The extreme market volatility in recent weeks has given new life to the active-passive management debate. While there are advantages and disadvantages to each approach, in reality, neither is a panacea. Passive strategies may provide low-cost and tax-efficient management at the expense of outperforming the market. Active strategies may be more nimble, but challenged to identify the “right” opportunities. The discussion over each method’s merits becomes increasingly complex when bonds are involved. In this piece, we discuss the pros and cons of active and passive management, and explore the nuances of each in the fixed income world.

Definitions

Active Investing: An active fixed income investment strategy involves positioning the portfolio to capitalize on market conditions. Goal is to produce results that are better than that of the index.

Passive Investing: A passive fixed income investment strategy involves mimicking the index and limiting trading activity. Goal is to produce results that are similar to that of the index.

Pros and Cons

Passive Investing Adoption in Equity Markets

- Passive equity strategies track easily-understood and widely-used benchmarks

- Stocks trade on liquid exchanges, which are more efficient and transparent

- The universe of available investments is well-researched and similar in structure

- The emergence of mutual funds and exchange-traded funds (ETFs) has made it easier for investors to implement passive equity strategies

- Low-cost indexing reduces the complexity of constructing an equity portfolio, which appeals to retail investors

While passive investing has been very popular in the equity space, adoption has been slower in fixed income. We delve into why this may be next.

Passive Fixed Income Management Considerations

Index Considerations

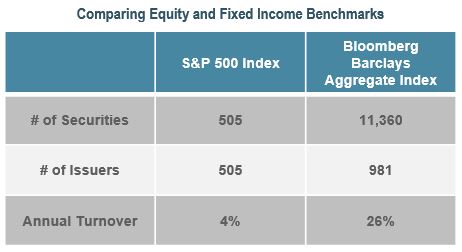

- The vast number of securities (11,000+) makes it nearly impossible to truly replicate bond indices with a passive strategy

- Passive managers can get close to replicating an index with a subset of holdings; however, not all risks can be mitigated

- Most bond indices, including the widely used Bloomberg Barclays U.S. Aggregate Index (Agg), are market-weighted; the issuers with the most outstanding debt carry the largest weights

- Passive funds are forced to invest in issuers with the most debt; these companies could be increasing leverage and risk

- 67% of the Bloomberg Barclays US Aggregate Index is comprised of U.S. Government exposure through Treasuries and Agency mortgage-backed securities (MBS)

- Passive strategies force investors to hold these securities, which are at historically low yields

Security Selection Opportunities

- The most widely used fixed income indices exclude many bonds with attractive return profiles

- For instance, the Agg excludes privately-placed securities (144A’s) and issues that do not meet the Index’s minimum size or maturity requirements

- Securities with embedded options or unique structures can be more bondholder friendly relative to straight debt

Trading Inefficiencies

- The new-issue market for corporate bonds, which totaled over $1.10 trillion in 2019, introduces many complexities

- New deals may come with sizable concessions, and funds that wait until index inclusion often sacrifice performance

- Bonds are traded over-the-counter (meaning that all bonds are traded through a negotiated process) rather than by a formal exchange, which reduces pricing transparency

Approaches to Active Fixed Income Investing

Fixed income managers can introduce a number of risk factors to generate alpha. Active approaches may exploit any one of these strategies individually or in combination. Typically, as more risk exposures are introduced, the more the strategy performance might deviate from the index. Some of the most common approaches are explained.

Asset/Liability Management

- Unlike a bond portfolio of similar quality, plan liabilities are immune to the effects of downgrades

- In an LDI context, this necessitates active investment in the portfolio to avoid downgrades and keep pace with the plan liabilities

Security Selection

- Managers can assess the relative attractiveness of fixed income sectors and identify securities that may outperform the broad market

- Managers can identify attractive issuers based on credit research

- Managers can choose bonds – some of which may be out of index – with favorable structural characteristics

Duration Management

- Duration management aims to reduce interest rate risk relative to the benchmark

- When expecting rising rates, active managers can shorten duration to help preserve market value

- When expecting falling rates, active managers can lengthen the portfolio to help achieve outperformance

Key Rate Management

- Key rate management aims to reduce interest rate risk by taking advantage of non-parallel shifts in the yield curve

- For instance, the 5-year rate is most sensitive to changes in monetary policy; managers may reduce exposure to this key rate if predicting less Fed accommodation

Leverage

- Managers may use leverage in an effort to enhance portfolio returns

- Managers can borrow funds to create a position larger than available through direct cash outlay

- A levered portfolio magnifies both gains and losses, and increases the client’s risk

At IR+M, we believe active security selection can generate positive excess returns over the long-term. While the lower fees associated with passive management can be appealing, investors sacrifice the tailored approach and available customization that active managers utilize to help clients meet their investment objectives. We believe that our relative value-oriented approach, dedicated team of experienced investment professionals, and proactive client service will continue to enable us to add value for our clients.