One of my post-college roommates used to race motorcycles on the weekends (I went to racing school with him once but was relatively slow – aka scared!). He was pretty good and racked up a decent number of points in the New England Amateur standings. The funny thing was, he hardly ever won except when racing in the rain. What was his strategy? It was to take it easy, know his skill set, the bike, and the track, and to let the guys that were usually faster crash when it was wet.

How does all this relate to bonds? Most of our clients hire us to manage their portfolios versus a benchmark (the “track”). However, as a practical matter, we are in a race against other managers, including those with passive funds, especially when it comes to passing new business performance screens. We’re not going to win every quarter, but as long as our performance is consistent over time, we should remain in the race.

There are managers that go “full throttle” all the time, and many that “crash” in a difficult year. These “crashes” can come for a variety of reasons, such as having too much risky spread product in a risk-off environment, taking an unpredictable currency bet, or making a bad duration bet. In particular, taking duration bets can have performance consequences. This can be great when it works, but if the market is moving to a new rate regime, a portfolio can lose that performance permanently. For example, many investors thought rates were going higher in 2019, but instead, the 10-year Treasury fell by about 75 basis points. A portfolio that was a year short in duration would have lost 75 basis points in performance due to the duration bet, and still would not have recovered from that loss. Moreover, the tendency is often to wave the caution flag and cover, which would reduce the potential for further damage but also lock in your losing position. Another point regarding betting on rates is that an off-market duration bet will likely be the major component of tracking error, which can easily create volatility of returns*.

At IR+M, our strategy is more measured, relying on our security-selection skills, along with some sector allocation and our time-tested strategy. We do not make duration or yield curve bets, so over time, about 70% of our value added in core portfolios comes from security selection, while sector allocation provides the rest. Every so often, we may have a security that doesn’t perform as expected, but overall, we count on strong security selection to add value. Conversely, sector allocation is a more opportunistic lever we can pull — another gear we can shift. For example, when corporate spreads are narrow, we may rotate into securitized product to diversify the portfolio and reduce volatility. When spreads are wider, we aim to add risk to a portfolio, typically in the form of selling Treasuries to buy corporates or securitized issues, depending on relative value. The attractive part about this strategy is that spreads exhibit a strong mean reversion tendency as shown in the below graph of corporate spreads – they typically don’t stay wide for long:

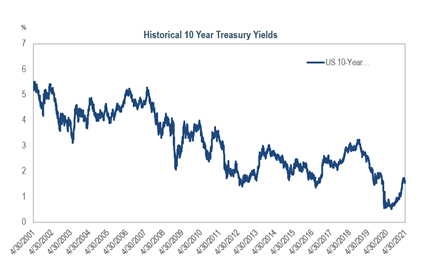

The same can’t be said for the mean reversion of rates, as you can clearly see the ongoing long-term move to lower rate regimes over the past 20 years:

Sometimes, a good defense pays off more than a good offense. Just like my buddy racing in the rain, playing it safe when spreads are narrow is an important way to add value when spreads widen. Performing well is not about being at the top all the time. If you finish in the top 10 most of the time, and you have a couple firsts or seconds, racing points add up and can place you on the podium at the end of the season. Similarly, a manager that is often in the second quartile, and occasionally in the first, is likely to be competitive over a long-term time period.

*(I’ll save the baseball analogy of Reggie Jackson’s 1969 season of 47 home runs and 142 strike outs for a future blog post.)