Extreme volatility has created dislocations across the fixed income markets. The municipal/Treasury ratio has moved from very rich to very cheap. At IR+M, we leverage our bottom-up security selection skills to search for inefficiently-priced taxable and tax-exempt bonds. Our crossover strategy may be an optimal solution for taxable investors looking to capitalize on these volatility-induced dislocations. In this piece, we assess the ever-changing after-tax relative value dynamic, and highlight why the case for crossover remains compelling.

WHY NOW? MUNIS ARE CHEAP, BUT SO ARE CORPORATES AND SECURITIZED

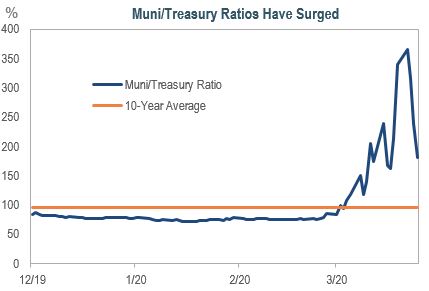

- The muni/Treasury ratio is a widely accepted gauge of the relative value of municipal bonds versus their taxable bond counterparts.

- Through February, municipals were relatively rich, reflecting high demand and lower supply. In March, that dynamic sharply reversed, and muni liquidity meaningfully declined. In response, muni/Treasury ratios rose to record-setting levels. Aided by the Federal Reserve’s (Fed) stimulus programs, liquidity has improved and ratios have tightened significantly — but not fully. We believe that ratios remain elevated due to redemptions ($25 billion over the past two weeks) and credit concerns over a longer-than-anticipated recession.

- We believe that there are attractively priced high quality corporate and securitized bonds. While placing a premium on liquidity and principal protection, we are repositioning our portfolio to capture this relative value and improve after-tax yield and return potential. Now may be an opportune time for investors to consider the additional benefits of a crossover strategy: higher after-tax yield, greater diversification, and nimble sector rotation.

Capitalizing on Market Dislocations: Higher After-Tax Yield

In March, investors’ flight to quality caused the average corporate bond spread to widen from a low of 130bps to a high of 400bps, before ending the month at approximately 300bps. Seemingly in the blink of an eye, value existed where there had been very little.

In March, investors’ flight to quality caused the average corporate bond spread to widen from a low of 130bps to a high of 400bps, before ending the month at approximately 300bps. Seemingly in the blink of an eye, value existed where there had been very little.- Many sectors – excluding Treasuries – experienced negative returns in March. To us, weak returns are a signal of broad and abundant opportunities across all fixed income sectors.

- Muni bonds are not always the most tax-efficient sector for investors in the highest tax bracket. While current tax-exempt yields are high, they are less compelling than other areas of fixed income, such as corporates.

- We believe that our dynamic crossover strategy is well-positioned to capitalize on these opportunities.

Unprecedented Times: The Fed to the Rescue

- The COVID-19 pandemic has brought the global economy to a halt, straining state and local budgets as businesses have closed and consumers stay at home. Income-tax and sales-tax revenues will likely decline, and with equity markets down more than 20% in the first quarter, capital gains receipts could follow.

- The Federal Reserve, using its playbook from the Great Financial Crisis, has unleashed numerous programs to support the US economy. In addition to its commitment to purchase unlimited amounts of Treasury and mortgage-backed securities, the Fed also has pledged to buy US investment grade (IG) corporate bonds with less than five years to maturity, US IG bond exchange-traded funds (ETFs), short-term municipal debt, and municipal variable rate demand notes (VRDNs).

- The CARES Act, a $2 trillion stimulus package passed by Congress, will provide $150 billion in direct aid to state and local governments. This fiscal policy, along with the Fed’s actions, may help address liquidity issues in the municipal market and mitigate default concerns.

IR+M Approach: Tax-Efficiency

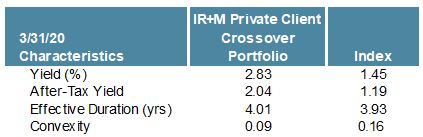

- At IR+M, we believe that a crossover strategy can play a key role in taxable fixed income allocations by replacing or complementing an existing municipal portfolio.

- With over 12 years of experience managing crossover portfolios, we feel that the addition of corporate and securitized bonds can help enhance both the after-tax total return and diversification of the portfolio.

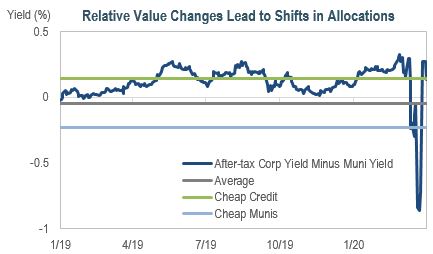

- Municipal bonds currently look less attractive relative to taxable sectors and as a result, crossover investors can respond to this dislocation by opportunistically adjusting allocations while still focusing on tax-efficiency.

- The make-up and sector concentrations will shift over time – the muni weighting has been as high as 60% and as low as 20% – as our disciplined, bottom-up approach helps to optimize portfolios by continuously monitoring after-tax yields and relative value metrics.

At IR+M, we believe that tax-sensitive clients may benefit now more than ever from a balanced approach. Our crossover strategy is nimble, and considers credit quality, structure, and after-tax relative value when determining the ideal sector allocation. In these rapidly changing markets, our investment team is poised to capitalize on our experience as bottom-up security selectors, and opportunistically shift allocations across the investable universe.