About seven years ago, my wife and I realized that our car wasn’t the right fit for us anymore. Our 2006 Honda Pilot had served us well as it played a major role in many of our major life events: bringing our first two children home from the hospital, family driving vacations, and carrying us to our new home in Boston after years in New York City. However, our third child and the ensuing hectic suburban lifestyle spurred our search for a vehicle with a little more flexibility and functionality – it was minivan time! The Toyota Sienna’s automatic sliding doors and captain’s chairs were a godsend. Plus, who doesn’t need 18 cupholders?

Six years later, our kids (and we) had gotten older. They no longer needed sliding doors at school drop-off and pick-up and by then, we’d added two dogs to our family unit – Leonbergers named Minnie and Moose. And by the way, Minnie is not mini, and Moose is a moose, each weighing well over a 100 pounds. During the evaluation process of potential vehicles, we quickly realized that size mattered most, and we landed on the Ford Expedition Max. It’s been a home run, and as you can see, Moose loves it.

You might be asking yourself, “Why is Jamie telling me these details about his cars, kids, and dogs?” Well, in addition to being relatable anecdotes, my family’s vehicle choices are an allegory for investment vehicle choices. The appropriate vehicle is extremely important – both in life and investing.

As with automobiles, investment vehicles continue to evolve, both in type and usage. For example, mutual funds, which dominated the retail and defined contribution (DC) landscapes for years, are now waning in popularity, as collective investment trusts (CITs) and exchange traded funds (ETFs) proliferate. According to Callan Institute’s 2021 DC Survey, the use of mutual funds has decreased by nearly 10% in the past decade. Meanwhile, CIT usage has jumped by 25%. At year-end 2018, mutual funds controlled an estimated 45% of DCIO assets to compared to just 28% for CITs; more recently, mutual funds were at 39% market share versus 34% for CITs.[1]

So, what exactly is a CIT? A collective investment trust is an investment vehicle (similar to a US mutual fund) available only to qualified retirement plans, such as 401(k) plans and governmental pension plans. They are institutional products sold only to plan sponsors and/or plan fiduciaries. CITs are excluded from security registration, but are sponsored by bank or trust companies under the supervision of the Office of the Comptroller of the Currency (“OCC”) or state banking regulators. CITs used to fly under the radar, though are becoming more mainstream in manager databases and consultant lexicon.

CITs can be a cost-effective vehicle for eligible qualified retirement plans. They typically charge lower fees than that of mutual funds, which need to offset compliance, administrative, advertising, and marketing expenses. Further, CITs can offer more flexible investment strategies, and serve as underlying sleeves in glide path or target-date funds due to their reduced fees and potential for customization. As DC plan sponsors continue to focus on fees, we would not be surprised to see CIT usage expand further.

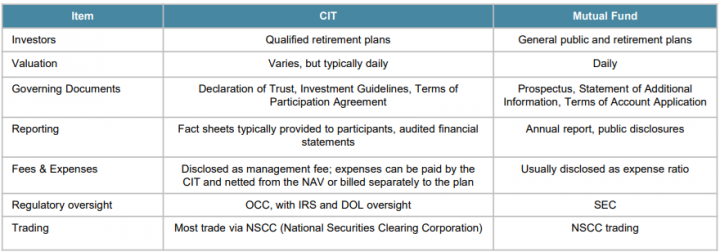

Key Distinctions Between CITs and Mutual Funds

As with the broader market, IR+M’s CIT lineup has grown since its start in 2014. We currently manage CITs in our Intermediate Government/Credit, Core, Intermediate Corporate, Long Corporate, and Intermediate TIPs strategies. Many of our clients use them as is, with a standard benchmark, while others customize to their needs. For example, if a client wants a US Corporate portfolio with a 9.75- year duration, that can be achieved with a 50/50 blend of our IR+M Intermediate Corporate Collective Fund and IR+M Long Corporate Collective Fund.

As IR+M expands its presence in the DC market, we believe that a robust, fee-aware CIT lineup is an important tool in our toolkit. In my 12+ years at IR+M, it has been exciting to witness the growth and change in our vehicle offerings, along with the evolution of the vehicles in my driveway (my oldest daughter will be driving soon!). We now offer many of our strategies across separate accounts, private funds, and collective investment trusts. Going forward, it will be interesting to watch what vehicles become most prevalent in the growing strategies offered to our clients. As for my daughters, their vehicle options will be limited… to maybe a 2006 Honda Pilot.