Introduction

As the eagerly anticipated COP26 is underway in Glasgow, the global audience awaits the outcomes of these international climate negotiations. These agreements will be key to slowing climate change and avoiding the worst-case scenarios associated with rising global temperatures. COP26 aims to “Keep 1.5C Alive” and will have far-reaching implications. Regardless of whether new regulations and targets emerge, it is clear that investors and corporations will need to increase their focus on these issues.

The COP26 Agenda

COP26 has several important topics on the agenda, as the Parties assess their net zero goals, look to determine how decarbonization will be financed globally, and discuss potential commitments to phase out coal and reduce methane. Finance’s involvement at COP26 is also expected to hit a new high as banks, insurers, asset owners and managers representing trillions in assets have pledged net zero goals ahead of COP261.

COP26 has several important topics on the agenda, as the Parties assess their net zero goals, look to determine how decarbonization will be financed globally, and discuss potential commitments to phase out coal and reduce methane. Finance’s involvement at COP26 is also expected to hit a new high as banks, insurers, asset owners and managers representing trillions in assets have pledged net zero goals ahead of COP261.

COP26 also takes place against the backdrop of growing climate-related regulations. The European Union is leading the way with sustainable finance regulations. The SEC is also contemplating mandatory climate disclosures, and the Biden administration is attempting to pass the Build Back Better framework. The landscape of global climate negotiations, treaties, and regulations are rapidly evolving. What are the implications of increasing global climate action for various client portfolios? Also, how can investors effectively integrate climate change risks?

Climate Risk Background

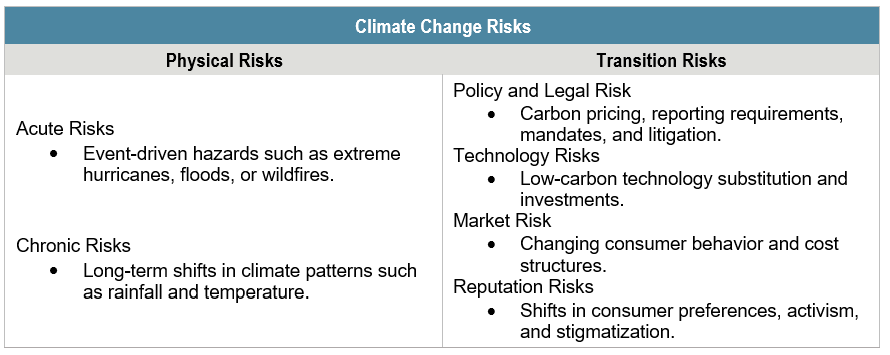

Climate change poses broad, economy-wide physical and transition risks that stretch beyond the ‘E’ in ESG – risks that will indirectly and directly impact issuers across all sectors. Physical climate risks reflect the economic disruptions from changes in climate and weather patterns, such as the increased frequency and severity of weather-related events. Transition climate risks result from the inevitable economic and regulatory shifts as the economy moves towards a low carbon future. These climate risks cannot be ignored and are beginning to influence the capital markets, creating important implications for investors.

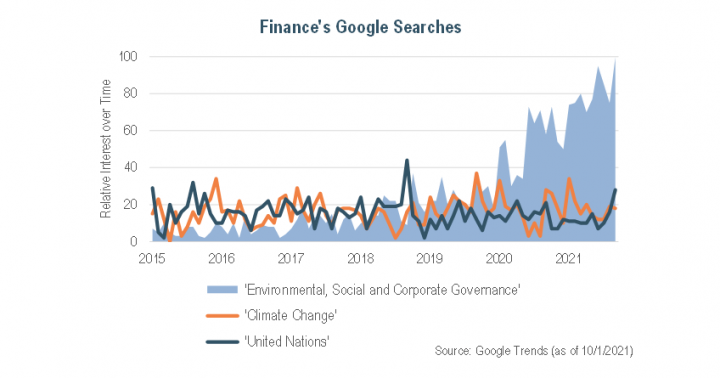

As these climate risks have become more apparent, public awareness of climate change has risen dramatically. Greater public acceptance of climate change has since fueled the rise in ESG investing, with ESG trending at an all-time high within the finance industry. Now, investors’ interest in climate change and global climate action specifically are gaining traction. Companies are being pushed to measure and report their climate-related risks and opportunities more accurately. Investors are more frequently requiring their portfolios to capture these metrics and reflect their values as they look to make a positive difference.

Investor Integration of Climate Change

Investors now face the challenge of how to effectively integrate climate risks in their portfolios. With the number of alliances, initiatives, and net-zero pledges, the finance sector’s involvement in global climate action is at an all-time high. Nevertheless, seeing how these pledges and goals transform into real emission reductions and meaningful portfolio alignment remains an open question.

As carbon pledges and enthusiasm mount, there are concerns about their credibility. For instance, little transparency currently exists around how organizations plan to achieve these pledges, with limited details on interim targets and time horizons, allocated capital expenditures and projected outcomes. Carbon offsets also come with concerns such as additionality and permanence. For example, how will companies prove that purchasing an offset leads to real emissions reductions that wouldn’t have occurred anyway (additionality), or, if planting a tree truly sequesters a set amount of carbon permanently (permanence)? As a result, regulators are exploring how to bring more clarity around sustainability reporting and emissions goals.

Corporates will need to develop more robust strategies to set net zero goals in motion and improve reporting and data consistency. Investors, too, will need to proceed with caution in developing portfolios aligned with a 2° or 1.5°C economy. This would require investors to employ a variety of tools, such as screening, investment stewardship, and climate integration.

Investing in line with a 2°C or 1.5°C scenario requires integrating forward-looking metrics that can accurately capture companies’ progress towards achieving emissions reduction and net zero goals. With the current lack of standardized disclosures, and a plethora of third-party data providers and ratings frameworks, the path is fraught with potential missteps. Many are turning towards the growing number of industry-led efforts, such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Transition Pathway Initiative (TPI).

There are numerous methodologies and assumptions involved in modelling and measuring the impact of climate change on asset valuations. As these are more fully developed, standardized protocols will likely be followed in an effort to integrate forward-looking metrics with portfolio strategies.

Conclusion

Today, more leaders are acknowledging that it is the combined responsibility of all—the public sector, private sector, civil society— to meet our global warming targets. The private sector, and finance specifically, may be one of the key levers in delivering the scale and speed needed to achieve this goal. It calls on new forms of expertise, collaboration, and diversity of thought to integrate climate change risks in a truly robust way. Responsible investors recognize the material risks climate change poses on our portfolios, underscoring the importance of ESG integration.

For investors, ESG is now a common lens to view issuers’ sustainability. Incorporating Environmental, Social, and Governance factors into the investment process offers additional insight into companies’ long-term value. ESG analysis captures micro risk factors not otherwise found in typical financial data, such as issuers’ greenhouse gas emissions (GHG) emissions, product safety and quality, and board governance. E, S and G considerations intertwine with the broader macro risks associated with climate change.

IR+M is tuning into the conversations and considering the potential changes and shifts resulting from COP26 and beyond.

Appendix

Origins of Global Climate Action

The plethora of ESG-related acronyms is truly just the start. The history of global climate negotiations and actions led by the United Nations are even more complex and becoming relevant for investors.

The Intergovernmental Panel on Climate Change (IPCC) was established in 1988 by the United Nations Environment Programme (UNEP) and World Meteorological Organization (WMO) to provide policymakers with regular scientific assessments on climate change. The First IPCC Assessment Report in 1990 officially linked human activities to increasing GHG concentrations and global warming, which sparked an international call to action and propelled the formation of The United Nations Framework Convention on Climate Change (UNFCCC).

COP and The Kyoto Protocol

Within a decade, the UNFCCC formed and drew 197 countries to become members (‘Parties’) of the first global agreement on climate change. Since then, Conference of Parties (COP) have been held annually to continually review, refine, and support UNFCCC global climate efforts. The first Conference of Parties (COP1), hosted in Berlin in 1995, sought to further strengthen UNFCCC commitments with specific emission goals, giving way to the Kyoto Protocol in 1997. The Kyoto Protocol legally bound developed country Parties to emission reduction targets (~5% below 1990 levels2). While ambitious, the Kyoto Protocol was ultimately considered a failure — some of the biggest polluters, including the United States, did not join and target emissions reductions were not achieved. The collapse of Kyoto led to continued negotiations and ushered in the Paris Agreement for renewed hope.

The Paris Agreement

The Paris Agreement was formed in 2015 at COP21 in Paris, and still stands to be the most renowned global climate change agreement. Unlike the Kyoto Protocol, the Paris Agreement requires all country members to reduce emissions to limit global warming to “well below 2 degrees, preferably to 1.5 degrees Celsius” compared to pre-industrial levels.3 Developed by the UNFCCC, the 2 degree and 1.5-degree Celsius scenarios are considered to reflect emissions levels that would avoid the most dangerous climate change risks. Committed Parties operationalize this goal through Nationally Determined Contributions (NDCs). While NDCs are voluntary, members are responsible, and politically pressured, to target emissions reductions consistent with the Paris Agreement.

The Paris Agreement was formed in 2015 at COP21 in Paris, and still stands to be the most renowned global climate change agreement. Unlike the Kyoto Protocol, the Paris Agreement requires all country members to reduce emissions to limit global warming to “well below 2 degrees, preferably to 1.5 degrees Celsius” compared to pre-industrial levels.3 Developed by the UNFCCC, the 2 degree and 1.5-degree Celsius scenarios are considered to reflect emissions levels that would avoid the most dangerous climate change risks. Committed Parties operationalize this goal through Nationally Determined Contributions (NDCs). While NDCs are voluntary, members are responsible, and politically pressured, to target emissions reductions consistent with the Paris Agreement.

The Paris Agreement also recognized the pivotal role of finance. Among the Parties, the Agreement facilitates financial assistance from developed country members to developing country members in order to implement NDCs across all Parties. COP21 also highlighted the private sector’s role in climate action by hosting business leaders and sparking a new wave of climate-related initiatives, such as Science Based Target initiative (SBTi) which helps companies set emissions reduction targets consistent with the Paris Agreement’s 1.5°C goal.4

Though the Paris Agreement achieved some consensus building among over 190 countries, its efficacy has been questionable. The voluntary nature of the agreement and “free rider” problem are common criticisms. Human activities have already contributed to a 1°C warming above pre-industrial levels and the current emission trends is likely to reach a 1.5°C warming between 2030 and 2050.5 Recent IPCC research has found that current NDCs fail to reach even a 2-degree scenario, suggesting that more stakeholders must take responsibility in reducing global warming. The spotlight is now turning towards how the private sector, especially finance, can help achieve the Paris Agreement’s goals.

Timeline of Global Climate Action

1972: Stockholm Conference on the Human Environment is held as the first global conference on the environment. Climate change is still largely considered a scientific, rather than social, issue.

1987: Montreal Protocol, the first environmental global treaty regulating the production and consumption of ozone depleting substances, is adopted.

1988: The United Nations Environment Programme (UNEP) and World Meteorological Organization (WMO) establishes the Intergovernmental Panel on Climate Change (IPCC) to provide policymakers with regular scientific assessments on the science of climate change.

1990: The IPCC’s First Assessment Report is published, finding that human activities are increasing greenhouse-gas concentrations, and that rising concentration would result in greater warming of the Earth’s surface.

1992: The United Nations Framework Convention on Climate Change (UNFCCC) forms to commit state parties to reduce greenhouse gas emissions.

1995: COP1 is hosted in Berlin. The IPCC’s Second Assessment Report describes a “discernible” human influence on the global climate.

1997: The Kyoto Protocol is adopted and later enters into force in 2005. It sets the first legally binding emissions reduction targets for industrialized countries.

2001: The IPCC’s Third Assessment finds “new and stronger evidence” of human-induced global warming.

2006: The UNEP helps launch the Principals for Responsible Investing (PRI) with industry signatories.

2007: The IPCC’s Fourth Assessment Report determines that observed warming since the mid-20th century is “very likely” due to anthropogenic GHG emissions.

2009: COP15 is hosted in Copenhagen, and a failure to reach agreements occurs.

2013: The IPCC’s Fifth Assessment Report determines that human activities are “extremely likely” to have predominantly caused observed warming.

2015: COP21 is hosted in Paris and the Paris Agreement is successfully adopted.

2021: The IPCC’s Sixth Assessment concludes that human activities “unequivocally” cause climate change.

2021: COP26 held in Glasgow, UK, after being delayed by the COVID-19 pandemic.