Plans that receive a lump sum need to reinstate and repay any previously suspended or reduced benefits.

Temporary Funding Relief

- ARPA allows for certain elections to reduce upcoming contributions and extend the time period to close funding deficits.

- Use of prior zone status for the two plan years between March 1, 2020, and February 28, 2022;

- A corresponding delayed update to rehabilitation and funding improvement schedules; and

- For plans in critical or endangered status in 2020 or 2021, an extension of rehabilitation or funding improvement periods by five years.

PBGC Premium Increase

- PBGC premiums will materially increase to $52 per participant starting in 2031 and indexed by inflation thereafter. Current premium rates are $31 per participant. As we have seen on the single-employer side, this cost headwind may incentivize multiemployer plan sponsors to transfer risk via annuities or reduce headcount through a bulk lump sum offering.

- Per the Fiscal Year 2019 PBGC Projections Report, the multiemployer program will reach insolvency with “near certainty” by the end of fiscal year 2027.

- Comparatively, the PBGC single-employer program is expected to remain solvent through fiscal year 2029 (i.e., the full projection period). Current single-employer PBGC premiums are much higher as well, at $86 per participant and $46 per $1,000 in unfunded vested benefits.

SINGLE-EMPLOYER PLANS

Interest Rate Stabilization

The single-employer funding relief extends interest rate stabilization and funding shortfall amortization periods, both of which reduce minimum required contribution amounts in the near-term. Last year, we hypothesized that these two strategies would eventually be included in an economic stimulus package in Can Relief Now Lead to More Pain Later?.

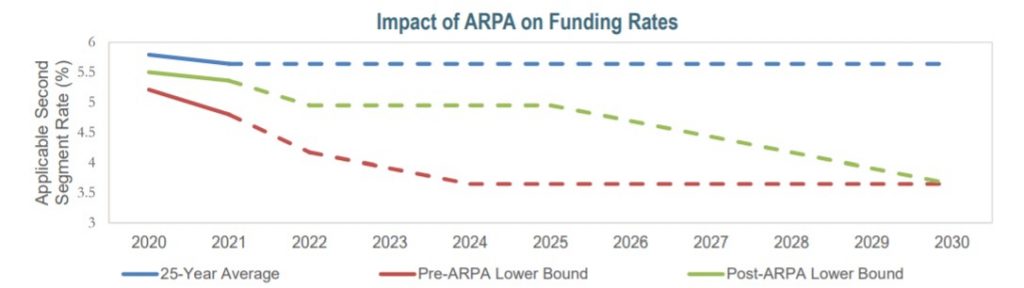

- ARPA marks the third extension of the interest rate corridors originally implemented in 2012 as part of Moving Ahead for Progress in the 21st Century (MAP-21). The current basis for funding interest rates is a 2-year average. The corridors limit these rates with a floor and ceiling based on long-term 25-year historical averages. With current rates hovering at all-time lows, only the floor is relevant and in effect. Interest rates for funding purposes are kept at higher levels. Higher rates in turn lower liabilities and reduce required cash contributions.

- Post-ARPA, the corridor for the 2020 plan year is 95% to 105% of 25-year average rates, and this range applies until 2025. The corridors will then widen by 5% each year until 2030. Further, 25-year average rates cannot be less than 5% (prior to applying the corridor). Sponsors can opt in to using these higher post-ARPA rates for plan years 2020 through 2022.

- Pre-ARPA, the interest rate corridors are wider in 2020 and set to phase out at a faster clip. The 2020 plan year corridor is 90% to 110% of 25-year average rates and set to widen by 5% for each following year until 2024. The below chart demonstrates how the post-ARPA rates used will be higher.

- The blue line is the 25-year historical average rates that the corridors reference (for illustration purposes, we have assumed rates after 2021 remain unchanged).

- The red line is the rates that would have applied prior to ARPA.

- The green line is the new rates that will be in effect after the adoption of ARPA. The post-ARPA rates will be higher than pre-ARPA rates (and result in lower contribution requirements) until 2030.

We are still awaiting additional technical guidance, which will clarify some of the specific details and applications of ARPA pension relief. However, sponsors may need to make decisions in short order to take advantage of the available relief. We recommend plan sponsors partner with their actuaries, consultants, and LDI managers to understand the immediate and future impact of any elections.