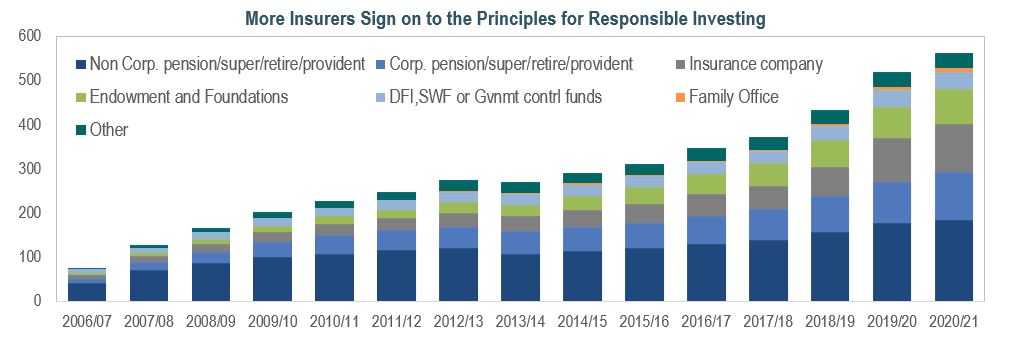

Throughout the volatility in 2020, global insurers’ interest in ESG investing has grown significantly. From both an asset and liability perspective, more and more insurers are focusing on ESG as they anticipate additional regulatory actions, calculate financial risks, and consider the potential reputational risks associated with ignoring the importance of ESG. As we head into 2021, we expect that this trend will become more pronounced, driving sustainable change in business and investment decisions.

AN ESSENTIAL TOOL FOR RISK MITIGATION

- Insurers are increasingly focused on ESG. While the method, application, and stages of implementation vary by region, type of insurer, and asset class, we believe the direction is clear. European insurers have led the way, and North American insurers are beginning to follow.

- While some insurance companies are investing specifically in ESG strategies, others are incorporating ESG more broadly within the investment process, and many have published ESG-related goals and commitments.

- Recent surveys have identified significant ESG adoption rates within the insurance industry. Since 2016, the amount of insurance assets incorporating ESG in some form has increased nearly 50%.

- This increase may be attributed in part to the California Insurance Commissioner’s January 2016 announcement that required firms doing business in the state to disclose their carbon-based investments.

- Insurers have seen increased regulatory attention on ESG issues, particularly related to climate change. In addition, 2020 has underscored the importance of social issues and their impact on insurers’ underwriting and investments.

- Insurers anticipate additional regulation on the horizon. For example, regulators in New York, a key state for insurers, have indicated their intent to publish detailed guidance on climate-related financial supervision. Social issues, such as board and employee diversity, along with underwriting practices that may harm minorities, will also be a top priority.

- For many years, the NAIC has been focused on climate change and its accompanying risks to insurers. The NAIC’s Climate and Resiliency Task Force continues to consider appropriate climate risk disclosures within the insurance sector. In addition, the NAIC announced the formation of the Special Committee on Race and Insurance in July 2020.

- Although capital charges are not yet explicitly connected to ESG, they are indirectly impacted with bottom-line implications as credit ratings become increasingly influenced by ESG factors.

- Overall, incorporating ESG is increasingly seen as a way to mitigate financial risk on both sides of the balance sheet.

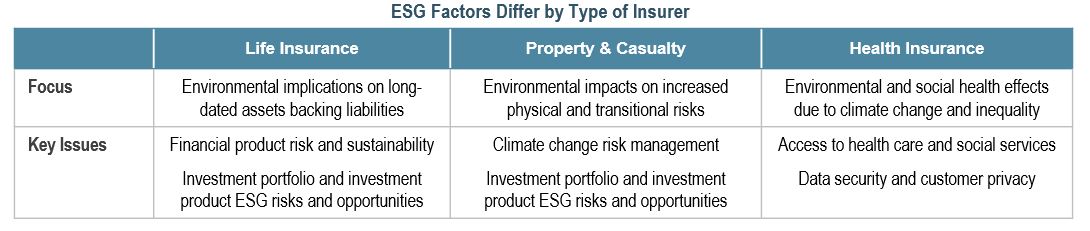

Not All Factors are Created Equal

- While many insurers publish reports discussing their approach, efforts, accomplishments, and overall strategy related to ESG, others are not as focused or transparent. A lack of standardized reporting requirements and metrics adds confusion.

- There are also varying levels of influence of the specific ESG factors across different types of insurers.

- At IR+M, we began formally incorporating ESG within our investment process when we became a PRI signatory in 2013.

- Our bottom-up, fundamental ESG research is an integral part of the investment process. The overall credit profile, bond structure, and relative-value evaluation drive our investment decisions. Within the insurance space, we are focused on the key ESG issues that may have a material financial impact on the credit.

Consistency is Key

- As insurers increasingly incorporate ESG across their portfolios, the importance of these factors within the municipal and securitized sectors becomes accentuated. At IR+M, we apply a proprietary sector-specific framework across all asset classes, which allows our analysts to identify and evaluate ESG issues consistently.

- While municipal bonds can be broadly categorized as ESG-positive assets, the devil is in the details. We believe that our bottom-up security selection process provides insight into the true ESG leaders and shines light on potential ESG risks.

- Evaluation of environmental concerns like climate-change risk-management, social issues like infrastructure and resiliency, and general governance practices, help differentiate issuers and complement our credit analysis.

- Securitized assets have lagged behind equities and other fixed income assets in providing the data transparency necessary to apply ESG factors. However, there is an increasing level of focus on these issues. Our analysts incorporate material ESG factors in their overall analysis.

- While governance factors span almost all sectors, social factors often play a large role in the securitized space, particularly as we focus on product safety, data security, and access to finance.

ESG’s significant rise has not been deterred by the pandemic. We expect ESG to remain a key focus in conversations across the market, and particularly within the insurance space. Regulations and client demand will continue to push these discussions forward. At IR+M, we believe that the incorporation of ESG factors in our investment analysis leads to a more complete understanding of potential material issues, and may ultimately result in superior risk-adjusted, sustainable returns over the long-term.