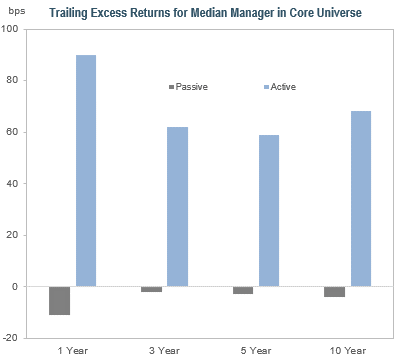

Investors must make an important decision when selecting investment managers – a decision that reflects their tolerance for risk, return expectations, needs and constraints, and fee preferences. An age-old question continues to prevail: should an investor choose an active or passive manager? According to eVestment, over the last ten years, the median active fixed income manager outperformed the standard benchmark by 68bps, while the median passive manager underperformed by 4bps. In this piece, we examine the nuances of the fixed income market, and the nimbleness of active management in this dynamic and diverse market.

Oh, Your Sweet Disposition, Mr. (Bond) Market

- Message in a Bottle. The use of index funds has become much more accepted in recent years, particularly within publicly traded equities. The US fixed income universe is much more diverse,

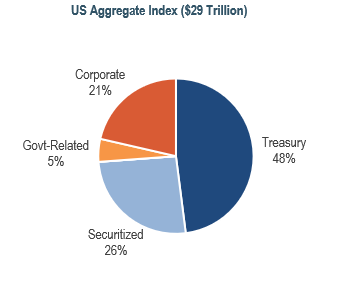

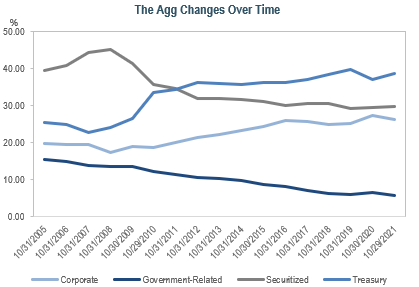

with over four million CUSIPs totaling over $45 trillion, plus debt instruments such as bank loans and derivatives. A little more than half of these securities are represented in the Bloomberg Aggregate Index (the Agg), which is generally seen as the barometer for the US fixed income market. The Agg is more heavily-tilted towards low-yielding government securities such as US Treasuries and agency mortgage-backed securities (MBS), which makes it more vulnerable to the Federal Reserve’s (Fed) quantitative easing measures. In November, Fed Chair Jerome Powell signaled that the central bank would begin to taper Treasury and agency MBS purchases by $10 and $5 billion respectively, but left themselves room to adjust the amounts should economic conditions warrant a change to this pace. It is likely that if the Fed were to deviate from expectations, volatility would occur, leaving passive investors more exposed given their presumably larger weights to Treasuries and agency MBS.

with over four million CUSIPs totaling over $45 trillion, plus debt instruments such as bank loans and derivatives. A little more than half of these securities are represented in the Bloomberg Aggregate Index (the Agg), which is generally seen as the barometer for the US fixed income market. The Agg is more heavily-tilted towards low-yielding government securities such as US Treasuries and agency mortgage-backed securities (MBS), which makes it more vulnerable to the Federal Reserve’s (Fed) quantitative easing measures. In November, Fed Chair Jerome Powell signaled that the central bank would begin to taper Treasury and agency MBS purchases by $10 and $5 billion respectively, but left themselves room to adjust the amounts should economic conditions warrant a change to this pace. It is likely that if the Fed were to deviate from expectations, volatility would occur, leaving passive investors more exposed given their presumably larger weights to Treasuries and agency MBS.  This Place is Too Crowded. Besting 2017’s investment grade (IG) corporate bond supply of $1.3 trillion, 2020’s nearly $1.8 trillion was a new record. This was aided by the Fed’s decision to promote liquidity and stability in the credit markets, with their announcement of primary and secondary corporate bond buying facilities, as investment grade spreads widened nearly 300bps in less than two months. Issuance skewed longer as borrowers capitalized on the attractive funding environment. This corporate borrowing binge continued into 2021; year-to-date issuance surpassed 2017’s deluge in mid-November, with a little over one month still left in the year. Aside from implicitly promoting investment in low-yielding government securities, the Agg may expose passive investors to unintended sector and/or issuer concentration risks, with the financial sector dominating supply over the last two years. Just because a company issues a lot of debt and becomes a big part of the index, doesn’t necessarily mean that owning the company’s debt is a prudent investment. Passive investors would also be exposed to the same coupons that the Fed is purchasing within agency MBS.

This Place is Too Crowded. Besting 2017’s investment grade (IG) corporate bond supply of $1.3 trillion, 2020’s nearly $1.8 trillion was a new record. This was aided by the Fed’s decision to promote liquidity and stability in the credit markets, with their announcement of primary and secondary corporate bond buying facilities, as investment grade spreads widened nearly 300bps in less than two months. Issuance skewed longer as borrowers capitalized on the attractive funding environment. This corporate borrowing binge continued into 2021; year-to-date issuance surpassed 2017’s deluge in mid-November, with a little over one month still left in the year. Aside from implicitly promoting investment in low-yielding government securities, the Agg may expose passive investors to unintended sector and/or issuer concentration risks, with the financial sector dominating supply over the last two years. Just because a company issues a lot of debt and becomes a big part of the index, doesn’t necessarily mean that owning the company’s debt is a prudent investment. Passive investors would also be exposed to the same coupons that the Fed is purchasing within agency MBS.- Ending So Suddenly. A record number of Fallen Angels took flight in 2020, totaling over $150 billion in market value. A fallen angel is an IG issuer who has been downgraded by at least two of the rating agencies to high yield. Following the downgrade, the issuer is removed from the Agg at the end of the month. Passive managers are forced to sell downgraded bonds in sympathy with the index change, when credit spreads may be at their widest. Because of this rule, passive managers cannot participate in the typical spread compression on any positive ratings action back towards IG. While the anticipated wave of rising stars has been underwhelming thus far, their spreads have already compressed from their widest levels, as seen in our latest infographic “Twinkle, Twinkle Rising Stars, How I Wonder Where You Are?”

I Just Want to Know You Better Now

- Not Just a Scarf Sitting in a Drawer. Active manager trading activity is dictated by fundamental research and finding relative value among sectors concurrent with trends in the broader market, not just when the index makes routine changes based on predetermined rules, the latter of which can lead to higher turnover and trading costs.

Over time, active managers should earn better yield and carry than passive managers. Active managers can add value by performing rigorous fundamental research to construct fully diversified portfolios. When credit spreads were attractive last March, active managers opportunistically added to their exposure, overweighting sectors and/or credits that were oversold from a technical standpoint but fundamentally sound based on solid credit analysis. This logic also works in reverse; when spreads reached near-historic tights, active managers likely pared risk to increase liquidity and monetize their gains. To add alpha, active managers can take advantage of the fluidity of the bond market, as well as the flatness or steepness of credit curves, which is especially important in a low-yield environment. Active managers also have more flexibility within the securitized sector. In the Agg, MBS pools are aggregated into generic cohorts based on program, coupon, and vintage. Active managers can analyze prepayment speeds and structures to find the most attractive opportunities within agency MBS.

Over time, active managers should earn better yield and carry than passive managers. Active managers can add value by performing rigorous fundamental research to construct fully diversified portfolios. When credit spreads were attractive last March, active managers opportunistically added to their exposure, overweighting sectors and/or credits that were oversold from a technical standpoint but fundamentally sound based on solid credit analysis. This logic also works in reverse; when spreads reached near-historic tights, active managers likely pared risk to increase liquidity and monetize their gains. To add alpha, active managers can take advantage of the fluidity of the bond market, as well as the flatness or steepness of credit curves, which is especially important in a low-yield environment. Active managers also have more flexibility within the securitized sector. In the Agg, MBS pools are aggregated into generic cohorts based on program, coupon, and vintage. Active managers can analyze prepayment speeds and structures to find the most attractive opportunities within agency MBS.

- State of Grace. Just as no two indices are the same, neither are client objectives and constraints. Active managers provide flexibility to address individual client guidelines such as permissible ratings, desired duration, or cash flow needs. Portfolios can be customized to incorporate environmental, social, and governance (ESG) factors, which have been an increasing area of focus. An active manager can also tailor solutions for non-economic investors, such as insurers who may be book yield or capital loss constrained and have fewer levers to pull to increase portfolio yield. Active managers can manage key rate duration exposure, which may be a more useful measure of duration for liability-relative investors and those wishing to optimize the portfolio around expected non-parallel shifts in the yield curve.

- The Lucky One. Active managers can source their best ideas from a larger universe than passive managers. To be included in the Agg index, bonds must be US dollar-denominated, investment grade, fixed rate, taxable, longer than one year in maturity, and have a minimum outstanding par amount of $300 million. Because of these rules, passive managers cannot invest in smaller deals or certain attractive areas of the market such as bonds issued under Rule 144(a), floating-rate bonds, municipal bonds, and non-index eligible securitized issues such as asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), and Small Business Administration loans (SBAs). Diversification beyond the index allows active managers to avoid unattractive, index-eligible bonds and rotate into their best ideas to unlock value.

Fixed income investors have an insatiable thirst for yield, as well as a need to balance risk and return. Rather than focusing on passive management’s lower explicit costs, investors should assess which management style would more likely generate better risk-adjusted, net-of-fee returns over the long-run, while also seeking managers who can tailor their approaches and provide customization as needed. At IR+M, we believe that an active approach to fixed income investing will generate stronger returns over time. In a constantly evolving and dynamic market, we rely on our active security selection and relative value-oriented approach to create diversified portfolios, adding value for our clients, as we take what the market gives us.