As an actuary at IR+M, I always cringe when I see falling rates. When interest rates decrease, pension liabilities go up, translating into a drag on funded statuses and potentially higher cash contributions for underhedged pensions. Records were broken at the end of July, with 10-year Treasuries at 0.53% and the FTSE pension liability index at 2.31%. Despite the rate rise in August, discount rates used for valuing pension plans are still down around 50bps year-to-date. But there is a possible silver lining. This may be an opportunity for sponsors to issue debt at low financing rates to fund up their pensions.

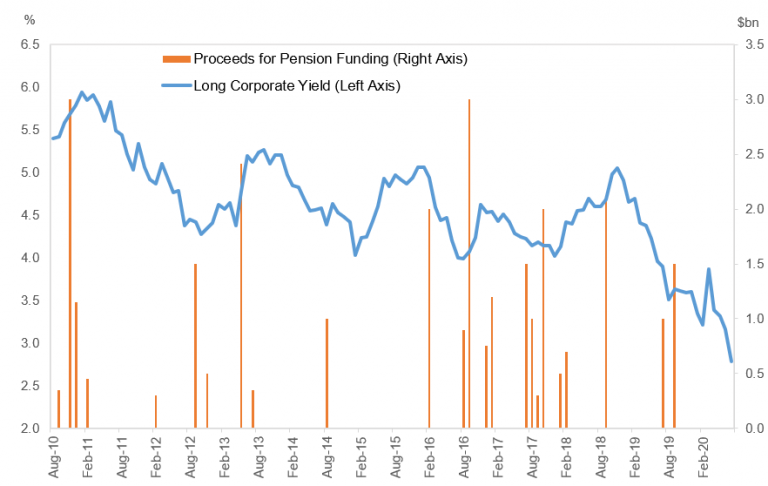

Borrow-to-fund is analogous to exchanging a floating pension debt (subject to a high-quality corporate discount rate) for a fixed-rate bond. The concept has become more widely accepted in recent years, and in our experience, rating agencies consider it a credit neutral to credit positive event. Historically, we have seen heightened borrow-to-fund activity in interest-rate troughs. The chart below shows long corporate yields versus the total amount of debt issued where the entire proceeds were used for pension funding. The latest deals occurred in Q3 2019, when Caterpillar issued $1.5 billion and FedEx issued $1 billion. Please note, though, that this is just a subset of total deals, and does not capture any debt issuance where only part of the proceeds was used for pension funding.

In addition to limiting interest-rate risk, there are tangible dollar savings possible, primarily as they relate to PBGC premiums. PBGC premiums have sky-rocketed in recent years and, anecdotally, have been a leading cause of pension risk transfer activity among our clients. In particular, the variable-rate portion of PBGC premiums is determined as a percentage of the unfunded liability. The variable rate has just about quintupled in the past seven years – from 0.9% in 2013 to 4.5% in 2020. This compares favorably to long corporate bond yields, which are hovering around 3%. If I can just hop on my actuary soapbox for a moment, these premium increases are not being driven by a PBGC deficit. In fact, the PBGC has projected that their Single-Employer Program will be solvent for at least the next 10 years (the maximum forecast period they use). Despite this, Congress has used PBGC premiums as a means to balance the budget twice – in 2005 and 2015. PBGC premiums cannot be used except for the sole purpose of rescuing distressed pensions, but these levels of premiums are a significant cost deterrent and, in my opinion, accelerating the demise of pensions.

And back to the matter at hand, with borrow-to-fund, there is also the chance for tax benefits. First, contributions to pension plans are entirely tax-deductible when made. Second, interest payments on bonds are deductible, but only as accrued. The magnitude of these savings may be difficult to predict, with the November elections around the corner, and near-term corporate tax rates up for debate.

Some sponsors may seek to issue enough debt to terminate the entire plan with an insurer. While the sponsor would retain the fixed-rate debt (at current low rates) on the balance sheet, all associated costs (e.g., investment, actuarial, legal, audit) with maintaining the plan would be eliminated. However, more likely, the proceeds would only partially close any pension deficits. In response to the funded status improvement, we suggest investing the proceeds in Liability Driven Investing (LDI) strategies. LDI can provide future downside protection against interest and market volatility as sponsors progress towards their desired end state. As you consider whether borrow-to-fund is appropriate for your plan, we are always available as a resource, and welcome the opportunity to discuss further.