At IR+M, we looked beyond the recent headlines covering the Single-Family Rental (SFR) market. There has been significant criticism of the intention and influence of the major institutional owners of these rental properties. SFR owners are accused of creating obstacles for would-be first-time home buyers through home price inflation and all-cash offers. In addition, the shift in local communities away from homeowners to more renters has been portrayed negatively. We took a deep dive into SFR owners, their various practices, and their holistic impact on communities, applying an ESG lens to determine the material issues and assess the ESG Leaders and Laggards within the space. We engaged with a majority of SFR operators on material ESG issues and gained additional insights into complex risks and opportunities not otherwise captured in traditional research or ratings.

Single-Family Rental 101

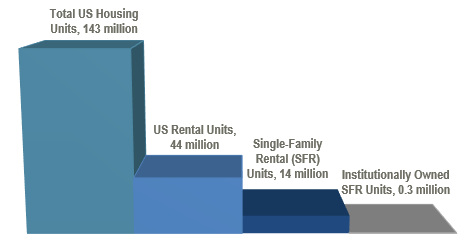

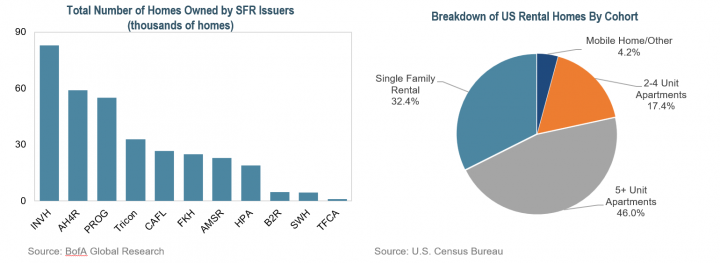

The Single-Family Rental (SFR) market emerged after the Great Financial Crisis, as institutional buyers purchased portfolios of single-family homes out of foreclosure. The homes, largely concentrated in the southeast and southwest United States, were updated and put on the market to rent. SFR operators have proven that this model is a viable business and have grown their portfolios over the last 10 years; however, institutions own less than 2% of single-family homes available for rent. Most single-family rentals are small “mom and pop” investors, who typically own only a handful of properties. On the institutional side, several SFR REITs issue debt in the public bond market and SFR securitizations are a growing part of the CMBS market.

SFR securitizations are deals collateralized by thousands of single-family rental properties, primarily backed by a single loan. Deals typically consist of A-F tranches that pay sequentially as rent is collected from underlying properties. Since 2019, they are almost exclusively fixed rate. The SFR CMBS market totals over $25 billion and continues to grow, with $12-14 billion of new issuance expected in 2022.

SFR Engagement 2022

- We held engagement calls with eight of the larger SFR operators who comprise a majority of the market and asked the same series of questions on each call. We also tailored additional questions to specific issues related to each operator.

- Our questions spanned all three ESG pillars, while focusing on social themes.

- We covered topical issues including eviction rates and policies, maintenance costs and responsibilities, successful applicant profiles compared to the entire applicant pool, community involvement, and environmentally-focused housing upgrades.

- We participated in one operator’s inaugural fixed income investor day, attending property tours in a large metro area and hearing from senior leaders regarding their investment decisions, property maintenance, and residential support.

IR+M’s SFR Assessment

- Credit. We currently view the SFR market favorably given the positive supply and demand dynamics that provide principal protection and stable cash flows. Several long-term tailwinds benefit fundamentals, including aging millennials forming households, greater consumer acceptance of renting a home, and problematic home ownership affordability, along with a housing shortage. We see additional room for growth within the rental market, particularly as mortgage rates rise and home prices become less affordable. Additionally, the institutional SFR owners are large, programmatic issuers with solid track records.

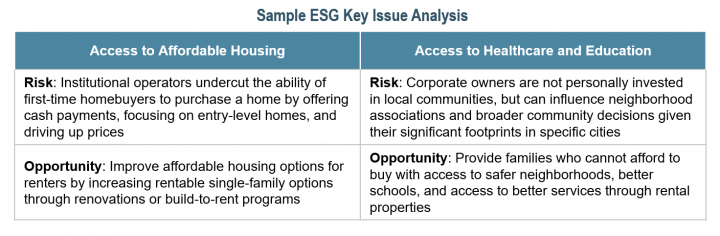

- ESG. The media often paints a one-sided picture of this business. However, as with most ESG analysis, the truth is nuanced; multiple perspectives are needed to view key issues and make assessments at a more granular issuer level. We look at a variety of key ESG factors relevant to this sector, including access to affordable housing and community relations, along with the implications of providing better educational opportunities and reducing inequalities. Overall, while we acknowledge the headlines and risks, we do not find the sector to be severely lagging from an ESG perspective and tier specific issuers across our ESG ratings spectrum.

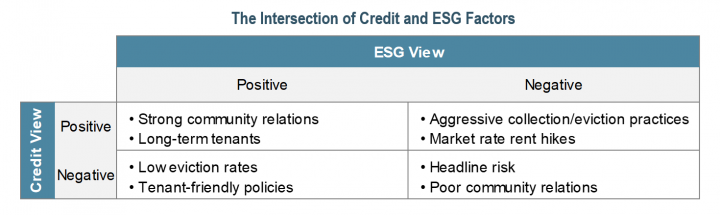

- The Intersection of Credit and ESG. Many of the material ESG issues assessed within the SFR space help to inform our credit view. For example, the SFR operator’s relationship with local communities is key to preserving their access to specific neighborhoods and municipalities. Their brand within these communities as well as their treatment of their tenants and the maintenance of the homes is paramount to their success. Homeowner Association (HOA) rules and local laws can be easy levers to pull to make it more difficult for SFR owners to do business in their communities, which would clearly be detrimental to the credit.

- Some of the more positive ESG attributes within the sector may appear to contradict typical credit metrics. For example, more lenient eviction policies may result in less cashflow to support outstanding debt expenses. However, our conversations with the operators confirmed that rent relief programs are manageable while affording the operators a better reputation within the tenant community. Additionally, their larger balance sheets allow them flexibility to provide this leniency while still maintaining a profitable business model.

SFR: IR+M’s Engagement Findings

- ESG is a relatively new focus. Many of the operators recently hired ESG-focused employees and released – or plan to release – their first ESG or Corporate Sustainability reports. Some operators indicated that this was their first engagement call focused on ESG.

- Data is not always available. The operators discussed the difficulty in obtaining data, specifically around some of the environmental metrics. In other cases, the operators choose not to disclose data, like their eviction numbers and policies. As SFR operators’ ESG efforts grow, we expect data availability and reliability to continue to improve.

- SFR properties are geographically concentrated in the Sunbelt. SFR operators acknowledged that their top markets typically have more landlord-friendly regulations but insisted that they target areas with high population growth and reasonable opportunity for home price appreciation.

- SFR operators are incentivized to keep renters in their homes. Avoiding turnover, interim vacancies, and maintenance issues helps build and maintain a stronger pipeline of customers, which is critical to their business model.

ESG Highlights

Our ESG Assessment

- Environmental. While there are some environmental benefits from housing upgrades, such as refurbished heating systems, new appliances, and smart home technology, this did not seem to be a major focus for the SFR operators. Data availability continues to be a struggle, and granular metrics at the renter/property level are difficult to measure. We view this as an area of opportunity for SFR operators.

- Social. SFR operators often help to provide a more spacious home with a yard in neighborhoods with access to better schools and services. Their renters are typically priced-out of the housing market; some SFR operators provide a rent-to-buy program. The impact on other potential first-time homebuyers cannot be ignored, particularly with the concentration in certain cities causing real pressure on the housing market. However, many of the SFR operators are helping to improve neighborhoods while also creating jobs for maintenance, construction, and property managers.

- Governance. Management and oversight of the SFR operator’s partners, specifically focused on some of the more operational aspects of the business, are a key governance factor. This is important for the efficiency of the business but also plays into their reputational risks, particularly as the media focuses on items like the timeliness of addressing maintenance issues and ensuring tenants’ needs are addressed.

We believe that analyzing material ESG factors is part of conducting good credit work. From a fundamental investment point of view, we favor the SFR business model. The underlying rental income provides solid cash flow, with some built-in inflation protection. If home price appreciation is positive, the underlying asset value increases. If housing is weak, it is typically due to a softer economy, in which case there would be fewer home buyers and more rental demand.

From an ESG perspective, we view the SFR sector as “ESG Neutral” on our three-point ESG ranking system (Leader, Neutral, Laggard). We dig into the specific issuers to provide a name-by-name analysis of the material ESG factors and ultimately assign an ESG rank for each issue. Many of these ESG factors are material inputs to our credit view and inform our assessment and portfolio construction process. Within our ESG-specific mandates, the SFR operators we deem as ESG Leaders can be emphasized and the ESG Laggards are avoided.

Despite the recent media attention and negative portrayal, our deep dive with SFR owners found that there’s more to consider when making an assessment. While there are favorable credit aspects of the issuers, we also believe that many deals are applicable for our ESG-specific mandates. We continue to engage in dialogue with the SFR owners to ensure that we are assessing the credits holistically.