2020 has been a year for the ages, and not just because of the coronavirus pandemic. With the Federal Reserve (the Fed) signaling that interest rates will remain near all-time lows for the foreseeable future, countless issuers have taken inventory of their financial standing. Liability management, which preserves liquidity by balancing the maturities of assets and liabilities, has become the norm. Bond issuance and tenders have occurred at a record-setting pace. While a supply explosion can be an ominous signal of issuers borrowing to weather a downturn, we believe that, in this instance, many borrowers are taking a more strategic and innovative approach.

MONEY, MONEY, MONEY

Watershed moments, like the tech bubble and 2008 financial crisis, underscore the importance of a robust corporate balance sheet. In general, companies with weak liquidity profiles are more likely to struggle to fund day-to-day operations, access the debt markets, and remain a going concern. Cash provides a buffer against deteriorating business results. While the pandemic has wreaked havoc on many corporations’ earnings, those with strong balance sheets and cash reserves are better positioned to withstand the crisis.

- Corporate debt and earnings have been adversely affected during the pandemic. Leverage has increased 0.2x quarter-over-quarter, and 0.4x year-over-year, to 3.3x. The rise was most pronounced in a few sectors, such as food/drug retail, media, and automotive.

- Companies have used billions in bond proceeds to repay revolving credit facilities, which, thanks to the Fed’s historic leap into the corporate bond market, carry low interest rates. In the second quarter, despite relatively weak earnings and record debt issuance, lower rates contributed to interest coverage averaging a still healthy 9.4x.

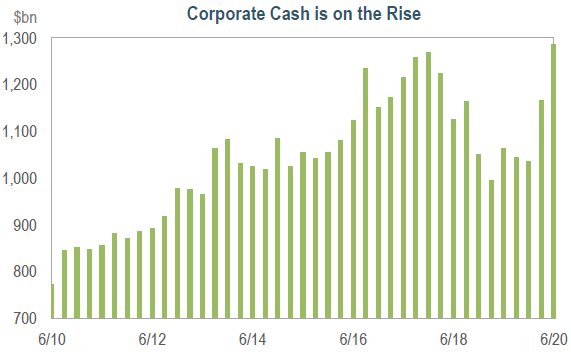

- Corporate cash balances have been on the rise, increasing over 10% quarter-over-quarter and 21% year-to-date. At the end of the second quarter, total investment grade cash measured $1.3 trillion, a level not seen since the second quarter of 2018.

Love Me Tender

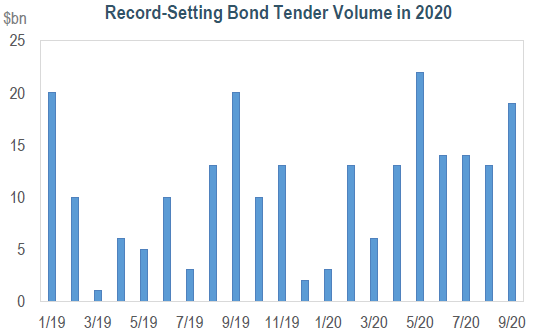

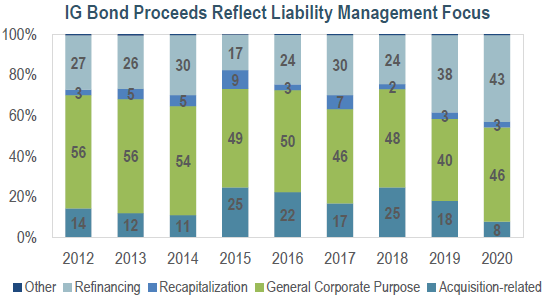

The pandemic has contributed to a record-setting $1.5 trillion in investment-grade bond sales thus far this year. While some may wonder if companies are trying to borrow their way out of an economic recession, we believe the data suggests otherwise. In many instances, the supply wave is the result of prudent corporate liability management. As with issuance, 2020 has witnessed a new high for bond tenders, with $117 billion repurchased year-to-date, topping the previous record set in 2019. Tenders – and exchanges – are two tools in the liability management toolkit.

- Corporations often use liability management to buy back, exchange, or alter the terms of outstanding bonds in order to restructure or refinance their current capital structure.

- With tenders, issuers publicly solicit bondholders and offer to repurchase all or a portion of their outstanding bonds for cash.

- Bond tenders decrease a corporation’s existing liabilities and cost of capital without necessarily pressuring its liquidity.

- Issuers may tender for high coupon bonds, and then account for that payment in earnings.

- In subsequent reporting periods, new coupon payments will be lower, which will benefit earnings.

- With exchanges, issuers offer to repurchase their outstanding bonds in exchange for new bonds with different terms.

- Both tenders and exchanges achieve reduced interest costs.

- In 2020, a growing portion of bond proceeds (89%) have been used for refinancing and general corporate purposes; this compares to 78% in 2019 and 72% in 2018. While a debt issuance boom can be a foreboding signal, this time, we believe that many corporations are acting responsibly.

Long Time Gone

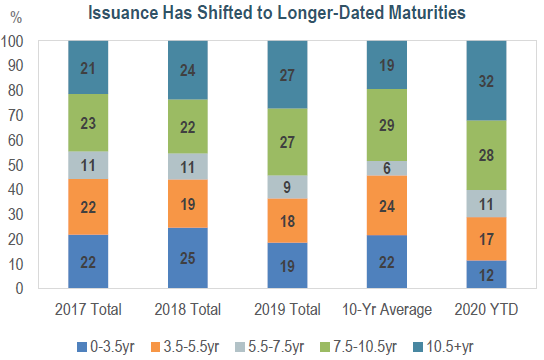

In 2020, the shift to longer-dated maturities has been pronounced. Demand for these bonds has been strong, with new issue concessions recently hovering around zero. 32% of investment-grade supply has had a maturity of 10.5 years or longer, compared to a 10-year average of 19%.

- While demand on the short end has been robust, supply has declined. Year-to-date, 12% of new issues have matured in 3.5 years or less, versus a 10-year average of 22%.

- The average tenor of newly issued bonds is on the rise. This year, the average maturity is 12.5 years, compared to 11.8 years in 2019, 10.5 years in 2018, and 10.1 years in 2017.

A Few Thoughts from our LDI Team on the Potential Drivers of Long Supply

- Long supply may be affected by pension plan sponsors utilizing a borrow-to-fund strategy. Consistent with liability management, sponsors can opportunistically refinance their floating rate pension debt for a fixed rate loan at historically low levels. Demand for longer-dated bonds has remained robust, with deals multiple times oversubscribed.

- Sponsors that are committed to a de-risking path can further capitalize on funded status improvement by investing the proceeds in Liability Driven Investing (LDI) assets. This would help mitigate near-term uncertainty about the pandemic and election by limiting funded status volatility and providing downside protection.

- As we enter the later months of 2020, many corporations are looking ahead to 2021, and shifting their focus from liquidity to capital management and rebuilding earnings in a post-pandemic world.

Navigating a New Reality

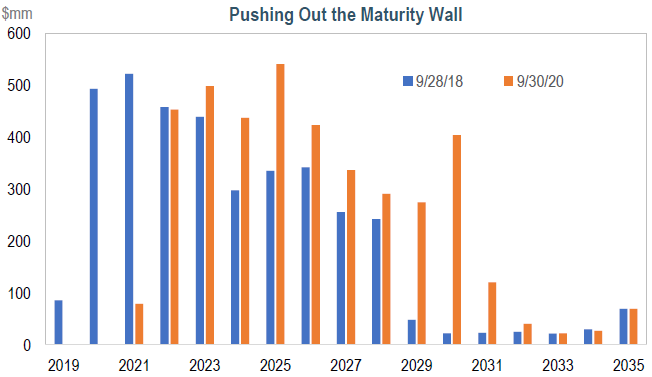

In March 2020, uncertain of what was ahead, approximately 200 companies informed investors that they were withdrawing earnings guidance. Today, despite a 21% decline in third quarter earnings, there is good news. The ratio of companies reporting that earnings estimates are too low is 3.3x higher than those reporting they are too high. For many, liability management may have been one of the few remaining – but effective – tools in the toolbox. As we navigate the final months of 2020, and look forward to 2021, we ask what other options remain for issuers. Will they look to grow their top line? Use excess cash for share buybacks? With the oft-mentioned maturity wall pushed out a little further, issuers have stretched out their debt to lock in lower rates for longer.

IR+M Positioning

- At IR+M, we are focused on monitoring liquidity and evaluating credit fundamentals. We have opportunistically lowered our credit allocation – which remains generally overweight relative to the benchmark – and reduced names that have limited upside or are susceptible to COVID-related risks. As spreads have retraced much of their earlier 2020 widening, we have decreased our credit spread duration from our May 2020 highs. To offset our lower credit allocation, we have increased our securitized allocation, and our slight credit spread overweight is concentrated in the front-end of the curve, where we feel that technicals and breakevens are more attractive.

- We firmly believe that now is not the time for companies to change course. Corporate leverage has increased, but we believe that companies have responded logically to lower interest rates and issued debt at rates historically reserved for higher-rated entities. Investment-grade companies are motivated to protect their high-grade ratings because of better market access and Fed support. Fourth quarter investment-grade supply is likely to be down, providing an additional tailwind. Overall, we believe that the markets remain open and liquidity remains robust.

At IR+M, we believe that our investment process and team are time-tested, having worked closely with our clients amid extreme market volatility. In all market conditions, we rely on our experience as disciplined, bottom-up security selectors to help guide us. While we appreciate the ever-changing dynamics of the corporate bond market, we believe that many issuers’ prudent decisions today will allow them to rebuild – and thrive – tomorrow.