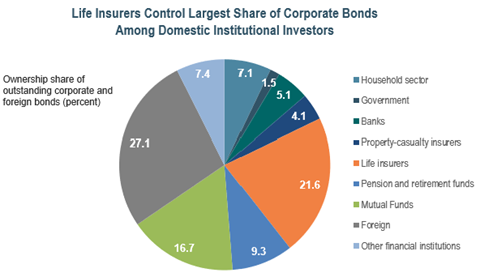

Life insurance companies are among the largest investors in the U.S. corporate bond market. As such, any potential changes in their investment behavior could impact market technicals and are worth monitoring. This explains why the recent changes by the National Association of Insurance Commissioners (NAIC) have piqued the insurance industries’ interest. For years, the NAIC has contemplated changes to their Risk-Based Capital (RBC) C-1 risk factors, which help determine how much capital life insurers must hold against their bond portfolios, and are a meaningful input in informing their investment strategy. In June, the NAIC finally agreed to these changes, which will be implemented for year-end 2021 RBC reporting.

What is changing?

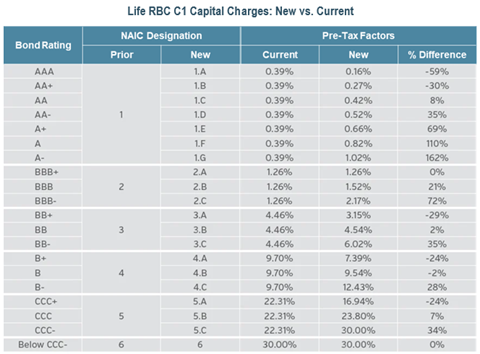

The changes to the RBC C-1 factors will introduce more granular C-1 risk charges for bonds in life insurers’ RBC formula by expanding the number of NAIC designations from 6 to 20. The NAIC designations are based on bonds’ nationally recognized statistical ratings organization (NRSRO) ratings. Under the old system, an A-rated bond would be categorized as NAIC 1 and receive the same capital treatment as a AAA-rated bond. While market participants have long recognized the difference in the risk profile of a AAA-rated bond relative to that of an A-rated bond, the NAIC asset risk structure had not. This made A-rated corporate securities a capital efficient asset for life insurance companies relative to AAA-rated assets given their higher yield for the same capital charge.

The table below compares the old factors to the newly approved risk factors:

Under this newly approved proposal, investment grade bonds are largely subject to more punitive RBC charges. This will be especially pronounced at the low end of the quality spectrum within each ratings bucket. Additionally, in a few select ratings categories, capital efficiency is improved, namely at the upper level of each ratings category: AAA, AA+, BB+, B+, etc.

So, what does this all mean for life insurers and the bond market?

Life Insurers:

For life insurers, these changes are expected to have a slightly negative impact on their overall RBC level. However, since the industry is currently well-capitalized, these changes are expected to be absorbed without a significant industry impact.

Bond Market:

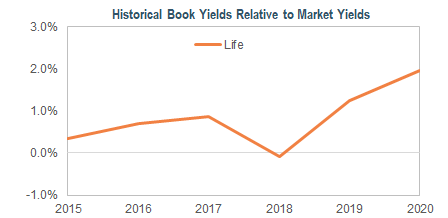

For the bond market, one of the most fascinating things about managing insurance assets is the different facets that impact investment decisions. While capital efficiency is an important input, it is only one of many important factors to consider when managing investment portfolios for insurance companies. Other considerations, such as book yield and tax management, will likely limit the immediate impact from this change. For example, the difference between life insurers’ overall portfolio book yields and current market yields is at its widest level on record. As such, it will be difficult for life insurers to reposition their portfolios without degrading book yield and giving up income at a time when income is especially difficult to achieve.

While initial portfolio changes are likely to be at the margin, over time this modification could alter investment preferences for life insurance investors. This could result in reduced interest in those securities that were most negatively impacted by this change, and increased interest in those securities that benefited from more favorable capital treatment, such as BB+ rated securities. It also could raise interest in AAA-rated structured securities that receive more favorable capital treatment under the new RBC regime.

Conclusion:

At IR+M, we believe consistent communication with our clients is of the utmost importance. For our insurance clients, regulatory, tax, and company changes can have a direct impact on their optimal investment approach. While one variable will not typically drive investment decisions, they are each an important piece to the insurance company investment puzzle. As changes occur, we encourage insurers to have conversations with their investment managers around potential guideline changes that may improve portfolio efficiency.