“No one in their right mind goes to sea to encounter heavy weather. But those who make longer voyages are likely to experience bad weather at some time because it cannot be avoided all the time. It is in these situations that our seamanship is tested, and this is not a test we can afford to fail, so thought and preparation for bad weather are an integral part of the preparation for a voyage offshore or across the ocean.” – Forward by Sir Robin Knox-Johnston to the 7th edition of Heavy Weather Sailing by Peter Bruce.

Anyone who has spent time in Boston between September and April has likely experienced a Nor’easter. This ocean storm swirls counter-clockwise, blowing out of the northeast and battering the coast with wind, water, and cold. It truly feels like the ocean’s froth is being heaved onto land like a sloppy snowball. Boston suffers a prolonged week of nasty weather when they stall off the coast.

This market feels an awful lot like a nor’easter. Whipping volatility and ruthless price action just won’t end. Days feel like weeks and weeks feel like full market cycles. The Bloomberg Global Aggregate Bond Index has now suffered a drawdown of 12.2% YTD – the worst in history. But blue skies will return, and so will fixed income tailwinds. The market’s reaction to inflation’s perfect storm – one precipitated by Russia’s invasion of Ukraine, intense Asian lockdowns, and domestic labor shortages – will likely subside long before CPI returns to the Fed’s comfort zone. Meanwhile, experienced sailors know not to oversteer in heavy swells, and bond investors know not to over-trade in high volatility markets. Here are ten observations to help navigate this storm:

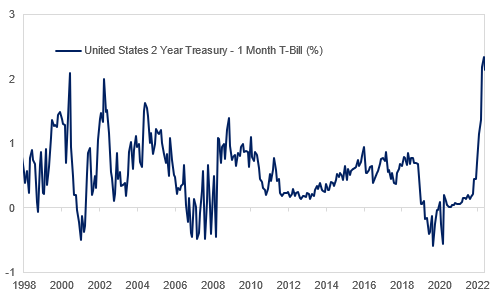

- There are few shortcuts around the Fed’s messy policy correction, but breakeven analysis is beginning to show value in short maturity bonds. The Fed’s breezy market tailwind lasted for years; now markets must correct for a new reality. But today’s yield curve does have the benefit of the Fed’s enhanced forward guidance. Currently, seven to eight additional hikes are priced into the curve for the remainder of 2022. This has steepened the front end of the yield curve, out to two-years, to generational highs. Even conservative investors can agree that short bonds are now a much more attractive alternative relative to cash.

- The Fed remains protective of market conditions despite sunsetting their active bond buying. While they wish to soften broad financial conditions, they don’t want to risk daily transactional liquidity in the $50+ trillion bond market. Their recently released Financial Stability Report (FSR) elaborated on their monitoring efforts. Vice Chair Brainard oversees these market stability efforts – a good sign that it’s high on the Fed’s priority list.

- The pace of Quantitative Tightening (QT) may make more headlines later this year. If the 2017-2019 QT experience is any guide, the reduction in demand for Treasuries, TIPS, and Agency MBS will be seamlessly replaced by the private sector – including banks, pensions, insurance, and retail buyers. The additional supply from QT will be large, but it will not be a large market surprise.

- Many of these investors have moved to cash in recent months – yet yields on most money market accounts remain near zero. Meanwhile, the Bloomberg 1-3-year Government/Credit Index is now yielding 2.8%. A good portion of cash-heavy investors may find that yield enticing and start to creep out the yield curve in the coming quarters.

- Markets do not like unbounded trend lines, as we are learning once again. The near-vertical ascent in mortgage delinquencies amidst the 2008 subprime crisis, the spiraling write-downs by European banks amidst the 2011 sovereign crisis, and the exponentially rising case numbers amidst the 2020 COVID crisis brought market panic. Now Core CPI is the instigator. But inflation measures are showing signs of peaking – and an inflection point could be in the offing.

- Speaking of other crises, this one lacks significant fundamental deterioration to date. At our 2008 Investment Committee meetings, we asked ourselves, “What is the next shoe to drop?” In 2011, we asked ourselves, “Where is the contagion headed next?” And in 2020, we asked ourselves, “How much worse can the economic lockdowns get?” While our Investment Committee remains concerned about the economy, we are reassured by our analyst teams that fundamentals have shown little evidence of erosion. That gives us comfort for now.

- This current bout of exceptionally high interest-rate volatility has persisted for more consecutive days than any other period since 2009. But this doesn’t mean we’re back to a Great Financial or COVID trading crisis. Transactional liquidity remains solid, and bid-ask spreads manageable. This summer, we expect more dramatic headlines on fixed-income liquidity, but don’t expect extraordinary market halts.

- No security’s daily price action is more telling of our economic path than the 2-year Treasury Note. On days when the market believes the Fed can tighten but avoid recession, the 2-year yield holds steady or drifts higher. On days when the market believes the Fed plan is too aggressive, the 2-year yield rallies. This dynamic gets to the heart of the matter – must the Fed break the economy to quell inflation? In my opinion, its movement is more telling than the 2-year-10-year yield spread.

- Does the Fed have the runway to fight inflation without causing a recession? Today’s data trends suggest about six months of run room. Meanwhile, this summer is huge for economic data and “Fed speak.” Monthly releases – manufacturing surveys, retail sales, housing trends – will be compared to evolving Fed language by the market. The Fed’s June meeting will bring new rates and economic forecasts. Their July meeting won’t be so sleepy this year. And their Jackson Hole conference in August will have significant volatility potential. Perhaps not the year to “sell in May and go away.”

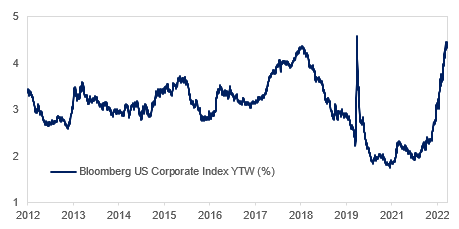

- High-quality corporate bonds offer a possible haven amidst this volatility. The Bloomberg Corporate Bond Index yield is now 4.4% – well above the market’s implied 5-year inflation rate of 3.1%. Furthermore, the Option Adjusted Spread (OAS) is now 141bps, above its 10-year mean and median. OAS and interest rate movements now have more potential to offset each other. If the economy slows with inflation’s decline, declining interest rates may counteract incremental spread widening. Conversely, if inflation rises on the strength of a resilient economy, rising rates may be softened by spread tightening. Either way, corporate bond yields may remain more range-bound than they have year-to-date.

Any seaman will tell you that weather forecasting is not an exact science. They’ll also joke that “gentlemen do not go windward.” But extending this analogy to bond investors preferring to sit in cash amidst a Fed hiking cycle is misguided. Sure, beating windward into the Fed’s heavy seas can be wet, rough, and sloppy. But today’s racing yachts are designed to perform best in the windward direction, as that is often where the race is won. Bond investors who continue to buy high-quality paper during a Fed hiking cycle can be rewarded for their tactical skills. They’ll also be the ones fully invested when that sudden and pronounced change in market wind direction fills the sails of long-term returns.