In many locations around the US, the residential real-estate market has been on fire, ignited by a pandemic that has impacted the way we work and live. The Federal Reserve (Fed) has acted swiftly, leveraging lessons learned during the Great Financial Crisis and launching programs aimed at supporting the US economy. While the housing market played a prominent role in the last downturn, we believe this time is different. We caught up with our Securitized Team to discuss the current state of the housing market, the unprecedented steps taken by the Fed and Congress to combat the virus and keep people in their homes, and the impact on agency mortgage-backed securities (MBS).

With mortgage rates near historical lows and home prices trending higher, can you comment on housing affordability?

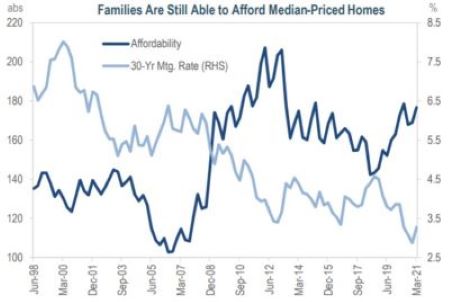

For many, the pandemic has blurred the line between work and home, motivating buyers to seek out houses with outdoor and home office space. This movement has helped fuel a surge in home price appreciation (HPA), which continues to dominate headlines. According to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, in May 2021, US home prices rose nearly 17% from a year earlier – the highest level in the report’s 30-plus years. While it is important to monitor (but not necessarily predict) home prices, we also believe it is vital to track affordability. Housing affordability and interest rates usually go hand in hand. Two decades ago, 30-year mortgage rates were above 8%. Since then, 30-year rates have been on the decline, hitting a historical low of 2.82% in December 2020. Against this backdrop of ultra-low interest rates, homes in the US are relatively affordable, according to the National Association of Realtors’ Affordability Index, which exceeded 170 in the first quarter of 2021. When the Index is 100, a family earning the median income can exactly afford a median-priced home. If it is below 100, the same family cannot afford a median-priced home. We believe that even if mortgage rates were to rise from 3% to 4.5%, the affordability equation would be largely unchanged. However, supply continues to be a material factor.

For many, the pandemic has blurred the line between work and home, motivating buyers to seek out houses with outdoor and home office space. This movement has helped fuel a surge in home price appreciation (HPA), which continues to dominate headlines. According to the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, in May 2021, US home prices rose nearly 17% from a year earlier – the highest level in the report’s 30-plus years. While it is important to monitor (but not necessarily predict) home prices, we also believe it is vital to track affordability. Housing affordability and interest rates usually go hand in hand. Two decades ago, 30-year mortgage rates were above 8%. Since then, 30-year rates have been on the decline, hitting a historical low of 2.82% in December 2020. Against this backdrop of ultra-low interest rates, homes in the US are relatively affordable, according to the National Association of Realtors’ Affordability Index, which exceeded 170 in the first quarter of 2021. When the Index is 100, a family earning the median income can exactly afford a median-priced home. If it is below 100, the same family cannot afford a median-priced home. We believe that even if mortgage rates were to rise from 3% to 4.5%, the affordability equation would be largely unchanged. However, supply continues to be a material factor.

How has the Fed supported the housing market during the pandemic?

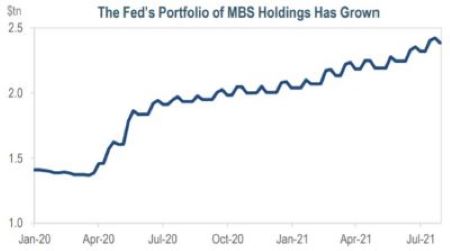

The Fed unleashed its tool kit at the start of the pandemic, pairing new initiatives with its asset purchase program, which debuted during the Great Financial Crisis. This time around, the central bank has acted swiftly, as opposed to 2008, when it waited nearly three months after Lehman’s collapse to purchase bonds. Since March 2020, the Fed has been purchasing $40 billion in agency MBS each month, and reinvesting paydowns of $50 billion to $90 billion. For context, the Fed has purchased $4.5 billion to $6.5 billion of MBS every day – or approximately 80% to 90% of daily originations. The Fed’s MBS holdings now exceed $2.3 trillion.

The Fed unleashed its tool kit at the start of the pandemic, pairing new initiatives with its asset purchase program, which debuted during the Great Financial Crisis. This time around, the central bank has acted swiftly, as opposed to 2008, when it waited nearly three months after Lehman’s collapse to purchase bonds. Since March 2020, the Fed has been purchasing $40 billion in agency MBS each month, and reinvesting paydowns of $50 billion to $90 billion. For context, the Fed has purchased $4.5 billion to $6.5 billion of MBS every day – or approximately 80% to 90% of daily originations. The Fed’s MBS holdings now exceed $2.3 trillion.

How has the Fed’s MBS purchase program impacted valuations?

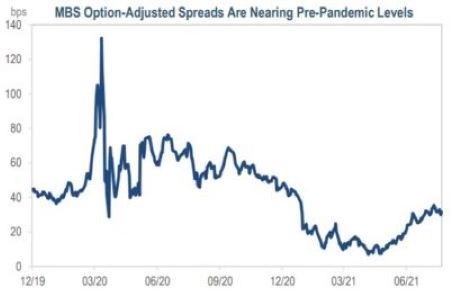

At the end of 2019, MBS spreads, or the additional yield over a Treasury, were 39bps. Less than three months later, as the pandemic tightened its grip on the global economy, MBS spreads reached an almost 13-year high of 132bps. That month – March 2020 – Fed Chair Jay Powell announced that the central bank was cutting the fed funds rate to zero and implementing an open-ended asset purchase program. In response, MBS spreads retreated to 30bps by month end, and continued to narrow until reaching single digits in April 2021. Recently, MBS spreads have widened marginally as the Fed has started “talking about talking about” tapering asset purchases. As the Fed provides further clarity on its plans, we may see MBS spreads widen further.

At the end of 2019, MBS spreads, or the additional yield over a Treasury, were 39bps. Less than three months later, as the pandemic tightened its grip on the global economy, MBS spreads reached an almost 13-year high of 132bps. That month – March 2020 – Fed Chair Jay Powell announced that the central bank was cutting the fed funds rate to zero and implementing an open-ended asset purchase program. In response, MBS spreads retreated to 30bps by month end, and continued to narrow until reaching single digits in April 2021. Recently, MBS spreads have widened marginally as the Fed has started “talking about talking about” tapering asset purchases. As the Fed provides further clarity on its plans, we may see MBS spreads widen further.

How has fiscal support helped the housing market and MBS investors?

During the 2008 financial crisis, the federal government directly experienced the benefits of interventionist economic policies. As such, it wasted little time in passing the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020. This $2.2 trillion economic stimulus bill introduced the government’s forbearance program, which prevented a flood of foreclosures. It has allowed homeowners with federally-backed mortgages to delay their payments for up to six months, and possibly six months more. Homeowners who attested to experiencing a pandemic-induced hardship have been spared additional fees, penalties, and excess interest on paused payments – and can exit forbearance at any time. After forbearance, homeowners could choose one of several repayment options, including deferrals, repayment plans, or loan modifications. Mortgage investors have also benefited from the government’s forbearance program through lower mortgage defaults, which limit the earlier-than-expected return of principal to investors, thus preserving the mortgage bond’s long-term carry.

How does IR+M incorporate ESG into MBS investing?

We view ESG analysis as an integral part of risk assessment when evaluating securities, including our MBS holdings. Our Research Analysts consider material sector-specific ESG key issues using our proprietary framework when analyzing credits. Specifically, within the MBS sectors, we are looking across the environmental, social, and governance pillars at the issuer, trust, collateral, and servicer levels. We look for risks associated with climate change related to rising sea-levels and focus on positive aspects, such as access to finance and affordable properties. As the industry continues to develop and more data becomes available and potentially standardized, we will evolve our process and incorporate any additional ESG data in our analysis. In the meantime, we actively engage with issuers to advocate for pertinent ESG data.

The pandemic-induced economic downturn has had a broad impact on the U.S. economy. Unlike the previous financial crisis, this downturn has not pushed home prices lower or triggered a spike in defaults and foreclosures. Instead, we see a national movement toward home buying alongside swift and effective action by the Fed and other policymakers to stabilize a critically important segment of the fixed income markets. At IR+M, we rely on our bottom-up security selection skills – and consideration of material ESG factors – to source high-quality, liquid, and alpha-generating agency MBS bonds for our clients.