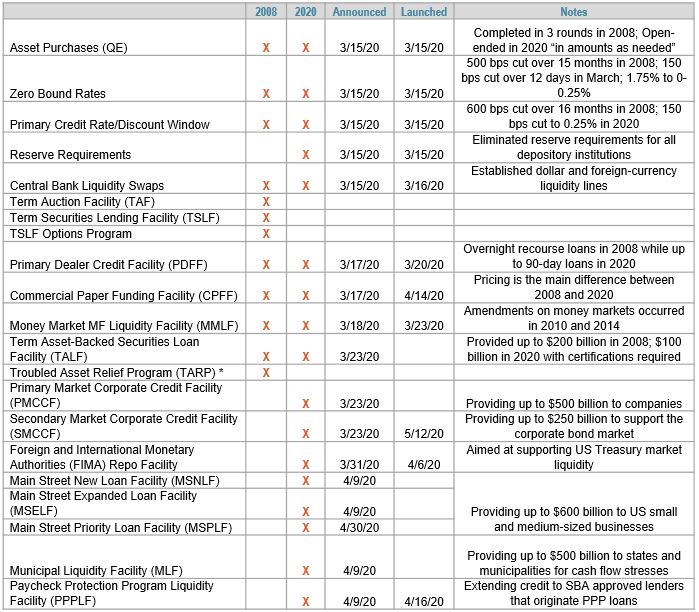

In response to a rapidly deteriorating global economy stemming from the COVID-19 outbreak, the Federal Reserve launched emergency lending programs that have not been used since the 2008 financial crisis. Details of these programs – which are intended to maintain the flow of credit to the US economy – are summarized in this piece. As new initiatives emerge, we will provide further updates.

CRISIS ERA COMPARISONS

* TARP was overseen by the U.S. Treasury. The program allowed up to $700 billion to be used to make loans and backstop credit markets, provide ongoing support to the housing market, and provide support to select industries and companies. While not directly overseen by the Federal Reserve, the Treasury consulted with the Fed to determine which securities to purchase.

FED FUNDS RATE

- Fed cut rates to 0.00-0.25% on the evening of March 15th after previously announcing a 50bps emergency cut on March 3rd

- Federal Open Market Committee (FOMC) statement: “The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals”

- The market expects the Fed to maintain rates near zero through the end of 2021

TIMELINE OF ACTIONS

Quantitative Easing (Round 4)

- Announced on March 15th, the Fed committed to purchasing up to $500 billion of Treasuries and $200 billion in agency mortgage-backed securities (MBS); all principal payments from the agency MBS sleeve will be reinvested

- Purchases were heavily front loaded, initially buying $40 billion/day (faster than previous QE programs), and on March 19th, they accelerated to $75 billion/day; the Fed was halfway through the purchase levels before their next announcement

- Announced on March 23rd, the Fed will now conduct open-ended QE “in amounts as needed” and also purchase agency commercial mortgage-backed securities (CMBS)

Reserve Requirements

- Announced on March 15th, reserve requirement ratios have been reduced to 0% effective on March 26th (the beginning of the next reserve maintenance period)

- FOMC had shifted to an ample reserves regime in January 2019

- Purpose is to eliminate the reserve requirements for thousands of depository institutions and will help to support lending to households and businesses

Discount Window

- Provides access to funding for depository institutions and plays a vital role in supporting liquidity and stability of the banking system; encourages more active use by depository institutions to meet unexpected funding needs

- Announced on March 15th, the Fed lowered the primary credit rate, which was previously 175bps; 100bps reduction reflects the reduction in the target fed funds rate and the 50bps narrowing in the primary credit rate relative to the top of the target range

Commercial Paper Funding Facility (CPFF)

- Originally announced on March 17th and revised on March 23rd to support the flow of credit to households and businesses and allows companies to raise new cash directly from the Fed; operations began on April 14th

- Structured as a credit facility to a special purpose vehicle (SPV) which will serve as a funding backstop to facilitate term commercial paper issuance

- Eligible issuers: US issuers of commercial paper, including municipal issuers and US issuers with a foreign parent company

- Loans will be made by the New York Fed and on a recourse basis

- The Treasury, using the Exchange Stabilization Fund (ESF), will provide $10 billion of credit protection

- Pricing will be based on the then-current 3-month OIS + 110bps on A1/P1; the then-current-3 month OIS rate + 200bps on A2/P2

- Purchases will cease on March 17, 2021 unless the Fed extends it; the Fed will continue to fund the SPV until the underlying assets mature

Primary Dealer Credit Facility (PDCF)

- Announced on March 17th to allow primary dealers to borrow cash from the Fed for up to 90 days in exchange for offering up collateral in order to support the smooth market functioning and facilitate the availability of credit to businesses and households; operations began on March 20th

- Acceptable collateral: Open market operation eligible collateral (Treasuries, agency MBS, agency debt), investment grade (IG) corporate debt, international agency securities, commercial paper, municipals, MBS, asset-backed securities (ABS), and equities

- Equity exchanged traded funds (ETFs), mutual funds, unit investment trusts, rights and warrants are not eligible

- Foreign currency-denominated securities are not eligible at this time

- Rate: Offered at 25bps (equal to the primary credit rate of the Discount Window)

- Duration: Started on March 20th and in place for at least 6 months; the Fed may extend this as conditions warrant

- Borrower eligibility: Only primary dealers of the New York Fed are eligible to participate

- Borrowers may prepay loans at any time

Money Market Mutual Fund Liquidity Facility (MMLF)

- Originally announced on March 18th and revised on March 20th and 23rd to enable fund managers to sell assets back to intermediaries and raise cash through September 30, 2020 (this could be extended by the Fed); operations began on March 23rd

- Fed Reserve Bank of Boston will make loans available to eligible financial institutions secured by high-quality assets to meet redemptions by households and other investors

- The MMMF must be a fund that identifies itself as a Prime, Single State or Other Tax Exempt money market fund

- Eligible collateral: Treasuries, US Government Sponsored Entities, asset-backed commercial paper, unsecured commercial paper, negotiable certificate of deposit, short-term municipal debt (maturities not exceeding 12 months) rated in the top short-term rating category by at least two of the major rating agencies, variable rate demand note (VRDN)

- All US depository institutions are allowed to participate

- Loans are non-recourse and borrowers under the MMLF will bear no credit risk

- The Treasury, using the ESF, will provide $10 billion as credit protection

- Money market mutual funds were a critical weak spot during the GFC in September 2008 when Lehman’s collapse caused the Reserve Primary Fund to break the one dollar NAV mark; this event became known as “breaking the buck”

Central Bank Liquidity Swaps

- Fed coordinated with five other central banks to make sure USD was available around the world to provide liquidity – Canada, England, Japan, ECB, and Switzerland; on March 15th, these central banks agreed to extend their swap terms to 84 days

- On March 19th, the Fed extended a temporary swap line with other central banks – Australia, Brazil, Denmark, Korea, Mexico, Norway, New Zealand, Singapore, and Sweden – in order to swap their currencies for dollars from the Fed to provide liquidity

- Up to $60 billion for Australia, Brazil, Korea, Mexico, Singapore, and Korea; up to $30 billion for Denmark, Norway, and New Zealand; these arrangements will be in place for at least 6 months

- During the GFC, 14 central banks participated, including Brazil and New Zealand

Term Asset-Backed Securities Loan Facility (TALF)

- Originally announced on March 23rd and revised on April 9th and May 12th to enable the issuance of ABS backed by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration (SBA) and other eligible loans; size of Facility will be up to $100 billion

- Eligible loans: Auto loan and lease, student loans, credit card receivables, equipment loans and leases, floorplan loans, insurance premium finance loans, certain small business loans that are guaranteed by the SBA, leveraged loans (CLOs), outstanding CMBS

- ABS must be issued on or after March 23rd to be eligible except for CMBS

- Underlying exposures for CMBS must be to real property located in the US or one of its territories

- SBA Pool Certificates or Development Company Participation Certificates must be issued on or after January 1, 2019

- Loan terms are 3 years and non-recourse, provided the TALF requirements are met

- Loan amount will be equal to the collateral market value less a haircut (will be roughly in line with the haircut schedule used in 2008)

- Rates:

- CLOs – 30-day average secured overnight financing rate (SOFR) + 150bps

- SBA Pool Certs – top of fed funds rate + 75bps

- SBA Development Company Participation Certs – 3-yr fed funds overnight index swap (OIS) + 75bps

- All other eligible ABS – weighted avg. life < 2 yrs. – 2-yr OIS + 125 bps; weighted avg. life of 2+ yrs. – 3-yr OIS + 125 bps

- Loans will be pre-payable in whole or in part, but issuers are not allowed to substitute collateral during the loan term

- Borrower must certify that it was unable to secure adequate funding from other banking institutions and that it is not insolvent

- The Treasury, using the ESF, will fund the SPV with a $10 billion equity investment

- Purchases will cease on September 30, 2020 unless the Fed and the Treasury extend it

Primary Market Corporate Credit Facility (PMCCF)

- Originally announced on March 23rd and revised on April 9th to allow for new bond and loan issuance in the primary market and businesses to maintain operations and capacity during the pandemic; the combined size of PMCCF and SMCCF will be up to $750 billion with $500 billion for PMCCF

- Issuer must be rated a minimum of BBB-/Baa3 as of March 22nd by at least two agencies, subject to Fed’s review; the Fed will also purchase bonds from fallen angels and syndicated loans

- Eligible fallen angels: issuers that were downgraded after March 22nd must be rated a minimum of BB-/Ba3 by at least two agencies

- May purchase no more than 25% of any loan syndication or bond issuance

- Issuer limits: may approach the Facility to refinance outstanding debt 3 months ahead of the maturity debt; may also approach the Facility to issue additional debt provided rating is reaffirmed at BB-/Ba3

- Maximum issuer amount is capped at 1.5% of the combined potential size of PMCCF and SMCCF

- Bonds issued by insured depository institutions or depository holding companies (under terms defined in Dodd-Frank) are not eligible

- Maturities will be 4 years or less

- Companies must have been created or organized in the US or under the laws of the US with significant operations in and a majority of its employees based in the US

- Companies expected to receive direct financial assistance under the CARES Act or any subsequent legislation are not eligible

- The Treasury, using the ESF and funds from the CARES Act, will fund the SPV with a $50 billion equity investment

- Purchases will cease on September 30, 2020 unless the Fed and the Treasury extend it; the NY Fed will continue to fund the Facility until assets mature or are sold

Secondary Market Corporate Credit Facility (SMCCF)

- Originally announced on March 23rd and revised on April 9th to provide liquidity for outstanding corporate bonds in the secondary market; the combined size of PMCCF and SMCCF will be up to $750 billion with $250 billion for SMCCF; ETF purchases began on May 12th

- Fed will purchase corporate bonds issued by US investment grade (IG) companies (rated at least BBB-/Baa3) with a remaining maturity of 5 years or less as well as US ETFs in the high yield (HY) and IG markets

- Issuer must be rated a minimum of BBB-/Baa3 as of March 22nd by at least two agencies, subject to Fed’s review; the Fed will also purchase outstanding bonds from fallen angels

- Eligible fallen angels: issuers that were downgraded after March 22nd must be rated a minimum of BB-/Ba3 by at least two agencies

- Issuer limits: secondary bond purchases are capped at 10% of issuer’s maximum bond outstanding from March 22, 2019 – March 22, 2020; maximum issuer amount is capped at 1.5% of the combined potential size of PMCCF and SMCCF

- ETF limits: capped at 20% of ETF’s outstanding shares

- Bonds issued by insured depository institutions or depository holding companies (under terms defined in Dodd-Frank) are not eligible

- Maturities will be 5 years or less

- Floating-rate debt priced off LIBOR are eligible

- The Treasury, using the ESF and funds from the CARES Act, will fund the SPV with a $25 billion equity investment

- Purchases will cease on September 30, 2020 unless the Fed and the Treasury extend it; the NY Fed will continue to fund the Facility until holdings either mature or are sold

Foreign and International Monetary Authorities (FIMA) Repo Facility

- Announced on March 31st to help support the smooth functioning of financial markets, including the US Treasury market, caused by financial stresses abroad

- Purpose is to alleviate Treasury market dislocations and upward pressure on yields by allowing foreign central banks to raise US dollars quickly without selling their Treasury securities outright and into illiquid markets

- Central banks will sell their Treasuries to the Fed’s Open Market Account and agree to buy them back at the repurchase agreement’s maturity

- Transactions will occur exclusively in US dollars so the Fed will not be exposed to exchange rate risk

- Terms: Overnight at a rate of 25bps over the rate on IOER (Interest on Excess Reserves)

- The rate above generally exceeds private repo rates when the Treasury market is functioning well

- Overnight term can be rolled over as needed

- Fed must approve applications from FIMA account holders in order to utilize the Facility

- Available on April 6th and will continue for at least 6 months

Municipal Liquidity Facility

- Originally announced on April 9th and revised on April 27th and June 3rd to help state and local governments manage cash flow pressures in order to continue to serve households and businesses in their communities; size of Facility will be up to $500 billion

- Eligible issuers: state (including DC), city (> 250,000 residents), county (> 500,000 residents) and certain multistate entities subject to review and approval; the Fed lowered population requirements to allow for more entities to borrow from the Facility

- Changes in population size as reflected in future US Census Bureau releases will not affect eligible issuers

- One issuer per state/city/county are eligible; however, the Fed may approve one or more additional issuers

- Multistate entities – an entity that was created by a compact between two or more states approved by Congress, acting pursuant to its power under the Compact Clause of the US Constitution

- Governors and the Mayor of DC will be allowed to designate two issuers whose revenues are derived from operating activities subject to certain limits

- Fed will purchase short-term notes that mature no later than 3 years from issuance date

- Eligible notes: tax anticipation notes (TANs), tax and revenue anticipation notes (TRANs), bond issuance notes (BANs), and other similar short-term notes

- Eligibility will be subject to Fed review; relevant legal opinions and disclosures will be requested as determined by the Fed prior to purchase

- SPV will purchase notes directly from eligible issuers at time of issuance (no secondary market purchases)

- Eligible issuers must have an IG rating as of April 8th from at least two major rating agencies

- City/State/County – a minimum of BBB-/Baa3; if the issuer was subsequently downgraded, it must be rated a minimum of BB-/Ba3 by two of the three agencies

- Multistate Entity – a minimum of A-/A3; if the issuer was subsequently downgraded, it must be rated a minimum of BBB-/Baa3 by two of the three agencies

- Limits on purchase amounts: up to aggregate amount of 20% of general revenue from own sources and utility revenue for FY2017 for city/state/county; 20% of gross FY2019 revenues for multistate entities

- Use of proceeds: manage cash flow impact from income tax deferrals, tax/revenue impact or increased expenses related to COVID-19, payment of debt on existing obligations, or purchase similar notes issued by/assist political sub-divisions or other government entities (must be solvent) for purposes listed above

- Issuer may issue taxable or tax-exempt eligible notes

- Written certification will be required and issuer must attest that it was unable to secure funding through other avenues and that it is not insolvent

- Bonds are callable at par by issuer at any time, in whole or in part

- Issuers that participate will pay an origination fee of 10bps; the fee may be paid from issuance proceeds

- The Treasury, using the ESF and funds from the CARES Act, will fund the SPV with a $35 billion equity investment

- Purchases will cease on December 31, 2020 unless the Fed and the Treasury extend it; the Fed will continue to fund the SPV until the underlying assets mature or are sold

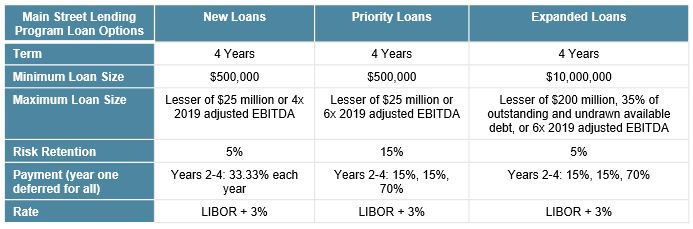

Main Street New Loan Facility (MSNLF), Main Street Expanded Loan Facility (MSELF), and Main Street Priority Loan Facility (MSPLF)

- Originally announced on April 9th and revised on April 30th to provide support for small and mid-sized businesses that were in good-standing before the pandemic; combined size will be up to $600 billion

- Terms: 4-year loans to US companies employing up to 15,000 workers or up to $5 billion in 2019 annual revenues

- Businesses created, organized, or under US laws with significant operations in and majority of employees based in US

- Borrowers can only participate in one of these facilities; must also not be involved in PMCCF

- Lenders that participate must be US banks, savings & loan companies, or insured depository institutions; the SPV will pay 25bps of the principal amount to the Lender under all Facilities

- Eligible loans must be originated after April 24th for all Facilities

- New Loan: secured or unsecured

- Expanded Loan: unsecured or secured at either time of origination or at the time of upsizing

- Priority Loan: secured or unsecured

- Prepayments are permitted without penalty

- Amortization of principal and interest are deferred for one year

- Borrower requirements: Businesses must make reasonable efforts to maintain payroll and retain its employees during the loan term; loans must not be used to repay other loan balances; may not seek to cancel or reduce outstanding debt; and must follow the compensation, stock buybacks, and dividend payments allowed under the CARES Act

- Lender requirements: Lenders must attest that the proceeds of the loan will not be used to repay or refinance existing debt and that it will not seek to cancel or reduce existing debt

- Certifications will be required from both borrowers and lenders attesting that the entity is eligible to participate

- A facility fee will be in place for loans extended under the New Loan and Priority Loan Facilities whereby the lender will pay the SPV a fee of 100bps of the principal amount; the Lender may require the Borrower to pay this fee

- Loans extended under the Expanded Loan Facility will pay the SPV a fee of 75bps of the principal amount of the upsized tranche

- The Treasury, using the ESF and funds appropriated from the CARES Act, will make a $75 billion equity investment

- Purchases will cease on September 30, 2020 unless the Fed and the Treasury extend them; the Fed will continue to fund the SPV until underlying assets mature or are sold

Paycheck Protection Program Lending Facility (PPPLF)

- Originally announced on April 9th and revised on April 30th to bolster the effectiveness of the SBA’s Paycheck Protection Program (PPP); the program provides loans to small businesses in order to keep their workers on payroll

- Eligible borrowers: all PPP lenders approved by the SBA, including non-depository institution lenders

- Maturity: extension of credit under the Facility will be equal to the maturity of the underlying loan; will be accelerated if the loan goes into default and the borrower sells the loan to the SBA

- Rate: 35bps

- Lending on non-recourses basis, using PPP loans as collateral; the Fed will require documentation from the SBA demonstrating that the pledging institution is the beneficiary of the SBA guarantee for the loan

- Purchases will cease on September 30, 2020 unless the Fed and the Treasury extend it

Promise for Transparency

- On April 23rd, the Fed announced that it would provide extensive and timely public information regarding its programs that were launched using funds from the CARES Act. Information will be released every 30 days without redactions on its website and include:

- Names and details of participants in each facility

- Amounts borrowed and interest rate charged; and

- Overall costs, revenues, and fees for each facility

- Disclosures will apply for the Main Street Lending Facilities (New Loan, Priority Loan, and Expanded Loan), Paycheck Protection Program Lending Facility, Municipal Liquidity Facility, Primary Market Corporate Credit Facility, and Secondary Market Corporate Credit Facility

- On May 12th, the Fed stated it will also release information on borrowers for TALF and the Paycheck Protection Program Liquidity Facility in the same manner as the programs listed above

Bank Actions and Regulations

- US Banks had temporarily suspended buybacks through Q2 2020 and the Fed is encouraging banks to drawdown on their Capital Conservation Buffer

- Since GFC, banks have built up $1.3 trillion in common equity and $2.9 trillion in high quality assets

- Banks met with the Fed on March 22nd to press the central bank to ensure promises not to sanction those who run down their liquidity buffers to aid the economy; also explored ways to boost lending without taking on too much risk

- Announced on April 1st, the Fed temporarily will exclude US Treasury securities and deposits from the supplementary leverage ratio (SLR); this temporary change will be in place until March 31, 2021

- The SLR is calculated by dividing a bank’s Tier 1 capital by its total leverage exposure; for banks with more than $250 billion in consolidated assets, they were to hold a minimum of 3%; more stringent requirements were in place for the largest and most systemic financial institutions

- The change temporarily decreases Tier 1 capital requirements by approximately 2% in aggregate

- By easing this regulatory restriction, the Fed is allowing banks to expand their balance sheets as appropriate to continue to serve as financial intermediaries in the Treasury market and to provide credit to households and businesses in support of the economy