“In this world, nothing can be said to be certain, except death and taxes… and the probable outperformance of municipal bonds in a rising rate environment.”

“In this world, nothing can be said to be certain, except death and taxes… and the probable outperformance of municipal bonds in a rising rate environment.”

After signing the United States Constitution in 1787, Benjamin Franklin famously penned the first part of that quote in a letter to French scientist Jean-Baptiste Leroy. While drafting a blog post in 2022, yours truly not-so-famously wrote the second part, and added the qualifier “probable” because a) in the pandemic’s junior year, nothing is certain and b) our eagle-eyed compliance team would’ve struck it down otherwise.

You’ve seen the headlines by now, but the Federal Reserve (Fed) has finally lifted off after more than three years. On March 16th, the Fed approved its first interest rate hike – 0.25% – since December 2018. According to Fed rhetoric, eight or nine more rate increases may occur in 2022, with another three in 2023. Typically, bond investors loathe rising rates, which erode bond valuations. If you’re a frequent consumer of our infographic series (and why wouldn’t you be?), you know that cooler heads should prevail.

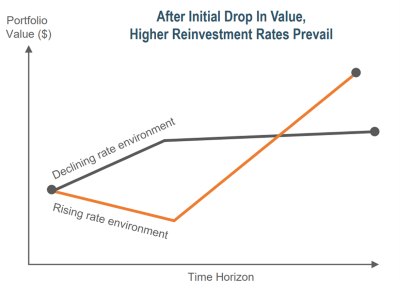

Contrary to popular opinion, rising rates can be good for bond investors who have longer investment horizons. Ultimately, higher yields on reinvested cashflows, like coupon and maturity payments, can outweigh price declines.

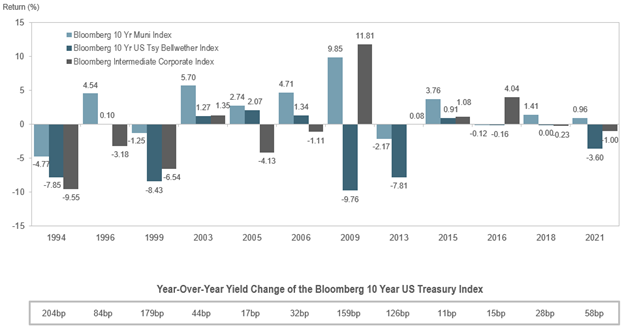

With history as our guide, the news may be even better for municipal bond investors. Why? Most municipal bonds possess a tax-exemption superpower. As Treasury rates rise, the value of this tax exemption also increases. Looking back as far as 1994, in all but two of 12 rising rate environments, muni bonds have outperformed relative to Treasuries and corporates.

With history as our guide, the news may be even better for municipal bond investors. Why? Most municipal bonds possess a tax-exemption superpower. As Treasury rates rise, the value of this tax exemption also increases. Looking back as far as 1994, in all but two of 12 rising rate environments, muni bonds have outperformed relative to Treasuries and corporates.

How can we best explain this phenomenon? Part of the answer may lie in the closely monitored relationship between munis and Treasuries. Until early 2022, the $4 trillion muni market had recently benefited from unprecedented demand. Last year, muni bond funds received a record-setting $100 billion in inflows, continuing the streak of positive net flows in 85 out of 86 weeks. That all changed in the second week of January 2022, when higher rates spooked retail investors, who, after seeing the losses in their monthly statements, started hastily pulling money from their muni bond funds. Munis have been on a wild ride ever since.

How can we best explain this phenomenon? Part of the answer may lie in the closely monitored relationship between munis and Treasuries. Until early 2022, the $4 trillion muni market had recently benefited from unprecedented demand. Last year, muni bond funds received a record-setting $100 billion in inflows, continuing the streak of positive net flows in 85 out of 86 weeks. That all changed in the second week of January 2022, when higher rates spooked retail investors, who, after seeing the losses in their monthly statements, started hastily pulling money from their muni bond funds. Munis have been on a wild ride ever since.

As 2022’s first frame came to a close, headlines screamed about munis’ worst quarter in 40 years, including a 6.4% loss and underperformance relative to Treasuries. Skittish retail investors have continued to jump ship, and selling pressure has remained intense. But before we go all bad news bears here, there is a bright side – a veritable one. Historically, munis have tended to perform well after large outflow cycles, which in recent years have been driven by a myriad of factors – Meredith Whitney, the 2020 election, and the pandemic, to name a few. Chaos breeds opportunity, and fortunately, the muni market is awash with good vibrations.

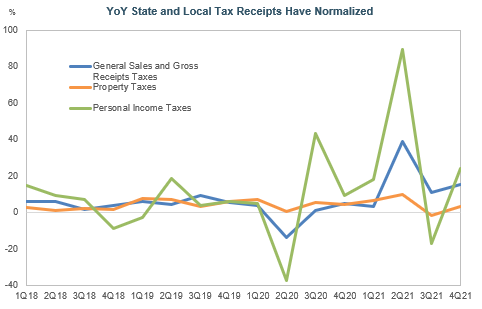

Despite the recent, and somewhat perplexing, volatility, muni credit remains fundamentally sound, now more than pre-pandemic, with tax collections and federal stimulus buttressing state and local governments’ balance sheets. Default rates continue to be low, and the prospects for elevated individual tax rates are high – both of which are positives for muni bonds. As evidenced by the 10-year muni/Treasury ratio, which has ballooned from 65% on January 3rd to 95% on March 31st, munis have underperformed Treasuries, which has both increased the value of the tax exemption and lured some buyers off the sidelines. Our June 2020 blog, “My Tax Haven is Worth Less, But Certainly Not Worthless,” really gets into the details, but here’s a quick example:

For an investor with a 40% tax bracket, a 3% taxable bond yield would result in 1.8% after paying taxes; at 6%, it would result in 3.6%. With a 65% muni/Treasury ratio, and taxable yields at 3%, the equivalent muni bond yield would be 1.95%; at 6%, it would be 3.9%. So, the taxable bond yield increased 1.8%, and the muni bond yield increased 1.95%. Although yields doubled, the muni bond still picked up 0.15% versus the taxable bond.

So, for those discerning investors, we invoke the words of Pat/Bradley Cooper in The Silver Linings Playbook: “You have to do everything you can, you have to work your hardest, and if you do, you have a shot at a silver lining.” The silver linings are out there for the world (and crossover buyers) to see – healthy muni credit fundamentals and cheap muni/Treasury ratios. Don’t blink or you may miss them.