ESG-labeled bond issuance again reached record levels in 2021. Continued growth is projected in 2022 as demand remains healthy and issuers look to take advantage of the space. Within the US market, issuance remains concentrated and reporting requirements are voluntary. While we applaud the progress being made and recognize the growing importance of the segment, we remain cautious about relying on a label to dictate our ESG positioning. We continue to monitor the market and invest in ESG-labeled bonds when we feel confident that the credit, structure, and price provide value for our portfolios.

ESG Labels: A Quick Refresher

Use-of-Proceeds. Green, Social, and Sustainability bonds are the three major ESG “use-of-proceeds” bonds. These labels indicate the type of project the bond, or equivalent proceeds, will be used to fund. The proceeds are expected to be tracked to appropriate projects within the specified category and reported regularly. Projects may include a “look-back period” where eligible projects previously started – or even completed – can be included within the allocation.

Key Performance Indicator (KPI)-Linked. Sustainability-Linked bonds differ from the use-of-proceeds bonds in that the funds raised from the issuance of the bond are not directly tied to a specific ESG project. Rather, the proceeds are used for general corporate purposes, but the bond’s coupon is tied to specified sustainable key performance indicators at the company level. The coupon can be stepped up (or down) if the company fails to meet (or succeeds in meeting) the KPI indicated in the prospectus.

Our Take. While KPI-Linked bonds often appear to have more teeth than use-of-proceeds bonds given the coupon step-up/down surrounding specific metrics, we believe that the analysis needs to be done at the deal level. KPIs are often easily attainable or weak measures of a company’s progress. Similarly, many of the projects funded with use-of-proceeds bonds would have been completed regardless of the bond issuance. We believe each deal should be evaluated individually and looked at holistically.

Best Practices

While tracking and reporting the use-of-proceeds is voluntary and specific regulations are currently lacking for ESG-labeled bonds, issuers typically follow best practices and issue these bonds in accordance with International Capital Markets Association (ICMA) frameworks, which are seen as industry-leading. Greenwashing concerns remain but issuers risk significant reputational harm if the appropriate reporting or labeling is misaligned with sustainability initiatives.

- Issuer Frameworks. Issuers generally produce their own frameworks aligned with ICMA guidance, publicly memorializing their external metrics and reporting requirements.

- External opinions. Numerous parties offer pre- and post-issuance opinions. These range from assurance to ratings to second-party opinions to verification.

- Reporting. Annual reporting is encouraged to track the specific projects and allocations, along with their expected impacts.

ESG-Labeled Bond Issuance

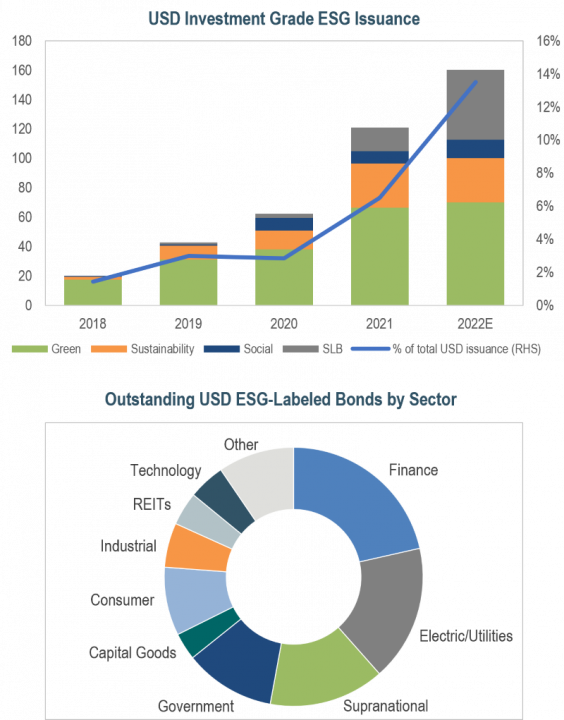

- Record issuance continued in 2021. USD ESG-labeled bond issuance nearly doubled from 2020 levels, with a significant increase in green and sustainability use-of-proceeds bonds. Sustainability-linked bond issuance grew meaningfully in 2021, up more than 5x from 2020. However, these remain a small fraction of the overall investment grade bond market.

- Looking ahead. Total ESG-labeled issuance is projected to continue its growth, with some dealers expecting 10%-15% of total investment grade issuance to come with an ESG label. We expect a focus on sustainability-linked bonds along with continued growth in the green and sustainability use-of-proceeds bond space.

- Sector concentration. Financials and utilities made up almost half of all ESG-labeled issuance in 2021, continuing previous trends. However, we saw large issuance from retail names like Walmart, who issued a $2 billion green bond, and health care names like Merck, who issued a $1 billion sustainability bond. We expect these sector imbalances to remain but foresee the gap closing slowly as more issuers come to market with ESG labels.

- Greeniums. ESG label premiums, often referred to as “greeniums”, are estimated at 2-4bps, on average. This can vary widely with some bonds trading on top of their non-labeled counterparts, and others demanding a significantly higher premium; it is a reality within the market that must be noted.

Why the label? Issuers incur significant up-front costs when issuing a labeled bond. Creating a framework, updating the legal language within the prospectus, and establishing a reporting structure is a significant undertaking. Many smaller companies are less likely to issue labeled bonds given the additional hurdles and required resources. However, many issuers expect to programmatically issue ESG-labeled bonds and take advantage of the benefits, such as expanding their investor base, improving their company’s image, and potentially lowering their cost of borrowing.

As the ESG-labeled bond market continues its exponential growth, we look to approach each deal with a bit of caution. We don’t believe there is widespread intentional greenwashing overwhelming the market, but we do believe a bit of skepticism is warranted. We look to understand the overall credit and ESG factors of the issuer on a deal-by-deal basis. Our analysts understand the intricacies of the market and look beyond the label to view the issue holistically, remaining consistent with our bottom-up security selection approach.

For additional information, please see our previous mailer (It’s Not Easy Being Green) issued in July 2020.