The current environment, which is characterized by exceedingly low interest rates, may cause clients to reevaluate their cash management programs. Investors are increasingly turning to substitutes for traditional cash vehicles, and may be inadvertently sacrificing liquidity – or raising credit risk – for return potential. We believe that prudent cash management is an important element to achieving long-term investment goals. At IR+M, we are a dedicated partner to our clients, and we seek to identify and implement solutions directed at accomplishing those goals.

When Preparation Meets Opportunity

- In response to the coronavirus pandemic and uncertainty around the globe, investors are reassessing their liquidity requirements, risk tolerance, and expected return potential.

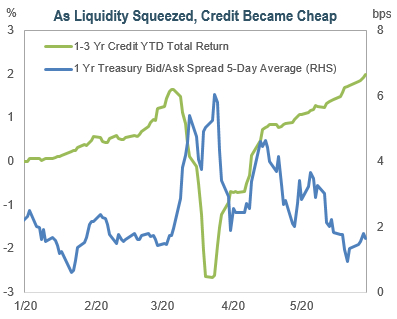

- During the volatility witnessed in March, investors with operating cash shortfalls faced vanishing liquidity, and some were forced to sell assets below their fair value. Even investments considered the most resilient, such as Treasuries, suffered a significant blow to their liquidity.

- Conversely, investors with ample liquidity were handed an opportunity to invest in high-quality assets at discounted prices. Being a liquidity provider in these times, and taking what the market gives you, can be a prudent allocation of capital.

- We believe that proper preparation – combined with disciplined investing – allows participants to take advantage of opportunity during market dislocations.

Using Tiers: Liquidity Versus Market Risk

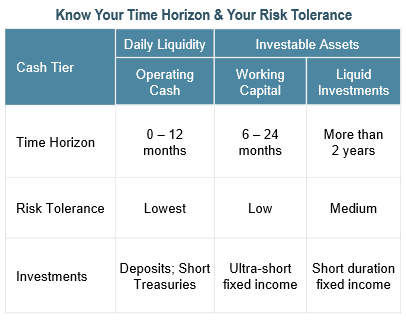

Optimizing a cash portfolio is an essential component for treasurers and investment committees. An effective strategy employs accurate forecasting for both operating cash and working capital, and a properly defined risk tolerance for investable assets.

Optimizing a cash portfolio is an essential component for treasurers and investment committees. An effective strategy employs accurate forecasting for both operating cash and working capital, and a properly defined risk tolerance for investable assets.- Principal protection and liquidity are paramount when investing cash. Traditional vehicles for cash include deposit accounts and money market funds. However, low interest rates and financial regulation have reduced the attractiveness of these options.

- We believe that short-duration fixed income strategies are an attractive solution. These mandates may provide a boost to portfolio income while maintaining healthy liquidity and limiting downside risks.

Preserve Capital, Improve Returns

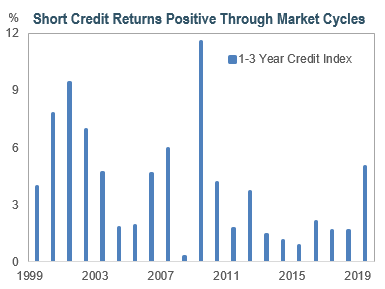

- An overarching concern of cash investors is the safety of their principal. Recently, some market participants have even signaled a willingness to pay for protection – with negative yields on risk-free US Treasuries.

- However, short-duration bonds provide additional yield over Treasuries and have a lengthy history of capital preservation. The 1-3 Year Credit Index has had positive annual returns in every year since 1998.

- Liquidity is also vital to investable cash and, as such, we tailor our portfolios to each client’s needs. In most cases, a Goldilocks approach is best – not too hot, and not too cold. We believe this means a diversified combination of liquidity, credit quality, and yield.

- Maintaining portfolio liquidity, through allocations to Treasuries and agency securities, may provide additional sources of cash during uncertainty, when revenues and other cash inflows cease. Alternatively, these allocations can be used as ‘dry powder’ when market dislocations produce attractive investment opportunities.

- Spread product, such as high-quality corporate and securitized sectors may increase income and improve overall portfolio diversification. Recently, many of these bonds received support from the Federal Reserve; we expect this to benefit the risk-return profile of short duration fixed-income strategies.

Staying Short But Seeking Yield

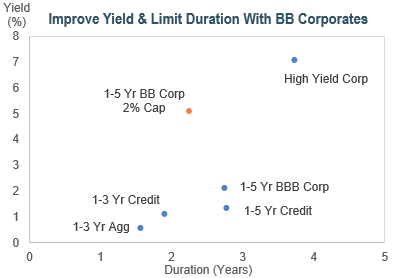

- For investors who are less regulated or have little need for cash on hand, an alternative to extending duration may be a short diversified income portfolio, increasing yield instead through credit exposure.

- These mandates opportunistically seek yield in shorter maturities rated BB or better, focusing on companies with stable credit profiles. Historically, short-duration BBs have higher risk-adjusted returns, and the addition of securitized bonds may diversify and dampen volatility of the portfolio.

- Additionally, these short-duration bonds exhibit lower interest rate sensitivity, roll down quickly, and are “self-liquidating” – improving portfolio liquidity and allowing for reinvestment.

Managing the balance between cash flow requirements and short-term investments can be laborious and risk-laden, with little compensation to show for it. Now may be an excellent time for an alternative to low-yielding deposit accounts and money market funds – short duration fixed income. At IR+M, we are committed to partnering with our clients and navigating this difficult environment together. We believe our bottom-up investment philosophy and risk management practices may ease the burden of cash management and improve investment results over the long term.