As the dust settles on a year that changed the world, and a January marked by an insurrection and inauguration, we believe stability is returning to Washington and the US bond market. With vaccines being distributed across the country, there is reason for optimism. Many corporate balance sheets are flush with cash after 2020’s record-setting issuance. The Federal Reserve (Fed) has assured markets that it will not abruptly taper asset purchases. Moreover, the President’s nearly $2 trillion stimulus package could be an economic lifeline. While spreads are tight and pandemic fatigue is high, we believe there are pockets of opportunity for discerning investors.

A HEAVY DOSE OF HOPE

- Is the pandemic nearing its end? It may sound hyperbolic, but vaccines may have the power to cure many of our ills in 2021. Over 43 million doses of COVID-19 vaccines have been administered to date, each one bringing us a little closer to normalcy. The new administration’s proposed rescue package and the Fed’s backstop may allow the economy to recover while enough vaccines are administered for economic activity to resume.

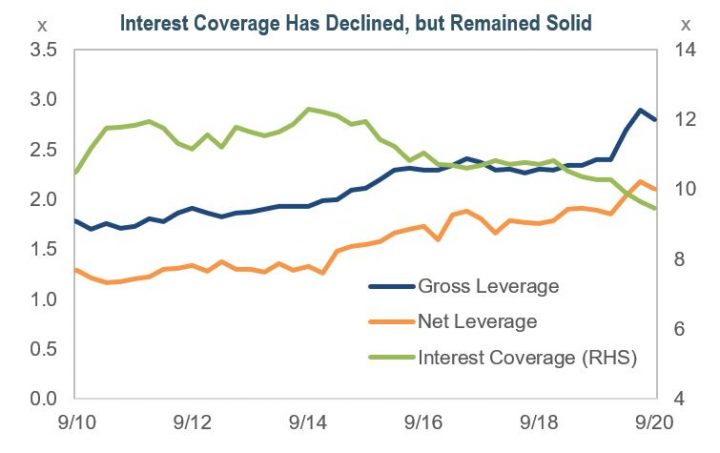

- How the crisis hit the US bond market. With corporate bond issuance exceeding a record $1.7 trillion in 2020, companies’ debt and cash positions have ballooned. While corporate leverage is at its highest level in nearly 30 years, interest coverage remains robust at 9.5x versus its 10-year average of over 11x. The good news is that companies are sitting on a significant amount of cash – an at least 17-year zenith of $1.3 trillion. This cash provides corporations with flexibility, and may be used for debt repayment, share purchases, or mergers and acquisitions.

- But things are looking up. Earnings estimates have been increasingly optimistic for the fourth quarter of 2020. Quarterly results are now expected to rise 1.7% YoY, compared to a previous estimated decline of 9.3%. For 2021, earnings are anticipated to rebound 21% for the first quarter and 23.4% for the full year. As corporate fundamentals strengthen, companies will likely rely less on the bond market for capital, especially as the economy recovers. For 2021, supply is expected to moderate to an estimated $1.1 trillion to $1.3 trillion – a positive technical for investors.

- Not all junk is trash. March’s massive spread widening was followed by a spate of companies falling to high yield. High-yield spreads peaked at 1,099bps in March before receding to 359bps by year end, reflecting the view that not all high yield bonds should be treated as such. We feel that some of the newest residents of junk land were fundamentally sound companies with solid balance sheets and resources, such as Kraft Heinz. Fallen angels outperformed the broad high yield index for the month of December and all of 2020 by 0.72% and 7.9%, respectively. We believe that experienced security selectors can find the gems hidden among the garbage.

On the Outside Looking In

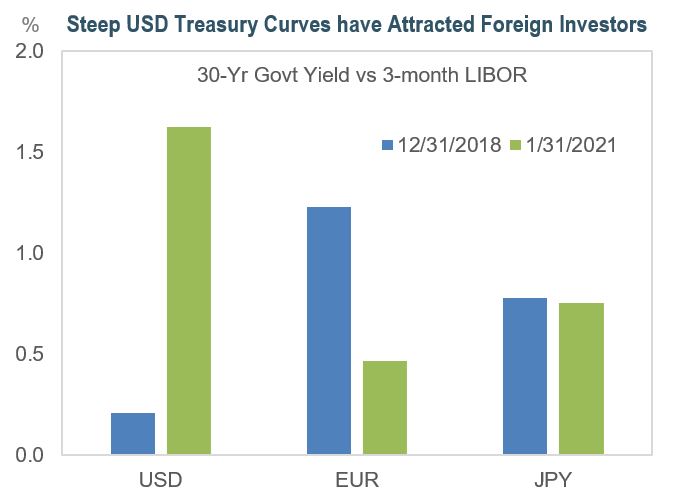

- International appeal. The decline of short-term Treasury yields, and the steepening of the yield curve, have been particularly attractive to international investors that hedge their US bond purchases. LIBOR’s continued march lower has reduced currency-hedging costs, which are driven by interest-rate differentials between two currencies. With the Fed committed to keeping short-term rates near zero, foreign demand for US corporate bonds is expected to remain elevated.

- The Fed’s role in the pandemic narrative. The Fed, which exists to promote a strong US economy, remains an ever-present backstop and unusually accommodative. The Fed confirmed that it will keep its benchmark short-term rate near zero through mid-2023, which will help the economy withstand recovery threats. The Fed also intends to continue monthly purchases of at least $80 billion in Treasuries and $40 billion in mortgage-backed securities “until further progress has been made” towards maximum employment and price stability objectives. These asset purchases should help facilitate market function and financial stability, as well as the flow of credit to households and businesses.

On the Horizon

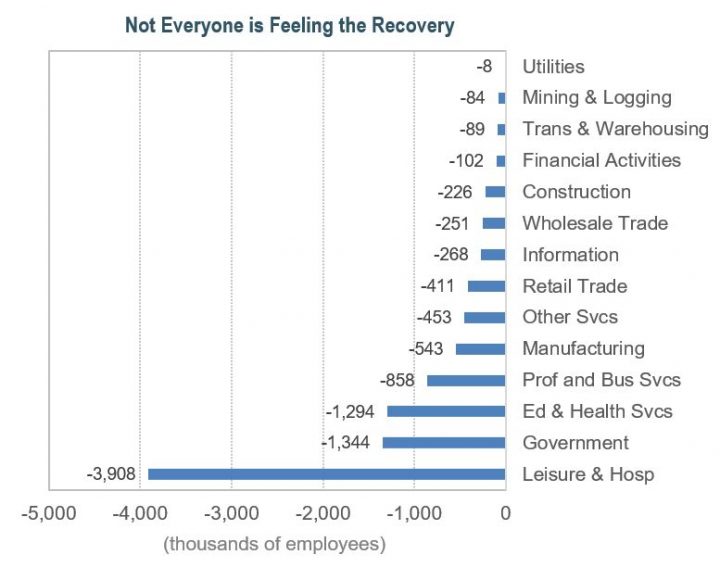

- K is for recovery. There has been extensive debate over what type of economic recovery we are experiencing – V, U, W, L, or K. A K-shaped recovery is perhaps the most accurate descriptor, given the sharp recession that accompanied the pandemic and the uneven recovery that has followed. Certain segments of the population and industries have rebounded quickly and completely, while others, such as leisure and hospitality, continue to suffer.

- Green means go. In 2020, the US green bond market totaled $28 billion in issuance, increasing 21% YoY. Social and sustainability bond issuance exceeded $17 billion, compared to just over $1 billion in 2019. Issuance is likely to rise in 2021, given President Biden’s sweeping actions on climate change. The Biden administration also intends to review the Department of Labor rule that precludes ERISA plan fiduciaries from investing in non-pecuniary vehicles that sacrifice investment returns. We believe that ESG criteria are pecuniary, and that securities with positive ESG attributes should be eligible investments for these plans.

TAKING WHAT THE MARKET GIVES US

- Where we are at IR+M… After marginally reducing our risk exposure at the end of 2020, we believe we are well positioned for 2021. While the Fed, market technicals, and low rates continue to support spread product, we do not foresee much tightening in most sectors.

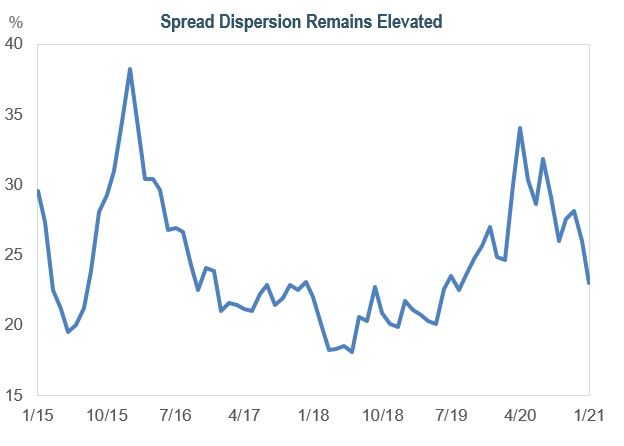

- We do believe that there are pockets of opportunity. Spread dispersion, which hit a 10-year low of 18% at the cycle tights in March 2018, spiked to 34% in April 2020 before settling at 23% in January 2021. With spreads at such tight levels, this is a signal that some sectors’ yields have yet to compress. These sectors have been disproportionately affected by the pandemic, and still offer value.

- …and how we got there. We believe that our performance will be driven more by opportunistic trades and not by significant shifts in exposures. Overall, technicals remain robust due to $17 trillion in negative-yielding debt globally and more typical supply expectations. In our Core strategy, we remain slightly overweight credit. We have moderated this overweight since May 2020, rotating out of credit and into historically less-volatile securitized. We are focused on commercial mortgage-backed securities, particularly seasoned bonds with high-levels of credit support and diverse collateral. We also favor agency mortgage-backed securities, which are supported by the Fed and have ample liquidity.

What We Should be Talking About…

- The Reddit Rebellion possibly affecting the US corporate bond market.

- Investors’ quests for higher yields leading some to overreach and overcomplicate their portfolios.

- Inflation making a run at the Fed’s 2% target in 2021.

- Credit deals posing as securitized deals.

- The future of taxable municipal issuance after 2020’s dramatic increase.

For thirty-four years, together our team and clients have withstood bouts of extreme market volatility, recessions, and now a global pandemic. Through it all, we continue to rely on our experience as disciplined, bottom-up security selectors to uncover opportunities despite market dislocation. While we appreciate the challenges that are before us, we continue to believe that better days are ahead.