In the aftermath of the 2008 financial crisis, economists warned that artificially low interest rates were creating ideal conditions for “Zombie Companies” to proliferate across the globe. These companies – which have unsustainable debt burdens but manage to stave off bankruptcy due to the availability of cheap debt – comprise roughly 10% of public U.S. firms, according to a 2021 study1.

The rise of Zombie Companies begs the question for us Securitization nerds: is there a similar phenomenon occurring in the securitized markets? Unfortunately, the answer is yes. Zombie Securitizations exist within a select part of the non-traditional Asset-Backed Securities (“ABS”) sector and have grown in number since the onset of COVID-19 (thankfully, we currently don’t own any here at IR+M and weren’t stuck with any when the pandemic unfolded in 2020). While Zombie Securitizations do not have the same negative effects on the overall economy as their corporate counterparts, they can still wreak havoc on bond portfolios – and in some ways are more dangerous.

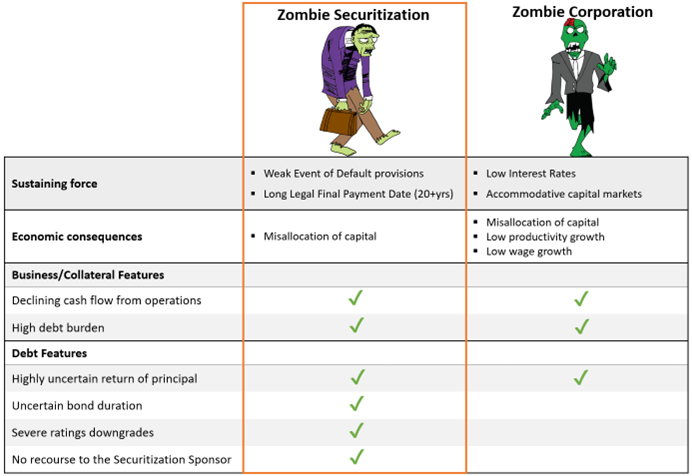

Chart 1: Zombie Securitizations vs Zombie Corporations

1Favara, Giovanni, Camelia Minoiu, and Ander Perez-Orive (2021). “U.S. Zombie Firms: How Many and How Consequential?,” FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 30, 2021, https://doi.org/10.17016/2380-7172.2954.

Zombie Securitizations: a background

Like their corporate cousins, Zombie Securitizations struggle to service the principal portion of their debt. Deteriorating collateral cash flows puts extreme pressure on the deal, yet they somehow manage to stagger on.

What keeps them going? Interestingly, low interest rates are not the sustaining force for Zombie Securitizations; instead, loose Event of Default provisions(1) and a long Legal Final Payment Date(2) are the key factors that keep Zombie Securitizations alive. Unlike corporate debt financing, securitization provides a permanent financing vehicle for assets – regardless of the Anticipated Repayment Date (“ARD”) of the debt. This allows deals backed by long-dated assets to devolve into Zombies when performance deteriorates, as ARDs are missed and the outstanding debt balance remains unpaid for years (and sometimes decades) on end.

Once a securitization has devolved into a “Zombie”, there become numerous consequences for bondholders. Besides the obvious widening in credit spreads, hedging the interest rate risk of the bond becomes challenging since the ultimate duration of the security is unknown. Meanwhile, the bond can undergo severe ratings downgrades since most tranches of securitizations typically start with relatively high investment grade ratings (BBB- or higher).

Another negative consequence of Zombie Securitizations is the lack of control that senior bondholders have over the assets when performance deteriorates. As long senior bondholders continue to receive timely interest payments, they cannot direct the servicer to liquidate the collateral to pay off the debt. This arguably puts senior bondholders at a disadvantage, especially in an environment where asset values are rapidly deteriorating after the Anticipated Repayment Date.

Lastly, securitized bondholders have no recourse to the sponsor of the transaction, which can potentially put them at odds with the manager of the deal. Regardless of how the assets perform, the sponsor has no obligation – and sometimes no economic incentive – to inject equity into a Zombie Securitization, especially if they sold their equity in the assets to a third party.

Aircraft ABS 3.0: a new legion of Zombies?

To find recent examples of Zombie Securitizations, look no further than the $16 billion(3) sub-sector of the non-traditional ABS market known as Aircraft ABS 3.0. This sector, which is mostly backed by 12 – 15-year-old aircraft leased to speculative grade airlines in non-US countries, has suffered severe reductions in cash flow. As a result of these cash flow reductions, many of the 55 Aircraft ABS 3.0 deals completed between 2013 and the first quarter of 2020 appear to have devolved into Zombies, with subordinate bonds experiencing the brunt of ratings downgrades and cash flow disruptions.

How did this happen? Many airlines in the ABS pools did not receive sufficient financial support from their governments and investors during the pandemic. As a result, many have either renegotiated their leases or stopped paying them entirely. The Russia/Ukraine conflict only exacerbated this problem for some deals, as leases with several Russian airlines were promptly terminated to comply with Western sanctions. These credit-related events have resulted in cash flows only being sufficient to cover bond interest, throwing both senior and subordinate bonds off their target amortization schedules.

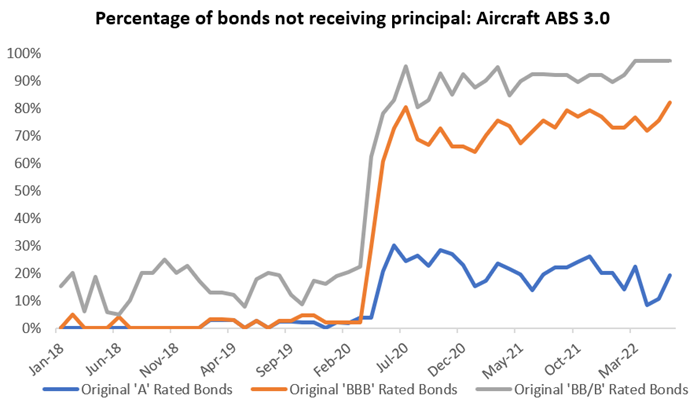

As you can see in Chart 2, virtually all subordinate bonds within the Aircraft ABS 3.0 sub-sector originally rated ‘BB’ and ‘B’ did not receive any principal in June 2022, while 80% of bonds originally rated ‘BBB’ did not receive any principal either. Even 10 – 20% of senior bonds originally rated ‘A’ are currently lacking principal payments, a much higher rate than the pre-COVID trend.

Chart 2: Percentage of Aircraft ABS 3.0 bonds not receiving principal

Source: Bloomberg and IR+M analysis of 55 Aircraft ABS transactions with an original balance of $28.9 billion originated between January 2013 and March 2020. Note that two transactions that closed in 2020 but failed to novate a large portion of the aircraft due to airline delinquencies were excluded from the analysis.

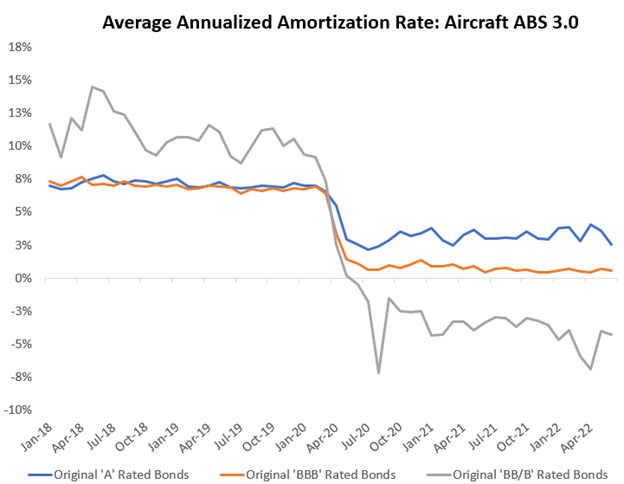

While most senior bonds are receiving a portion of scheduled principal and therefore don’t appear to be Zombies at first glance, a closer look at the average rate of amortization for these bonds reveals that they are still experiencing cash flow disruptions. As shown in Chart 3 below, senior Aircraft ABS bonds originally rated ‘A’ were amortizing at an average rate between 7% – 8% per year pre-COVID but are now amortizing at just half of that rate (excluding the impact of non-recurring principal payments related to sales of aircraft). This deceleration in regular principal payments is problematic given that underlying assets (mostly 12 – 15-year-old aircraft) declined in value during COVID, and will likely continue to depreciate over their remaining useful lives. The debt is not amortizing nearly as fast as it should be given the value destruction that has taken place, particularly for deals with heavy exposure to aged dual aisle “widebody” aircraft.

Chart 3: Average Annualized Amortization Rate for Aircraft ABS 3.0 deals

Sources: Bloomberg and IR+M. Amortization rate reflects bond principal received as a percentage of the original balance (excluding non-recurring sources of principal cash flow such as sales of aircraft)

You might notice by looking at Chart 3 that most subordinate bonds originally rated ‘BB’ and ‘B’ are now amortizing, on average, at a negative rate. The principal balance is increasing every month, a result of unpaid interest simply being added to the debt balance as a means of compensating bondholders. These bonds are worse than Zombies – they are not even receiving interest!

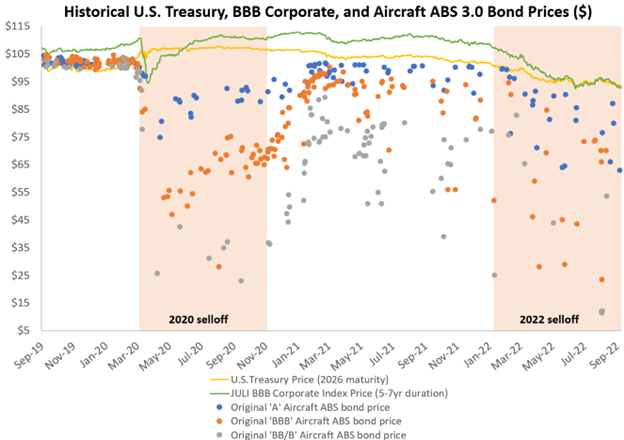

As you can imagine, the price action for Aircraft ABS 3.0 bonds has been incredibly volatile, far exceeding the selloffs that have occurred in the corporate bond market. The Zombies originally rated ‘BBB’ and ‘BB’ that traded at par pre-COVID quickly fell 40+ points in the spring of 2020, only to stage a stunning rally in late 2020 / early 2021 on hopes that cash flow would recover and/or deals would be refinanced. A few of the original ‘BBB’ bonds even rallied all the way back to par in early 2021, despite being shut out of principal since April of 2020. Unfortunately for some, the rally in these original ‘BBB’ bonds proved to be short-lived, as many of these bonds have since fallen 30+ points in 2022 (with wide dispersion in pricing). Further subordinate bonds originally rated ‘BB’ and ‘B’ – some which rallied to as high as $89 last year – have fared even worse, losing over 50 points in value this year for a select few deals.

Chart 4: Historical secondary trading prices for Aircraft ABS 3.0 deals

Source: FINRA TRACE and J.P. Morgan as of 9/6/22. Aircraft prices reflect the average traded price of the Class on a particular day. Reference U.S. Treasury bond is the 1.625% note due May 2026

Translating these bond prices into yields is an incredibly challenging task since the ultimate duration and path of the cash flows is unknown, due in part to the long Legal Final Payment Date that these deals employ (25 years). On a “Yield to ARD” basis, virtually all Aircraft ABS 3.0 bonds – including Senior bonds – are trading at yields in excess of 10%, signaling that the market views a refinancing at upcoming ARDs in the next 1 – 4 years as highly unlikely, with full repayment of principal in question. Subordinate bonds in particular face an uphill battle to recover principal, as senior bonds will first have to catch up to their target amortization schedules and maintenance reserves will have to be replenished. Ultimately, repayment of principal for these bonds may depend on resale values of highly aged aircraft – a terrifying prospect given that airlines are starting to refresh their fleets with newer, more fuel-efficient technology.

Survival Guide: how to protect portfolios from Zombie Securitizations

Too often, securitization professionals emphasize how difficult it is to “break” a bond rather than focusing on how easily a bond can be shut out of principal cash flow. The experience of Aircraft ABS 3.0 is a prime example of this fallacy – not a single deal has defaulted, and few have had to draw on their liquidity facilities, yet virtually all are trading at distressed prices. For a bond to maintain its spread-adjusted value, potential buyers must be confident in the return of principal – and in the case of Aircraft ABS 3.0, that return of principal is in doubt given the extreme cash flow disruptions that continue to take place.

This brings us to the heart of our discussion: how can portfolio managers keep potential Zombie Securitizations out of portfolios? Although credit events are unpredictable in nature, some bonds are more susceptible to cash flow disruptions than others. Subordinate bonds are clearly the most vulnerable to “Zombification”, although other recognizable features of Zombie Securitizations are:

- Weak obligor credit quality

- Cyclical asset performance history

- Reliance on non-contractual cash flow (re-leasing, selling assets, etc.)

- High senior expenses (maintenance, insurance, etc.)

- Low debt service coverage

- Long Legal Final Payment Date

- Slow debt amortization

- Misalignment of incentives with the securitization sponsor

Here at IR+M, we have successfully kept portfolios free of Zombie Securitizations for the last 30+ years. With our emphasis on high-quality securities, we plan to keep it that way.