Like many of you, I invested in a Peloton amid the pandemic. Unable to attend in-person classes at my gym, I needed a solution to combat stress, boredom eating, and “cooped-up” syndrome. As we enter this new world of hybrid work, I appreciate having the flexibility to squeeze-in a quick ride during the day. However, despite my best intentions, work and life can easily interfere. Unanticipated meetings come on my calendar last minute. Or I’ll find myself tempted by a glazed donut that would obviously affect my performance and therefore hurt my stats. I have learned that I am much more likely to work out when I set and stick to a plan. Similarly, while on a journey to de-risk a pension plan, we are likely more successful with a predetermined plan than trying to time additions to fixed income.

Be good out there, and if you can’t be good – be careful!

I would argue that very few, if any of us, are “good” at predicting interest rates. Rather than making bets on the direction, magnitude, and timing of rates, implementing Liability Driven Investing (LDI) may be the more careful action to take.

While market consensus is that we are in a rising rate environment, there is much less certainty around if/when we will reach “normal” rate levels and how much volatility we must stomach until then. With many pension plans now overfunded (our Average Plan was 102.5% at 4/30/22), pension risk transfer to an insurer is often the desired near-term end stage. Gambling on adding to LDI when and if rates rise to a certain level may postpone termination and jeopardize recent funded status gains.

Instead, we believe that sponsors should consider protecting their recent funded status gains. Just as it is easier to keep a consistently healthy lifestyle rather than having to shed pounds after a lapse in our exercise routine, it is easier to maintain the current funded status via a lower risk-asset allocation than having to earn out of a fall in funded status.

Are you ready to de-risk? Yes or Yes?

I am much more likely to follow through with a workout if I set myself up for success. I lay out my clothes the night before, pick the time to hop on the bike, and select the class. If I don’t perform these steps and create a plan, I can easily waste a solid 15 minutes looking for matching socks and then another 15 debating if I should tackle a HIIT and Hills or a Britney Ride…at which point, I will have missed my window of opportunity to pedal.

Similarly, sponsors are more likely to de-risk if they establish a structure to do so. A glidepath can be an efficient method of systematically shifting into LDI as funded status improves. Sponsors can make progress on their LDI journeys by choosing the cadence over which funded status will be monitored, trigger points, and asset allocations at said triggers.

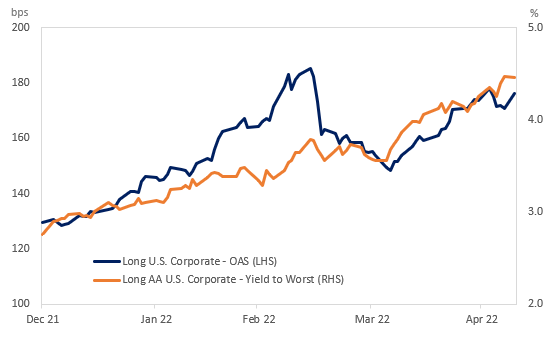

We have certain clients who are looking to take advantage of market opportunities to add to fixed income, including higher rates and wider spreads. The current market environment has proved challenging to capitalize upon, as such opportunities do not always exist for long. The chart below shows the volatility we have seen year-to-date, which we suspect is likely to continue given inflation concerns, Fed policy tightening, and geopolitical tensions.

We work with clients looking to execute this type of tactical approach to develop a well-defined and detail-oriented plan. The limited window to execute means the decision factors on whether to go or not go should be clear and decision making should be streamlined. Waiting for a vote from a pension committee or a Board might not be possible. A fully discretionary outsourced model may be one option, or if there is a desire to maintain more control, streamlining the communication and steps along a glidepath can facilitate a market-based strategy.

You don’t have to do LDI, you get to!

Some common reasons we have heard from sponsors that are delaying de-risking are they do not want to “lock-in losses” or “miss-out on” future higher rates or equity growth. In these cases, just like when I don’t want to add 10 points to my resistance, I think it is important to reframe the mindset. Assets should not be looked at in isolation. We should focus instead on funded statuses when we consider investment gains and losses. Despite the recent equity market sell-off, the S&P 500 is up 40% over the past two years, and long corporate yields are up 135bps during that same time, pushing most funded statuses higher. Now is an attractive time to protect those improvements.

We recommend and can help our clients complete an asset-liability study to understand the likely range of outcomes under different allocation amounts to fixed income. An asset-liability study incorporates robust capital market expectations to quantify the likely range of outcomes for key metrics (e.g., funded status, contributions). Such a study can better frame both the upside potential versus the downside risks. Given pensions have an asymmetric risk profile, sponsors can weigh whether a higher or lower allocation to LDI strategies fits their risk tolerance.

If you are a plan sponsor who has delayed additional de-risking, we can partner with you to create a dynamic LDI strategy that works for your needs and schedule. We welcome the opportunity to help increase the output and keep you motivated on your LDI journey. As your LDI manager, we can show you the risk-return (cadence-resistance) trade-offs of de-risking now versus waiting, and send you a high-five when you need it.