Whether or not we have a recession isn’t the only key theme for the second half of 2023. The Federal Reserve (Fed) has clearly committed to a higher-for-longer interest rate policy and that means credit fundamentals will be under pressure. This will stress liquidity, exacerbate idiosyncratic credit risks, and heighten spread volatility. We recommend moving up-in-quality and liquidity while stressing credit metrics for a prolonged period under the heat lamp of restrictive monetary conditions.

“As we started our rate hikes early last year, we said there were three issues that would need to be addressed kind of in sequence—that of the speed of tightening, the level to which rates would need to go, and then a period of time over which we’d need to keep policy restrictive… So, it seemed to us to make obvious sense to moderate our rate hikes as we got closer to our destination. The decision to consider not hiking at every meeting and ultimately to hold rates steady at this meeting, I would just say it’s a continuation of, of that process. The main issue that we’re focused on now is determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time.” — FOMC Chairman Jerome Powell @Press Conference, June 14th, 2023

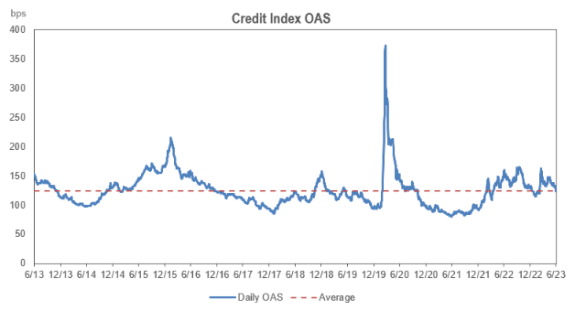

Bond investors are bred to be pessimists. It is the nature of our asset class – receive coupons and principal or get defaulted. Your upside to maturity is capped at your purchase yield but your downside is the entirety of your investment. We are compensated for this risk through spread, or additional yield above risk-free Treasuries. But knowing whether that spread is truly compensatory for future risks is always the challenge (Figure 1).

Figure 1: U.S. Credit Index Option Adjusted Spread (OAS)

Remember the powerful rally to start 2023? Since then, our Investment Committee has focused on better understanding the growing litany of fundamental fragilities relative to their market pricing. The notion that this Fed rate cycle is different than those of the recent past has us concerned. Repeatedly over the last fifteen years, the Fed has pivoted to dovish accommodation when credit stress emerged. But March proved this time is truly different. The Fed’s reluctance to use broad monetary accommodation to arrest the banking crisis signaled a real sea change to us. Clearly, the heat lamp of restrictive monetary policy will continue to compress credit fundamentals to various degrees across the economic spectrum.

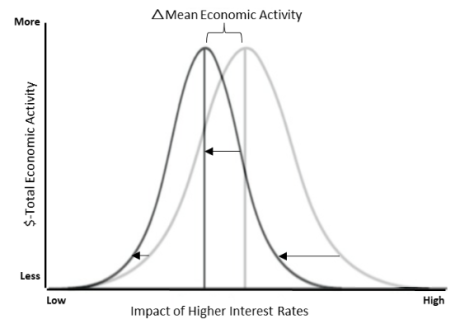

The blunt nature of the Fed’s inflation fighting tools necessitates this approach. However, issuers, industries, collateral types, and consumer credit tiers will be impacted in uneven ways (Figure 2). Furthermore, margin compression, asset depreciation, and job market softening will gradually erode fundamentals while the Fed remains restrictive. The impact on the margin-of-safety in credit fundamentals means more headlines, idiosyncratic credit events, and spread volatility face markets ahead.

Figure 2: Restrictive Monetary Policy Applied Across the Broad Economy.

Figure 2: Restrictive Monetary Policy Applied Across the Broad Economy.

So, as we enter the second half of 2023, we are closely watching the following:

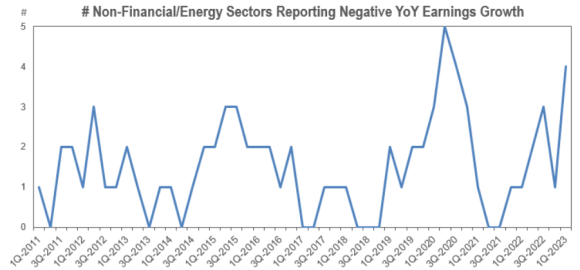

- 2Q-2023 earnings may continue the broad weakening trend: While second quarter earnings should be largely in-line with market expectations, FactSet forecasts a 6.8% overall decline in YoY earnings – the largest since 2020. Furthermore, the breadth of the declines is increasing (Figure 3) which is a concerning trend in our eyes.

Figure 3: Number of Sectors Reporting Negative Earnings Growth is Growing.

- Weakness in consumer credit is likely to spread: While prime credit card and mortgage delinquency rates continue to bely weakness, pockets of student, personal, and lower tier auto loans are weighing on asset-backed market sentiment. Serious delinquencies (2+ months of missed payments) are climbing fast in those sectors, and auto borrowers with credit scores below 660 now have default rates over 10% — potentially challenging the 2009 high of 16% by year end.

- “Idiosyncratic” credit events will emerge in unexpected places: While certain regional banks and commercial real estate remain under pressure (office space vacancies plus available-for-sale space has now risen above the 2010 highs of 28.8%), other sectors facing revenue compression due to slowing consumer spending, asset depreciation, and debt roll-over difficulties are likely to move onto the front pages in the second half of the year.

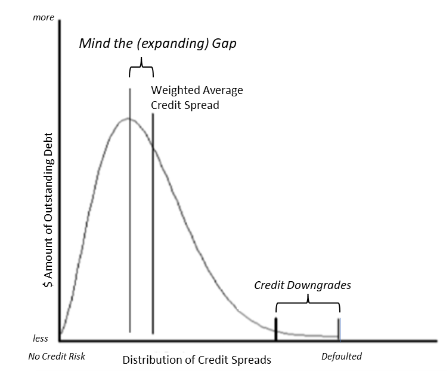

- You can’t passively diversify this away: Figure 4 illustrates the impact of credit’s asymmetric payout profile on broad credit spreads. Specifically, a few names or subsectors experiencing serious credit stress can push aggregate spreads wider absent a counterbalancing left tail. This can be further exacerbated by deteriorating liquidity conditions – often a byproduct of heightened idiosyncratic credit risk.

- Good active managers can add significant alpha: Active bond managers should work just as hard to produce alpha with defensive underweights as they do with opportunistic overweights. We are in an environment where the market may rapidly distance itself from a name or subsector at the first signs of fundamental stress. Maintaining a relatively clean portfolio, with a manageable number of names and subsectors, while still adhering to a prudent level of diversification, is a key aspect of active management in this environment.

Figure 4: Asymmetric Payout Profile & the Right Tail Effect.

Risks and opportunities abound just beneath the opaque surface of credit worthiness as the Fed moves to the third stage of its inflation fight – maintaining highly restrictive policy for “a period of time”. Even if the U.S. economy avoids recession, the March banking crisis demonstrated how fragile credit confidence can be. The good news is that this “heat lamp economy” should prove ripe for individual security selection opportunities for some time to come. And while that payout profile remains asymmetrical, the fulcrum of market price can swing towards tremendous upside in good credits. We plan to be there when it does.