We began 2021 with a renewed hope of normalcy given the production and distribution of COVID-19 vaccines. The global economy reopened, leading to a sharp rebound in economic activity from the pandemic-induced sell-off in March 2020. The supportive economic backdrop and positive investor sentiment pushed corporate spreads to their tightest levels since 2005. While we believe corporate fundamentals support these valuations, potential headwinds remain in 2022. In this piece, we review corporate technicals and fundamentals, while addressing what to look for in the year ahead.

Continued Robust Supply & Healthy Fundamentals

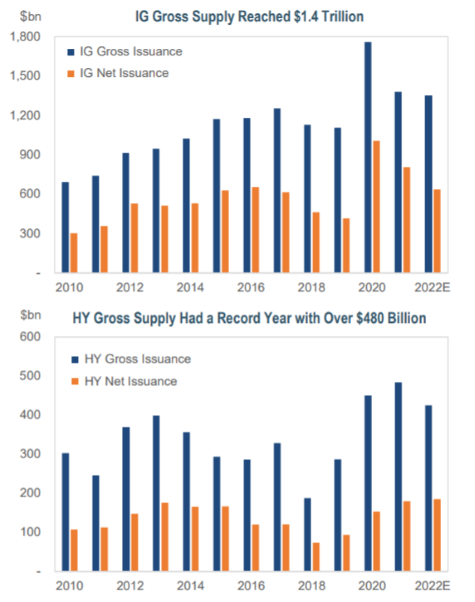

- Corporate supply remained robust in 2021. Given low rates and positive fundamentals, thanks to the unprecedented fiscal stimulus and accommodative monetary policy, corporate issuance surpassed expectations in 2021, marking it as the second highest annual total in history. Investment-grade (IG) issuance, although down year-over-year, ended the year at $1.4 trillion, while high yield (HY) set a record with over $480 billion. Gross supply in 2022 is estimated to be in-line with 2021, with a slight decrease in net issuance.

- Drivers of supply. Liability management increased in 2021 as companies took advantage of historically low spreads and yields to refinance their debt through tenders or make-whole calls, replacing them with new bonds which accounted for $240 billion (17%) of gross supply. ESG issuance increased last year, accounting for 6% of IG issuance and 4% of HY issuance; this is expected to grow in 2022. Although M&A-related supply was light in 2021, at only 13% of total issuance, it is expected to pick up this year.

- The market just couldn’t get enough. Despite the heavy supply, the market absorbed it well. Investor demand remained strong in 2021 despite the low yields, particularly from pension plans de-risking as equity markets hit new records and foreign buyers searched for yield given the lack of yield outside the US. As a result of strong demand, new issue concessions reached new lows.

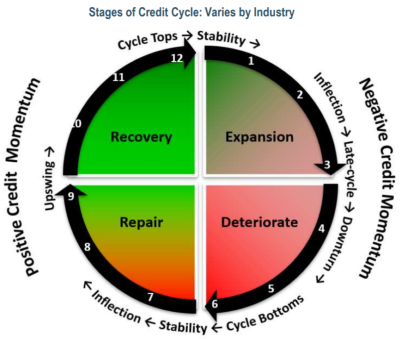

- Fundamentals are healthy. Earnings rebounded to pre-pandemic levels and will likely continue to improve at a more measured pace. Leverage declined and interest coverage ratios improved. Sectors such as alternative asset managers, cables, business development companies (BDCs), home construction, and transportation had positive momentum. Not all sectors, however, reaped the benefits, such as airlines and office REITS, which have yet to reach pre-pandemic levels.

- Ratings momentum improving. As a result of the improvement in fundamentals, rating agencies are adjusting some ratings higher. $277 billion in rising stars are expected over the next 12-18 months, 50% more than those that fell from IG to HY in 2020 ($180 billion), which would shrink the HY market by 10%. Despite healthy fundamentals overall, the persistent (no longer transitory) nature of inflation may impact certain sectors more than others going forward.

Inflation & Its Impact on Different Sectors

Inflation surged. Inflation nearly reached a four-decade high of 6.8% in November, driven by strong consumer demand and pandemic-related supply constraints. The Federal Reserve (Fed) had the belief for a good part of 2021 that inflation was “transitory”. It finally acknowledged the risks from the high level of inflation and removed “transitory” from its language. The Fed announced that it will double the tapering of asset purchases and will hike rates to curb the already persistent inflation.

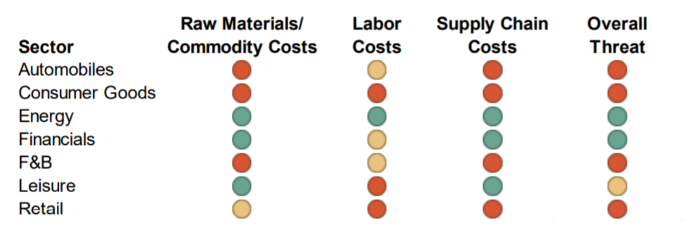

Inflation surged. Inflation nearly reached a four-decade high of 6.8% in November, driven by strong consumer demand and pandemic-related supply constraints. The Federal Reserve (Fed) had the belief for a good part of 2021 that inflation was “transitory”. It finally acknowledged the risks from the high level of inflation and removed “transitory” from its language. The Fed announced that it will double the tapering of asset purchases and will hike rates to curb the already persistent inflation.- Inflation impacts sectors differently. Sectors most exposed to commodity, labor, and supply chain costs, such as automobiles, consumer goods, food & beverage (F&B), leisure, and retail, are most at risk to higher inflation, largely due to the risk of margin compression from higher labor costs and supply chain disruptions. Conversely, banks and insurers within the financials sector can offset higher costs through higher interest rates.

- At IR+M, we believe that most IG companies can withstand inflation as margins are healthy, but specific sectors within the HY market could struggle. Our focus is on those companies that should have the ability to maintain pricing power and margins; for example, companies in the communications, packaging, or commodity chemical sectors.

- Going into 2022, we continue to remain cautious around certain sectors and names, favoring companies and sectors that are better able to pass cost increases along to the consumer.

Rich Valuations – We Know All Too Well

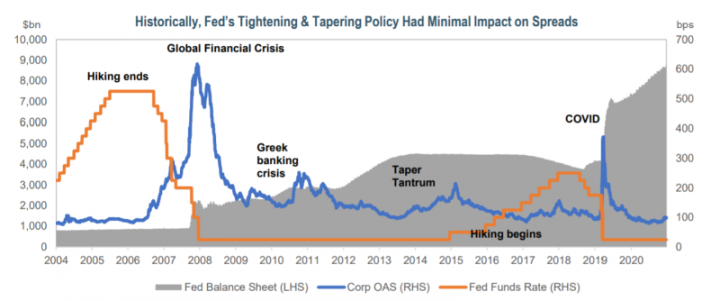

- Valuations remain rich. Valuations are persistently rich across the corporate bond market despite recent widening. Spreads on the Bloomberg Corporate Index were range-bound between 80 and 101bps in 2021 and closed the year 4bps tighter than 2020 at 92bps – below the 5-year average of 115bps – partly because the Fed has been a large player in the market. Historically, the Fed has tightened policy and tapered with minimal impact on spreads. As the Fed continues to taper in 2022, we will monitor spread movement and changes in volatility. Given rich valuations, we are comfortable adding incremental risk in the front-end, where we believe select issuers offer better relative value. Shorter-duration bonds would likely exhibit less downside risk should volatility rise, allowing us to reallocate across the curve to more attractive issues.

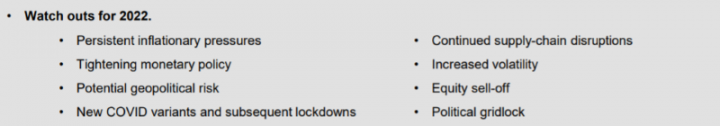

As we enter 2022, following a year of strong economic growth, robust fundamentals, tight spreads, and low yields, we anticipate a similar narrative. Although we believe fundamentals across most sectors are healthy, we acknowledge that there are several risks that could take hold this year. Despite potential headwinds, particularly with persistent inflationary pressures, we remain focused on companies with strong balance sheets that can withstand prolonged periods of volatility while still offering attractive relative value. We believe that active management is paramount in this environment, and our experience as disciplined, bottom-up security selectors will help us uncover opportunities and take what the market gives us in 2022.